As a diligent investor, you're likely familiar with the various forms and statements that financial institutions send to you throughout the year. One such form is the Vanguard Form 5498, which is a crucial document that provides information about your Individual Retirement Account (IRA) and other tax-deferred investments. In this article, we'll delve into the world of Vanguard Form 5498, exploring its significance, components, and what you need to know to make the most of it.

The Importance of Vanguard Form 5498

Vanguard Form 5498 is an annual report that provides a snapshot of your IRA and other tax-deferred investments. The form is typically sent to you by May 31st of each year and covers the previous tax year. The information provided on this form is essential for tax purposes, and it's crucial to understand what it entails.

The form is divided into several sections, each containing vital information about your investments. By carefully reviewing Vanguard Form 5498, you'll be able to:

- Verify the accuracy of your account information

- Confirm your investment contributions and earnings

- Ensure you're meeting the required minimum distribution (RMD) rules

- Plan for taxes and make informed investment decisions

Components of Vanguard Form 5498

The form is composed of several sections, which we'll break down below:

Section 1: Account Information

This section provides an overview of your account, including:

- Account number

- Account type (e.g., Traditional IRA, Roth IRA, SEP-IRA)

- Account owner's name and address

Section 2: Contributions

This section reports the contributions made to your account during the tax year, including:

- Regular contributions

- Rollover contributions

- Recharacterizations

Section 3: Fair Market Value

This section provides the fair market value of your account as of December 31st of the previous tax year.

Section 4: Distributions

This section reports any distributions made from your account during the tax year, including:

- Regular distributions

- Required minimum distributions (RMDs)

- Loans

Section 5: Investment Earnings

This section reports the investment earnings on your account, including:

- Interest

- Dividends

- Capital gains

What to Do with Vanguard Form 5498

Now that you've received your Vanguard Form 5498, it's essential to review it carefully and take the necessary steps:

- Verify accuracy: Ensure the account information, contributions, and distributions are accurate.

- Check RMDs: If you're 72 or older, verify that you've taken the required minimum distribution (RMD) for the year.

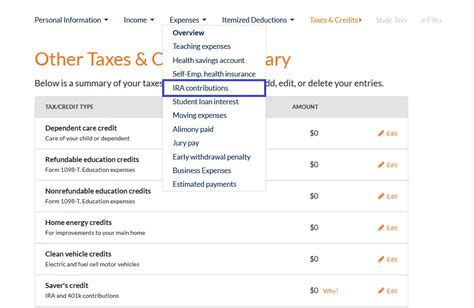

- Report contributions: Report any contributions made to your account on your tax return.

- Claim deductions: Claim any deductions for contributions made to your account.

- Plan for taxes: Use the information on the form to plan for taxes and make informed investment decisions.

Common Questions About Vanguard Form 5498

Q: What is Vanguard Form 5498, and why do I need it?

A: Vanguard Form 5498 is an annual report that provides information about your Individual Retirement Account (IRA) and other tax-deferred investments. You need it to verify the accuracy of your account information, report contributions, and plan for taxes.

Q: How do I get a copy of my Vanguard Form 5498?

A: You can obtain a copy of your Vanguard Form 5498 by logging into your Vanguard account online or by contacting Vanguard customer service.

Q: What is the deadline for receiving Vanguard Form 5498?

A: Vanguard Form 5498 is typically sent to you by May 31st of each year, covering the previous tax year.

Q: Can I use Vanguard Form 5498 to file my taxes?

A: Yes, you can use the information on Vanguard Form 5498 to file your taxes, but it's essential to consult with a tax professional to ensure accuracy and compliance with tax laws.

What is Vanguard Form 5498, and why do I need it?

+Vanguard Form 5498 is an annual report that provides information about your Individual Retirement Account (IRA) and other tax-deferred investments. You need it to verify the accuracy of your account information, report contributions, and plan for taxes.

How do I get a copy of my Vanguard Form 5498?

+You can obtain a copy of your Vanguard Form 5498 by logging into your Vanguard account online or by contacting Vanguard customer service.

What is the deadline for receiving Vanguard Form 5498?

+Vanguard Form 5498 is typically sent to you by May 31st of each year, covering the previous tax year.

In conclusion, Vanguard Form 5498 is a vital document that provides essential information about your IRA and other tax-deferred investments. By understanding the components of the form and taking the necessary steps, you'll be able to make informed investment decisions and plan for taxes with confidence. If you have any further questions or concerns, please don't hesitate to reach out to Vanguard customer service or consult with a tax professional.