As a global business owner or an individual with foreign financial interests, you may have come across the complex world of international taxation. One crucial aspect of this is the Form 5471, Schedule H, which is used to report the income and assets of controlled foreign corporations (CFCs). In this article, we will delve into the essential facts about Form 5471, Schedule H, and explore its significance in international taxation.

What is Form 5471, Schedule H?

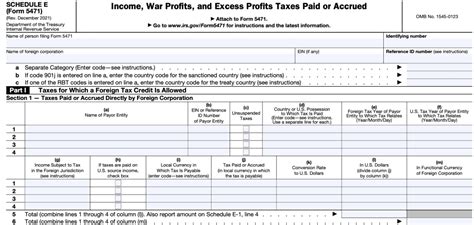

Form 5471, Schedule H, is a supplementary schedule to Form 5471, which is used to report the income and assets of CFCs. The form is used by U.S. shareholders of CFCs to report their share of the corporation's income, as well as to provide additional information about the corporation's assets and liabilities.

Why is Form 5471, Schedule H, Important?

Form 5471, Schedule H, is crucial for several reasons:

- It provides the IRS with essential information about the income and assets of CFCs, which is used to determine the U.S. tax liability of the corporation and its shareholders.

- It helps to prevent tax evasion and ensure compliance with U.S. tax laws.

- It provides transparency and accountability in international taxation, which is essential for maintaining fair and equitable tax systems.

Who Needs to File Form 5471, Schedule H?

The following individuals and entities need to file Form 5471, Schedule H:

- U.S. shareholders of CFCs who own 10% or more of the corporation's total voting power or value.

- U.S. citizens and residents who are officers or directors of CFCs.

- U.S. citizens and residents who have a financial interest in a foreign corporation that is a CFC.

What Information is Required on Form 5471, Schedule H?

Form 5471, Schedule H, requires the following information:

- The name and address of the CFC.

- The name and address of the U.S. shareholder.

- The U.S. shareholder's percentage of ownership in the CFC.

- The CFC's income and assets, including its earnings and profits.

- The CFC's liabilities, including its debt and other obligations.

How to Complete Form 5471, Schedule H?

To complete Form 5471, Schedule H, follow these steps:

- Obtain the necessary information about the CFC, including its income and assets.

- Determine the U.S. shareholder's percentage of ownership in the CFC.

- Complete the form according to the instructions provided by the IRS.

- Attach the form to Form 5471 and file it with the IRS.

What are the Penalties for Not Filing Form 5471, Schedule H?

Failure to file Form 5471, Schedule H, can result in significant penalties, including:

- A penalty of $10,000 or more for each failure to file.

- Additional penalties for failure to report income or pay taxes.

- Potential criminal penalties for willful failure to file or report income.

Conclusion and Next Steps

In conclusion, Form 5471, Schedule H, is a crucial component of international taxation that requires careful attention and compliance. By understanding the essential facts about this form, you can ensure that you are meeting your tax obligations and avoiding potential penalties.

If you have any questions or concerns about Form 5471, Schedule H, or international taxation in general, we encourage you to seek the advice of a qualified tax professional. Additionally, you can find more information about Form 5471, Schedule H, and other tax-related topics on the IRS website.

We hope this article has been informative and helpful. Please share your thoughts and comments below.

What is the purpose of Form 5471, Schedule H?

+The purpose of Form 5471, Schedule H, is to report the income and assets of controlled foreign corporations (CFCs) and to provide additional information about the corporation's assets and liabilities.

Who needs to file Form 5471, Schedule H?

+U.S. shareholders of CFCs who own 10% or more of the corporation's total voting power or value, U.S. citizens and residents who are officers or directors of CFCs, and U.S. citizens and residents who have a financial interest in a foreign corporation that is a CFC.

What are the penalties for not filing Form 5471, Schedule H?

+Failure to file Form 5471, Schedule H, can result in significant penalties, including a penalty of $10,000 or more for each failure to file, additional penalties for failure to report income or pay taxes, and potential criminal penalties for willful failure to file or report income.