The process of filing taxes can be overwhelming, especially when dealing with complex forms like the Form 3800. This form is used to claim the General Business Credit, which allows businesses to offset their tax liability by claiming credits for various business-related expenses. However, navigating the form's instructions can be daunting, even for experienced tax filers. In this article, we will provide a step-by-step guide to help you understand the Form 3800 instructions and ensure you are taking advantage of the credits you are eligible for.

The Importance of Accurate Tax Filing

Filing taxes accurately is crucial for businesses, as it directly affects their bottom line. Inaccurate or incomplete tax returns can lead to delayed refunds, penalties, and even audits. Moreover, businesses that fail to claim eligible credits may be leaving money on the table. The General Business Credit is a valuable opportunity for businesses to reduce their tax liability, and understanding the Form 3800 instructions is essential to claiming this credit.

Breaking Down the Form 3800 Instructions

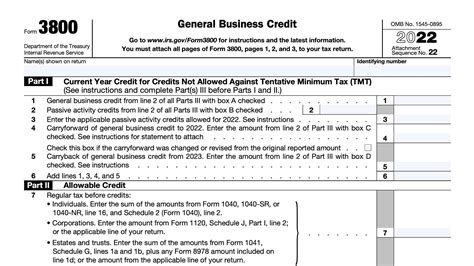

The Form 3800 is divided into several sections, each corresponding to a specific type of credit. To accurately complete the form, it's essential to understand the different types of credits and the requirements for claiming them.

Part I: General Business Credit

The General Business Credit is the primary credit claimed on Form 3800. This credit is calculated by adding up the credits from various sections of the form.

Section 1: Credit for Small Employer Pension Plan Startup Costs

This section allows small employers to claim a credit for startup costs associated with establishing a pension plan. To qualify, the employer must have 100 or fewer employees and must not have had a pension plan in place in the preceding three years.

Section 2: Credit for Employee Stock Ownership Plan (ESOP) Contributions

This section allows employers to claim a credit for contributions made to an ESOP. To qualify, the employer must have an ESOP in place and must make contributions to the plan.

Part II: Investment Credits

This part of the form is used to claim credits for investments made in certain types of property.

Section 1: Credit for Investment in Qualified Property

This section allows taxpayers to claim a credit for investments made in qualified property, such as solar panels or wind turbines.

Part III: Other Credits

This part of the form is used to claim credits for other business-related expenses.

Section 1: Credit for Research and Development Expenses

This section allows taxpayers to claim a credit for research and development expenses incurred during the tax year.

Step-by-Step Instructions for Completing Form 3800

Now that we've broken down the different sections of Form 3800, let's walk through the step-by-step instructions for completing the form.

Step 1: Gather Required Documents

Before starting the form, gather all required documents, including:

- Business tax return (Form 1120 or Form 1120S)

- Supporting schedules and statements

- Records of business-related expenses

Step 2: Complete Part I: General Business Credit

- Calculate the total credit by adding up the credits from each section

- Complete Section 1: Credit for Small Employer Pension Plan Startup Costs

- Complete Section 2: Credit for Employee Stock Ownership Plan (ESOP) Contributions

Step 3: Complete Part II: Investment Credits

- Calculate the total credit by adding up the credits from each section

- Complete Section 1: Credit for Investment in Qualified Property

Step 4: Complete Part III: Other Credits

- Calculate the total credit by adding up the credits from each section

- Complete Section 1: Credit for Research and Development Expenses

Step 5: Calculate the Total Credit

- Add up the credits from each part of the form

- Enter the total credit on Line 1 of the form

Step 6: Claim the Credit on the Business Tax Return

- Enter the total credit on the business tax return (Form 1120 or Form 1120S)

- Attach Form 3800 to the business tax return

Conclusion and Next Steps

Accurately completing Form 3800 requires a thorough understanding of the form's instructions and the various credits available. By following the step-by-step guide outlined in this article, businesses can ensure they are taking advantage of the credits they are eligible for. Remember to gather all required documents, complete each section of the form accurately, and claim the credit on the business tax return.

Don't forget to comment below with any questions or concerns you may have about completing Form 3800. Share this article with your colleagues and friends who may benefit from this information.

FAQ Section

What is the General Business Credit?

+The General Business Credit is a tax credit that allows businesses to offset their tax liability by claiming credits for various business-related expenses.

What types of credits can be claimed on Form 3800?

+Form 3800 allows businesses to claim credits for small employer pension plan startup costs, ESOP contributions, investment in qualified property, and research and development expenses.

How do I claim the credit on the business tax return?

+Enter the total credit on the business tax return (Form 1120 or Form 1120S) and attach Form 3800 to the return.