As a California resident, you're likely familiar with the state's income tax requirements. However, you may not be aware of the California Form 540 use tax, which is an essential aspect of the state's tax laws. In this article, we'll delve into the world of use tax, explaining what it is, how it works, and what you need to know to ensure compliance.

The Importance of Understanding Use Tax

Use tax is a type of tax that is levied on out-of-state purchases that are brought into California for use. It's a crucial aspect of the state's tax laws, as it helps to ensure that California residents and businesses pay their fair share of taxes on goods and services purchased outside of the state. By understanding the use tax, you can avoid potential penalties and fines, and ensure that you're in compliance with California's tax laws.

What is California Form 540 Use Tax?

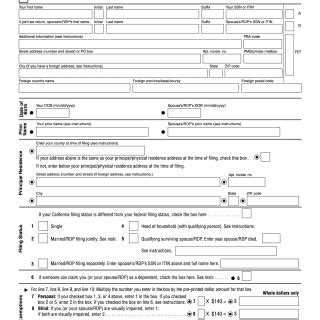

California Form 540 is the state's income tax return form, which also includes the use tax reporting section. The use tax is reported on Line 91 of Form 540, and it's used to calculate the amount of tax owed on out-of-state purchases. The use tax rate is the same as the sales tax rate in the location where the item is used, which in most cases is 7.25%.

Who is Required to Pay Use Tax?

You're required to pay use tax if you're a California resident or business that has made out-of-state purchases of tangible personal property, such as goods and merchandise, that are brought into the state for use. This includes:

- Goods purchased online from out-of-state retailers

- Goods purchased in person from out-of-state retailers

- Goods purchased from catalogs or mail-order companies

- Goods purchased at auction or through other means

Exemptions and Exceptions

There are some exemptions and exceptions to the use tax requirement. For example:

- Goods that are exempt from sales tax, such as groceries and prescription medication, are also exempt from use tax

- Goods that are purchased for resale, such as by a business, are exempt from use tax

- Goods that are purchased for use outside of California are exempt from use tax

Reporting Use Tax on Form 540

To report use tax on Form 540, you'll need to complete the following steps:

- Calculate the total amount of use tax owed: This is done by multiplying the total amount of out-of-state purchases by the use tax rate.

- Report the use tax on Line 91 of Form 540: This is where you'll enter the total amount of use tax owed.

- Pay the use tax: You can pay the use tax online, by mail, or in person at a California tax office.

Penalties for Non-Compliance

Failure to report and pay use tax can result in penalties and fines. The California Franchise Tax Board (FTB) may impose penalties of up to 10% of the unpaid use tax, plus interest and fees. In addition, you may be subject to an audit, which can result in additional penalties and fines.

Tips for Compliance

To ensure compliance with California's use tax laws, follow these tips:

- Keep accurate records of out-of-state purchases, including receipts and invoices

- Calculate the use tax owed on out-of-state purchases

- Report the use tax on Form 540

- Pay the use tax online, by mail, or in person at a California tax office

Conclusion: Take Control of Your Use Tax Obligations

Understanding California Form 540 use tax is essential for ensuring compliance with the state's tax laws. By knowing who is required to pay use tax, how to report it on Form 540, and the penalties for non-compliance, you can take control of your use tax obligations and avoid potential penalties and fines. Remember to keep accurate records, calculate the use tax owed, and report it on Form 540 to ensure compliance.

Common Mistakes to Avoid

When it comes to California Form 540 use tax, there are several common mistakes to avoid. These include:

- Failing to report use tax on out-of-state purchases

- Underreporting use tax owed

- Failing to pay use tax

- Failing to keep accurate records of out-of-state purchases

Frequently Asked Questions

Here are some frequently asked questions about California Form 540 use tax:

- Q: What is the use tax rate in California? A: The use tax rate is the same as the sales tax rate in the location where the item is used, which in most cases is 7.25%.

- Q: Who is required to pay use tax? A: You're required to pay use tax if you're a California resident or business that has made out-of-state purchases of tangible personal property that are brought into the state for use.

- Q: How do I report use tax on Form 540? A: You report use tax on Line 91 of Form 540.

What is the deadline for filing Form 540?

+The deadline for filing Form 540 is typically April 15th of each year.

Can I file Form 540 electronically?

+Yes, you can file Form 540 electronically through the California Franchise Tax Board's website.

What happens if I fail to report use tax on Form 540?

+If you fail to report use tax on Form 540, you may be subject to penalties and fines, including a penalty of up to 10% of the unpaid use tax, plus interest and fees.