When it comes to filing taxes, navigating the complexities of forms and regulations can be overwhelming. One such form that often requires attention is Form 5329, which deals with the repayment of excess distributions from qualified retirement plans. Understanding and correctly filling out Form 5329 is crucial to avoid any potential penalties or misreporting. Thankfully, with the guidance of TurboTax, you can master Form 5329 in 5 easy steps.

The Importance of Form 5329

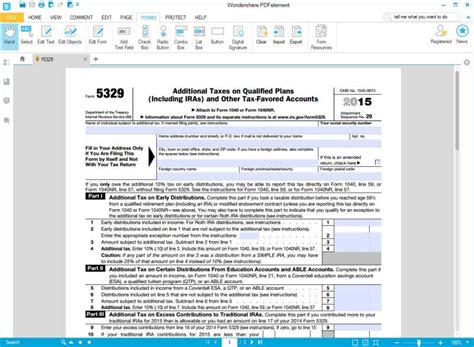

Form 5329 is specifically designed for individuals who have taken distributions from qualified retirement plans, such as 401(k) or IRA accounts, that exceed the allowed limits. The IRS uses this form to determine if any additional taxes or penalties are owed due to these excess distributions. Properly filling out Form 5329 is essential to report these distributions accurately and avoid any potential issues with the IRS.

Why TurboTax?

TurboTax is a powerful tool that simplifies the tax filing process, including the completion of complex forms like Form 5329. With its user-friendly interface and step-by-step guidance, TurboTax ensures that you complete Form 5329 accurately and efficiently. Whether you're a seasoned tax filer or new to the process, TurboTax provides the support and resources needed to navigate Form 5329 with confidence.

Mastering Form 5329 with TurboTax: 5 Easy Steps

Step 1: Gather Necessary Information

Before starting the Form 5329 process in TurboTax, gather all necessary documents and information related to your qualified retirement plan distributions. This includes:

- 1099-R forms showing the distribution amounts

- The type of qualified retirement plan (e.g., 401(k), IRA)

- The date(s) of the distributions

- Any applicable exceptions or waivers

Having this information readily available will streamline the process and ensure accuracy.

Step 2: Access Form 5329 in TurboTax

To access Form 5329 in TurboTax, follow these steps:

- Log in to your TurboTax account and select the tax year you're filing for.

- Navigate to the "Retirement Plans and Accounts" section.

- Click on "Excess Contributions" and select "Form 5329" from the options.

TurboTax will guide you through the process, but having your information ready will make it even smoother.

Step 3: Complete Part I of Form 5329

In Part I of Form 5329, you'll report the excess distribution amount. TurboTax will prompt you to:

- Enter the total distribution amount from your 1099-R form(s)

- Identify the type of qualified retirement plan

- Specify the distribution date(s)

Be sure to accurately enter this information, as it directly affects the calculation of any additional taxes or penalties.

Step 4: Calculate the Excess Distribution

TurboTax will automatically calculate the excess distribution amount based on the information provided in Part I. If you're eligible for any exceptions or waivers, you'll have the opportunity to claim them in this step.

- Review the calculated excess distribution amount carefully.

- If applicable, claim exceptions or waivers to reduce the excess distribution amount.

Step 5: Review and Submit Form 5329

Once you've completed Part I and calculated the excess distribution, review your entries carefully. Ensure all information is accurate and complete. If everything looks correct, submit Form 5329 through TurboTax.

TurboTax will guide you through the e-filing process, ensuring that your Form 5329 is submitted correctly and efficiently.

Conclusion

Mastering Form 5329 with TurboTax is a straightforward process that eliminates the complexity and uncertainty of tax filing. By following these 5 easy steps, you'll accurately complete Form 5329 and ensure compliance with IRS regulations. With TurboTax, you can confidently navigate the tax filing process and avoid any potential penalties or misreporting.

Take Action Today!

Don't let the complexity of Form 5329 overwhelm you. Use TurboTax to master this form and ensure accurate tax filing. Share your experiences with Form 5329 and TurboTax in the comments below. If you have any questions or need further guidance, feel free to ask.

What is Form 5329 used for?

+Form 5329 is used to report excess distributions from qualified retirement plans, such as 401(k) or IRA accounts, and to determine if any additional taxes or penalties are owed.

What information do I need to complete Form 5329?

+You'll need your 1099-R forms showing the distribution amounts, the type of qualified retirement plan, the date(s) of the distributions, and any applicable exceptions or waivers.

Can I e-file Form 5329 through TurboTax?

+Yes, TurboTax guides you through the e-filing process, ensuring that your Form 5329 is submitted correctly and efficiently.