Form 5471 is an essential document for US taxpayers with interests in controlled foreign corporations (CFCs). Schedule P is a crucial part of this form, providing detailed information about the CFC's income statement. Accurately completing Schedule P is crucial to avoid penalties and ensure compliance with the IRS. In this article, we will break down the 5 steps to complete Form 5471 Schedule P.

Understanding Form 5471 and Schedule P

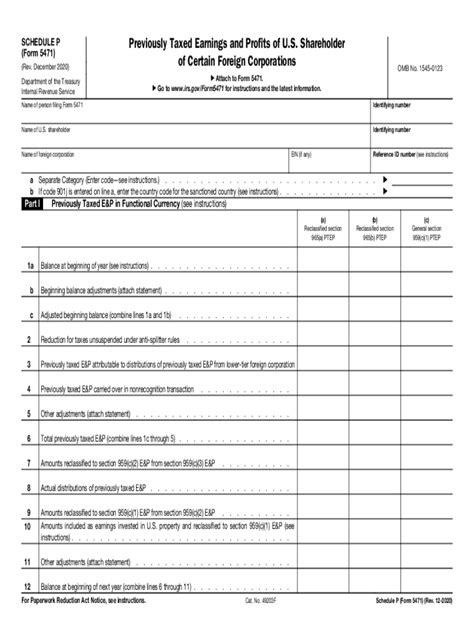

Form 5471 is a vital document for US taxpayers with interests in CFCs. It reports the CFC's income, expenses, and other relevant financial information to the IRS. Schedule P is a part of Form 5471, specifically designed to provide a detailed income statement of the CFC. This schedule is used to calculate the CFC's taxable income, which is then reported on the US taxpayer's tax return.

Why is Form 5471 Schedule P Important?

Form 5471 Schedule P is crucial for several reasons:

- It helps the IRS to assess the CFC's taxable income and ensure compliance with US tax laws.

- It provides a detailed breakdown of the CFC's income statement, enabling the IRS to verify the accuracy of the reported income.

- Accurate completion of Schedule P helps to avoid penalties and fines associated with non-compliance.

Step 1: Gather Necessary Information

To complete Form 5471 Schedule P, you will need to gather the following information:

- The CFC's financial statements, including the balance sheet and income statement.

- Information about the CFC's income, expenses, and other financial transactions.

- Details about the CFC's ownership structure and US shareholder information.

Tips for Gathering Information

- Ensure that all financial statements are accurately translated into US dollars.

- Verify that all financial information is consistent with the CFC's financial records.

- Consult with a tax professional or accountant to ensure that all necessary information is gathered.

Step 2: Identify the CFC's Functional Currency

The CFC's functional currency is the currency in which the CFC's financial transactions are primarily denominated. Identifying the functional currency is crucial for completing Schedule P, as it determines the exchange rate used to translate the CFC's financial statements into US dollars.

How to Determine the Functional Currency

- Review the CFC's financial statements to determine the currency in which most transactions are denominated.

- Consider the CFC's business operations and the currency in which most revenues and expenses are incurred.

- Consult with a tax professional or accountant to ensure accurate determination of the functional currency.

Step 3: Complete Schedule P

To complete Schedule P, you will need to provide detailed information about the CFC's income statement, including:

- Gross income

- Cost of goods sold

- Operating expenses

- Other income and expenses

Tips for Completing Schedule P

- Ensure that all financial information is accurately translated into US dollars using the functional currency exchange rate.

- Verify that all financial information is consistent with the CFC's financial records.

- Consult with a tax professional or accountant to ensure accurate completion of Schedule P.

Step 4: Calculate the CFC's Taxable Income

Once Schedule P is complete, you will need to calculate the CFC's taxable income. This involves applying the US tax laws and regulations to the CFC's income statement.

How to Calculate Taxable Income

- Apply the US tax rates to the CFC's taxable income.

- Consider any applicable tax credits or deductions.

- Consult with a tax professional or accountant to ensure accurate calculation of taxable income.

Step 5: Review and File Form 5471

Finally, review Form 5471, including Schedule P, to ensure accuracy and completeness. Once complete, file Form 5471 with the IRS by the required deadline.

Tips for Reviewing and Filing Form 5471

- Verify that all information is accurate and consistent with the CFC's financial records.

- Ensure that all required schedules and attachments are included.

- Consult with a tax professional or accountant to ensure accurate review and filing of Form 5471.

What is Form 5471?

+Form 5471 is a US tax form used to report the income, expenses, and other financial information of a controlled foreign corporation (CFC).

What is Schedule P?

+Schedule P is a part of Form 5471 that provides a detailed income statement of the CFC.

Why is Form 5471 Schedule P important?

+Form 5471 Schedule P is important because it helps the IRS to assess the CFC's taxable income and ensure compliance with US tax laws.

We hope this article has provided a comprehensive guide to completing Form 5471 Schedule P. If you have any further questions or concerns, please don't hesitate to reach out. Remember to consult with a tax professional or accountant to ensure accurate completion of Form 5471 and compliance with US tax laws.