As a California resident or a business owner operating within the state, it's essential to familiarize yourself with various forms and regulations to ensure compliance and avoid potential penalties. One such form that you might encounter is California Form 5805. In this article, we'll delve into the details of Form 5805, its purpose, and what you need to know about it.

Understanding California Form 5805

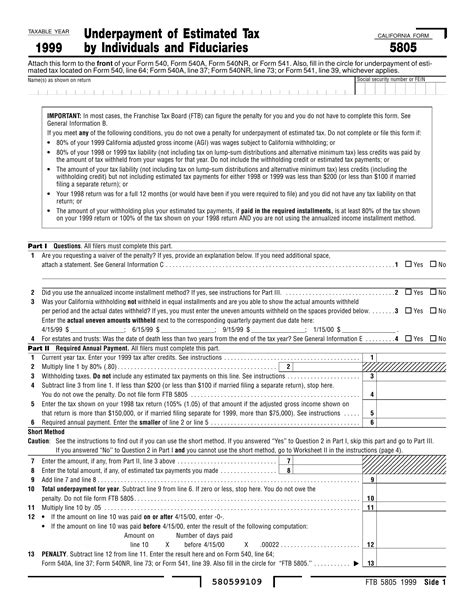

California Form 5805 is a tax-related document issued by the California Franchise Tax Board (FTB). The FTB is responsible for administering the state's tax laws and collecting taxes, fees, and other revenues. Form 5805 is specifically designed for taxpayers who need to report certain transactions or events related to their California income tax.

Purpose of Form 5805

The primary purpose of Form 5805 is to report changes to a taxpayer's name, address, or responsible person. This form is usually filed by businesses, estates, and trusts, although individuals may also need to submit it under certain circumstances. By completing and filing Form 5805, taxpayers can ensure that their records with the FTB are up-to-date and accurate.

Who Needs to File Form 5805?

Not all taxpayers are required to file Form 5805. The following entities typically need to submit this form:

- Businesses: Corporations, partnerships, limited liability companies (LLCs), and sole proprietorships that have undergone changes to their name, address, or responsible person.

- Estates and trusts: Entities that have experienced changes to their name, address, or fiduciary.

- Individuals: In some cases, individuals may need to file Form 5805 if they have changed their name or address and have outstanding tax liabilities or are required to make estimated tax payments.

When to File Form 5805

Taxpayers should file Form 5805 as soon as possible after the change occurs. The FTB requires that this form be submitted within a reasonable time frame, usually within 60 days of the change. It's essential to file Form 5805 promptly to avoid potential penalties or delays in processing tax returns.

How to Complete and File Form 5805

Completing and filing Form 5805 involves the following steps:

- Download or obtain the form: You can download Form 5805 from the FTB website or obtain a copy by contacting the FTB directly.

- Gather required information: You'll need to provide the following information:

- Taxpayer's name and identification number

- New name (if applicable)

- New address (if applicable)

- Responsible person's name and title (if applicable)

- Complete the form: Fill out the form accurately and completely, using black ink and capital letters.

- Sign and date the form: Sign the form as the taxpayer or authorized representative and include the date.

- Submit the form: Mail the completed form to the FTB address listed on the form.

Additional Tips and Reminders

When completing and filing Form 5805, keep the following tips and reminders in mind:

- Ensure accuracy: Double-check the information you provide to avoid errors or delays.

- Use the correct form: Make sure you're using the most recent version of Form 5805.

- File on time: Submit the form within the required time frame to avoid penalties.

Conclusion and Next Steps

In conclusion, California Form 5805 is an essential document for taxpayers who need to report changes to their name, address, or responsible person. By understanding the purpose, requirements, and filing process for this form, you can ensure compliance with California tax laws and avoid potential penalties. If you have any questions or concerns about Form 5805, consider consulting with a tax professional or contacting the FTB directly.

We encourage you to share your thoughts and experiences with Form 5805 in the comments below. Have you encountered any challenges or complexities when filing this form? Do you have any tips or advice for fellow taxpayers? Let's discuss!

FAQ Section:

What is California Form 5805 used for?

+California Form 5805 is used to report changes to a taxpayer's name, address, or responsible person.

Who needs to file Form 5805?

+Businesses, estates, and trusts, as well as individuals in certain circumstances, need to file Form 5805.

How do I file Form 5805?

+Complete the form accurately, sign and date it, and mail it to the FTB address listed on the form.