The Form 480.6A is a document that plays a crucial role in the world of taxes, specifically in Puerto Rico. If you're a business owner, accountant, or individual with financial interests on the island, understanding the intricacies of this form is vital for smooth compliance with tax regulations. Here are five essential facts about Form 480.6A that you should know:

What is Form 480.6A?

Form 480.6A is a tax form required by the Puerto Rico Treasury Department (Departamento de Hacienda) for businesses and individuals to report certain types of income and claim credits or deductions. It's specifically designed for entities that have activities subject to the Puerto Rico Excise Tax.

Purpose and Use

The primary purpose of Form 480.6A is to allow entities to report their annual income and claim any applicable credits or deductions related to the Puerto Rico Excise Tax. This form is crucial for businesses operating in Puerto Rico, as it helps them comply with local tax laws and potentially reduce their tax liability.

Who Needs to File Form 480.6A?

Entities required to file Form 480.6A include corporations, partnerships, and individuals who have a business or receive income from sources within Puerto Rico. This includes entities involved in manufacturing, mercantile, and service activities.

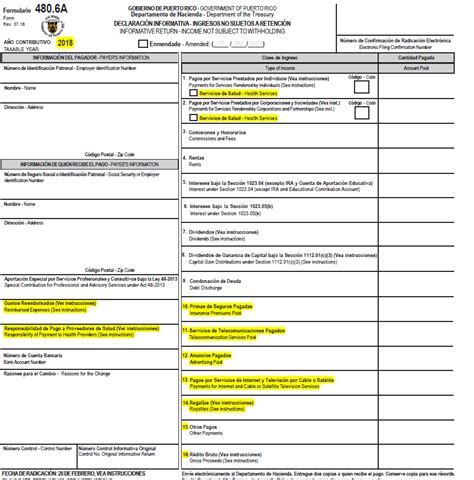

Components of Form 480.6A

Form 480.6A consists of several sections, including:

- Identification: The entity's name, address, and tax identification number.

- Business Activity: A description of the entity's business activities.

- Income and Deductions: A report of the entity's income and claimed deductions.

- Credits: A report of any credits claimed, such as the Puerto Rico Research and Development Credit.

Deadlines and Penalties

The deadline for filing Form 480.6A typically coincides with the federal tax filing deadline. Late filings or failure to file can result in penalties and interest charges.

Electronic Filing and Payment

To facilitate compliance and reduce paperwork, the Puerto Rico Treasury Department offers electronic filing and payment options for Form 480.6A. This allows entities to submit their forms and payments online, reducing the risk of errors and delays.

Benefits of Electronic Filing

- Convenience: Electronic filing is available 24/7.

- Accuracy: Reduced risk of errors compared to paper filing.

- Faster Processing: Faster processing and response times.

Compliance and Record-Keeping

Entities filing Form 480.6A must maintain accurate records to support their reported income and claimed credits or deductions. These records should be kept for at least three years from the filing date.

Importance of Compliance

- Avoid Penalties: Failure to comply can result in penalties and interest charges.

- Maintain Good Standing: Compliance helps maintain good standing with the Puerto Rico Treasury Department.

Conclusion

Understanding the Form 480.6A is essential for businesses and individuals operating in Puerto Rico. By familiarizing yourself with its purpose, components, and filing requirements, you can ensure compliance with local tax laws and potentially reduce your tax liability.

What is the purpose of Form 480.6A?

+Form 480.6A is used to report annual income and claim credits or deductions related to the Puerto Rico Excise Tax.

Who needs to file Form 480.6A?

+Entities required to file Form 480.6A include corporations, partnerships, and individuals who have a business or receive income from sources within Puerto Rico.

What are the consequences of late filing or failure to file Form 480.6A?

+Late filings or failure to file can result in penalties and interest charges.