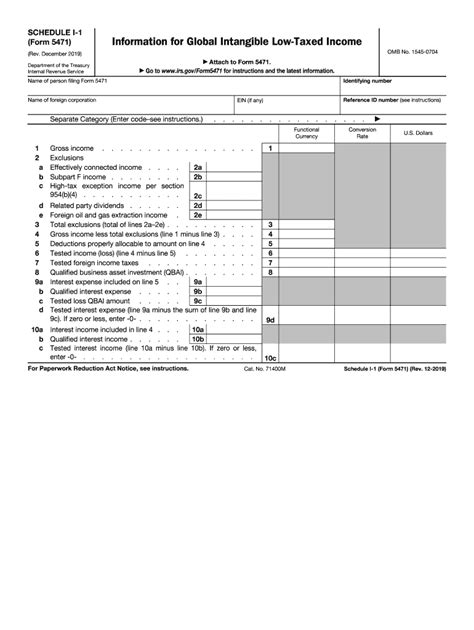

Form 5471 is a crucial document for United States citizens and resident aliens who are officers, directors, or shareholders in certain foreign corporations. The form is used to report information about these corporations to the Internal Revenue Service (IRS). One of the key components of Form 5471 is Schedule I-1, which is used to report information about the corporation's income, deductions, and credits. Mastering Schedule I-1 is essential to ensure accurate and complete reporting, and to avoid potential penalties and fines.

Understanding the Importance of Form 5471 Schedule I-1

Form 5471 is a critical document for U.S. taxpayers who have interests in foreign corporations. The form is used to report information about these corporations, including income, deductions, and credits. Schedule I-1 is a key component of Form 5471, and is used to report specific information about the corporation's income and expenses.

Tip #1: Determine the Type of Foreign Corporation

The first step in mastering Form 5471 Schedule I-1 is to determine the type of foreign corporation that is being reported. There are several types of foreign corporations that are subject to reporting on Form 5471, including controlled foreign corporations (CFCs), passive foreign investment companies (PFICs), and foreign personal holding companies (FPHCs). Each type of corporation has its own set of reporting requirements, so it is essential to determine the correct type of corporation before completing Schedule I-1.

**Calculating Income and Deductions on Schedule I-1**

Once the type of foreign corporation has been determined, the next step is to calculate the corporation's income and deductions. This involves completing Part I of Schedule I-1, which includes lines 1-10. The following lines are included in Part I:

- Line 1: Gross income

- Line 2: Total deductions

- Line 3: Net income (loss)

- Line 4: Net income (loss) per books

- Line 5: Reconciliation of net income (loss) per books to net income (loss) per return

- Line 6: Dividends

- Line 7: Interest income

- Line 8: Royalty income

- Line 9: Rents

- Line 10: Other income

**Foreign Tax Credits on Schedule I-1**

In addition to calculating income and deductions, Schedule I-1 also requires the reporting of foreign tax credits. This is done in Part II of the schedule, which includes lines 11-14. The following lines are included in Part II:

- Line 11: Foreign tax credit

- Line 12: Total foreign taxes paid or accrued

- Line 13: Foreign taxes paid or accrued on foreign-source income

- Line 14: Foreign taxes paid or accrued on foreign-source income reported on other returns

Tip #2: Reporting Passive Foreign Investment Company (PFIC) Income

If the foreign corporation is a PFIC, additional reporting is required on Schedule I-1. This includes reporting the corporation's PFIC income, which is done in Part III of the schedule. The following lines are included in Part III:

- Line 15: PFIC income

- Line 16: PFIC income from sources within the United States

- Line 17: PFIC income from sources outside the United States

Tip #3: Reporting Foreign Personal Holding Company (FPHC) Income

If the foreign corporation is an FPHC, additional reporting is required on Schedule I-1. This includes reporting the corporation's FPHC income, which is done in Part IV of the schedule. The following lines are included in Part IV:

- Line 18: FPHC income

- Line 19: FPHC income from sources within the United States

- Line 20: FPHC income from sources outside the United States

Tip #4: Completing the Reconciliation of Net Income (Loss) per Books to Net Income (Loss) per Return

One of the most complex parts of Schedule I-1 is the reconciliation of net income (loss) per books to net income (loss) per return. This is done on line 5 of Part I, and requires the taxpayer to reconcile the corporation's net income (loss) per books to the net income (loss) reported on the return. This involves reporting any adjustments that are necessary to reconcile the two amounts.

Tip #5: Seeking Professional Help

Finally, it is essential to seek professional help when completing Form 5471 Schedule I-1. The form is complex and requires a high level of expertise to complete accurately. A qualified tax professional can help ensure that the form is completed correctly, and that all necessary information is reported.

By following these tips, taxpayers can master Form 5471 Schedule I-1 and ensure accurate and complete reporting. Remember to seek professional help if you are unsure about any aspect of the form, and to carefully review the instructions and guidelines provided by the IRS.

What's Next?

Now that you've read this article, it's time to take action. If you're a U.S. taxpayer with interests in foreign corporations, make sure to review your Form 5471 Schedule I-1 carefully and seek professional help if needed. Don't hesitate to reach out to us if you have any questions or need further guidance.

What is Form 5471 Schedule I-1?

+Form 5471 Schedule I-1 is a component of Form 5471, which is used to report information about foreign corporations to the IRS.

Who needs to complete Form 5471 Schedule I-1?

+U.S. taxpayers who are officers, directors, or shareholders in certain foreign corporations need to complete Form 5471 Schedule I-1.

What information is reported on Form 5471 Schedule I-1?

+Form 5471 Schedule I-1 reports information about the foreign corporation's income, deductions, and credits.