As a business owner in Georgia, it's essential to stay on top of your tax obligations to avoid penalties and fines. One crucial requirement is filing the annual return, also known as Form 3907. In this comprehensive guide, we'll walk you through the process of filing Georgia Form 3907, providing you with the necessary information to ensure a smooth and accurate submission.

What is Georgia Form 3907?

Who Needs to File Form 3907?

Businesses that are required to file Form 3907 include:- Corporations (C-corporations and S-corporations)

- Partnerships (including limited liability partnerships)

- Limited liability companies (LLCs) that are taxed as corporations or partnerships

- Trusts and estates

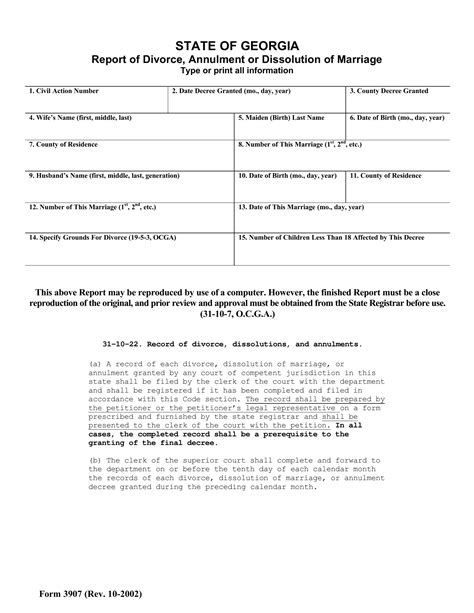

What Information is Required on Form 3907?

- Business identification information (FEIN, business name, and address)

- Tax year and accounting method used

- Income and deductions (including depreciation, amortization, and interest)

- Tax credits and deductions claimed

- Balance sheet and income statement information

How to File Form 3907

You can file Form 3907 electronically or by mail. The Georgia Department of Revenue recommends e-filing, as it's faster and more accurate. To e-file, you'll need to:- Create an account on the Georgia Tax Center website

- Fill out the form and attach any required supporting documents

- Submit the form and pay any due tax

If you prefer to file by mail, you can download the form from the Georgia Department of Revenue website or pick one up at a local tax office. Be sure to sign and date the form, and include any required supporting documents.

Deadlines and Penalties

Failure to file Form 3907 or paying late can result in penalties and fines. The Georgia Department of Revenue may impose a penalty of 5% of the unpaid tax for each month or part of a month, up to 25%.

Common Errors to Avoid

To avoid errors and penalties, be sure to:- Double-check your math and ensure accuracy

- Attach all required supporting documents

- Sign and date the form

- File on time or request an extension if needed

Conclusion

We encourage you to share your experiences and tips for filing Form 3907 in the comments below. If you have any questions or need further guidance, don't hesitate to reach out to a tax professional or the Georgia Department of Revenue.

What is the deadline for filing Form 3907?

+The deadline for filing Form 3907 is typically March 15th for corporations and April 15th for partnerships and S corporations.

Can I file Form 3907 electronically?

+Yes, you can file Form 3907 electronically through the Georgia Tax Center website.

What happens if I fail to file Form 3907 or pay late?

+Failure to file Form 3907 or paying late can result in penalties and fines, including a penalty of 5% of the unpaid tax for each month or part of a month, up to 25%.