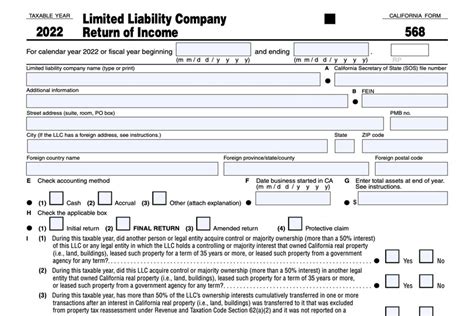

The Form 568 is a crucial document for limited liability companies (LLCs) operating in California, serving as the annual report or statement of information for these businesses. It is essential for LLCs to accurately complete and file this form to maintain compliance with the California Secretary of State's requirements. In this article, we will delve into the instructions for Form 568, providing a step-by-step guide to help LLCs navigate the filing process.

Understanding the Purpose of Form 568

Before diving into the instructions, it is crucial to comprehend the purpose of Form 568. This document serves as the annual report or statement of information for California LLCs, providing the Secretary of State with updated information about the company's management structure, ownership, and other relevant details.

Who Must File Form 568?

Not all LLCs are required to file Form 568. However, the following entities must submit this form:

- California LLCs

- Foreign LLCs registered to do business in California

- LLCs that have made changes to their management structure or ownership

When to File Form 568

The deadline for filing Form 568 varies depending on the LLC's filing status. Typically, the form is due on the last day of the anniversary month of the LLC's initial filing with the California Secretary of State.

Gathering Required Information

Before starting the filing process, LLCs must gather the necessary information, including:

- Company name and address

- Management structure (member-managed or manager-managed)

- Names and addresses of managers or members

- Business description

- Registered agent information

Step-by-Step Instructions for Filing Form 568

The following steps outline the process for filing Form 568:

Step 1: Obtain the Required Form

- Download the Form 568 from the California Secretary of State's website or obtain a paper copy by mail.

- Ensure the form is completed accurately and thoroughly.

Step 2: Provide Company Information

- Enter the LLC's name and address in the designated fields.

- Specify the management structure (member-managed or manager-managed).

Step 3: List Managers or Members

- Provide the names and addresses of all managers or members, depending on the management structure.

- Ensure the information is accurate and up-to-date.

Step 4: Business Description

- Briefly describe the LLC's business activities.

- Keep the description concise and accurate.

Step 5: Registered Agent Information

- Provide the name and address of the registered agent.

- Ensure the registered agent is authorized to receive service of process.

Step 6: Signature and Verification

- The LLC's representative must sign and date the form.

- Verify that the information provided is accurate and complete.

Step 7: Submit the Form

- File the completed Form 568 with the California Secretary of State.

- Pay the required filing fee.

Additional Tips and Reminders

- Ensure timely filing to avoid penalties and fines.

- Keep a copy of the filed Form 568 for the LLC's records.

- Update the registered agent information if changes occur.

By following these step-by-step instructions, LLCs can accurately complete and file Form 568, maintaining compliance with the California Secretary of State's requirements.

Conclusion

Filing Form 568 is a critical step for California LLCs to maintain compliance with the state's requirements. By understanding the purpose of the form, gathering required information, and following the step-by-step instructions, LLCs can ensure accurate and timely filing. Remember to keep a copy of the filed form and update the registered agent information as necessary.

If you have any questions or concerns about Form 568 or the filing process, please don't hesitate to ask. Share your experiences or tips for filing Form 568 in the comments below.

What is the purpose of Form 568?

+Form 568 serves as the annual report or statement of information for California LLCs, providing the Secretary of State with updated information about the company's management structure, ownership, and other relevant details.

Who must file Form 568?

+California LLCs, foreign LLCs registered to do business in California, and LLCs that have made changes to their management structure or ownership must file Form 568.

What is the deadline for filing Form 568?

+The deadline for filing Form 568 varies depending on the LLC's filing status, typically due on the last day of the anniversary month of the LLC's initial filing with the California Secretary of State.