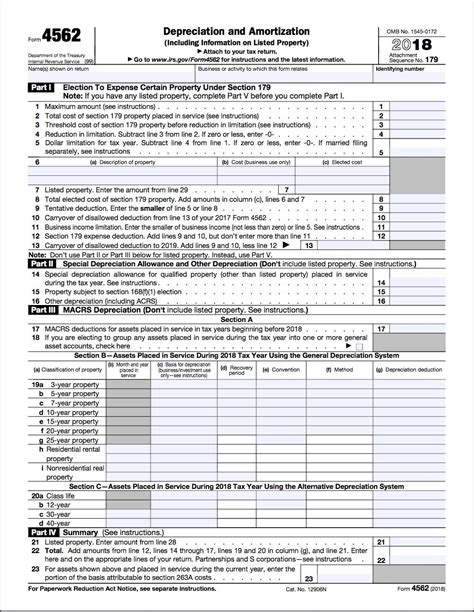

As a business owner or investor, claiming depreciation on your tax return can be a great way to reduce your taxable income and lower your tax liability. However, it can be a complex and confusing process, especially when it comes to filling out Form 4562, the Depreciation and Amortization form. In this article, we'll break down the different ways to claim depreciation on Form 4562, Line 11, and provide you with the information you need to accurately complete this section.

Depreciation is a tax deduction that allows businesses to recover the cost of certain assets over time. These assets, known as depreciable assets, lose their value due to wear and tear, obsolescence, or other factors. By claiming depreciation, businesses can reduce their taxable income and lower their tax liability. However, the rules surrounding depreciation can be complex, and it's essential to understand how to properly claim it on your tax return.

One of the most critical sections of Form 4562 is Line 11, which is used to report depreciation for assets that are not included in a general asset account (GAA). This can include assets such as buildings, equipment, and vehicles. To accurately complete this section, you'll need to understand the different types of depreciation and how to calculate them.

Understanding Depreciation Methods

Before we dive into the different ways to claim depreciation on Form 4562, Line 11, it's essential to understand the different depreciation methods. The two primary methods are:

- Straight-Line Method: This method involves depreciating an asset over its useful life by dividing the asset's cost by its useful life. For example, if an asset costs $10,000 and has a useful life of 5 years, the annual depreciation would be $2,000 ($10,000 ÷ 5 years).

- Accelerated Depreciation Method: This method involves depreciating an asset more quickly in the early years of its useful life. There are several accelerated depreciation methods, including the Modified Accelerated Cost Recovery System (MACRS) and the double declining balance method.

MACRS Depreciation

MACRS is the most commonly used depreciation method for tax purposes. It allows businesses to depreciate assets more quickly in the early years of their useful life. The MACRS system provides a specific percentage of the asset's cost that can be depreciated each year. For example, the MACRS percentage for a 5-year asset is 20% in the first year, 32% in the second year, and so on.

5 Ways to Claim Depreciation on Form 4562, Line 11

Now that we've covered the basics of depreciation, let's dive into the different ways to claim depreciation on Form 4562, Line 11:

1. Section 179 Deduction

The Section 179 deduction allows businesses to deduct the full cost of certain assets in the year they are purchased, rather than depreciating them over time. This can be a great way to reduce taxable income in the year of purchase. To claim the Section 179 deduction on Form 4562, Line 11, you'll need to complete Part I of the form and indicate the type of property being deducted.

2. MACRS Depreciation

As we discussed earlier, MACRS is the most commonly used depreciation method for tax purposes. To claim MACRS depreciation on Form 4562, Line 11, you'll need to complete Part II of the form and indicate the type of property being depreciated. You'll also need to calculate the MACRS percentage for each asset and multiply it by the asset's cost.

3. Bonus Depreciation

Bonus depreciation allows businesses to deduct an additional percentage of the cost of certain assets in the year they are purchased. This can be a great way to reduce taxable income in the year of purchase. To claim bonus depreciation on Form 4562, Line 11, you'll need to complete Part III of the form and indicate the type of property being depreciated.

4. Amortization of Intangibles

Intangible assets, such as patents and copyrights, can be amortized over their useful life. To claim amortization of intangibles on Form 4562, Line 11, you'll need to complete Part IV of the form and indicate the type of property being amortized.

5. Depreciation of Listed Property

Listed property includes assets such as vehicles and aircraft. These assets are subject to special depreciation rules and must be reported separately on Form 4562, Line 11. To claim depreciation of listed property, you'll need to complete Part V of the form and indicate the type of property being depreciated.

Calculating Depreciation on Form 4562, Line 11

To accurately calculate depreciation on Form 4562, Line 11, you'll need to follow these steps:

- Determine the asset's cost and useful life.

- Choose the correct depreciation method (MACRS, straight-line, etc.).

- Calculate the depreciation percentage for each asset.

- Multiply the depreciation percentage by the asset's cost.

- Report the depreciation on Form 4562, Line 11.

By following these steps and understanding the different ways to claim depreciation on Form 4562, Line 11, you can ensure that you're accurately reporting your business's depreciation and reducing your taxable income.

Common Mistakes to Avoid

When claiming depreciation on Form 4562, Line 11, there are several common mistakes to avoid:

- Failing to keep accurate records of asset purchases and disposals.

- Using the wrong depreciation method or percentage.

- Failing to report depreciation for all assets.

- Claiming depreciation for assets that are not qualified.

By avoiding these common mistakes, you can ensure that your business is accurately reporting its depreciation and reducing its taxable income.

Conclusion

Claiming depreciation on Form 4562, Line 11 can be a complex and confusing process. However, by understanding the different depreciation methods and following the steps outlined in this article, you can ensure that your business is accurately reporting its depreciation and reducing its taxable income. Remember to keep accurate records, choose the correct depreciation method, and report depreciation for all qualified assets.

We hope this article has been helpful in understanding how to claim depreciation on Form 4562, Line 11. If you have any questions or need further assistance, please don't hesitate to comment below.

What is depreciation?

+Depreciation is a tax deduction that allows businesses to recover the cost of certain assets over time.

What is Form 4562?

+Form 4562 is the Depreciation and Amortization form used to report depreciation and amortization for tax purposes.

What is MACRS depreciation?

+MACRS is the Modified Accelerated Cost Recovery System, a depreciation method that allows businesses to depreciate assets more quickly in the early years of their useful life.