When it comes to navigating the complexities of tax credits, one of the most important forms for businesses and individuals alike is the Form 3554 Credit Owner Entry. This form is crucial for claiming tax credits and ensuring compliance with the IRS. However, understanding and accurately completing this form can be a daunting task. In this article, we will delve into the intricacies of the Form 3554 Credit Owner Entry, providing you with 5 essential tips to ensure you're making the most out of your tax credits.

Understanding the Form 3554 Credit Owner Entry

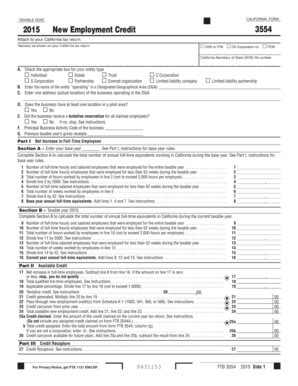

Before we dive into the tips, it's essential to understand what the Form 3554 Credit Owner Entry is and why it's necessary. This form is used to claim tax credits for businesses and individuals who have invested in low-income housing, renewable energy projects, or other qualified activities. The form is used to report the tax credits generated by these investments and to claim the credits against the taxpayer's liability.

Tip 1: Ensure Accurate Identification of Credit Owners

One of the most critical aspects of completing the Form 3554 Credit Owner Entry is accurately identifying the credit owners. This includes providing the correct name, address, and tax identification number (TIN) for each credit owner. Failure to provide accurate information can result in delays or even rejection of the tax credit claim.

To ensure accurate identification, it's essential to:

- Verify the credit owners' information through official documents, such as partnership agreements or corporate records.

- Ensure that the credit owners' TINs are correct and match the information on file with the IRS.

- Keep accurate records of all credit owners and their respective interests in the tax credit-generating activity.

Benefits of Accurate Credit Owner Identification

Accurate credit owner identification is crucial for several reasons:

- Ensures timely processing of tax credit claims

- Reduces the risk of errors or discrepancies

- Helps to prevent delays or rejection of tax credit claims

- Ensures compliance with IRS regulations

Tip 2: Calculate Tax Credits Correctly

Calculating tax credits correctly is essential to ensure that you're claiming the correct amount of credits. The Form 3554 Credit Owner Entry requires you to report the tax credits generated by the qualified activity, and failure to calculate these credits correctly can result in errors or discrepancies.

To calculate tax credits correctly:

- Refer to the relevant IRS regulations and guidelines for the specific tax credit program.

- Ensure that you're using the correct tax credit rate and calculation methodology.

- Verify that you're including all eligible expenses and income in the calculation.

- Keep accurate records of all calculations and supporting documentation.

Common Mistakes to Avoid

When calculating tax credits, it's essential to avoid common mistakes, such as:

- Using incorrect tax credit rates or calculation methodologies

- Failing to include all eligible expenses or income

- Not keeping accurate records of calculations and supporting documentation

Tip 3: Attach Required Documentation

The Form 3554 Credit Owner Entry requires you to attach specific documentation to support your tax credit claim. This documentation may include:

- Partnership agreements or corporate records

- Financial statements and reports

- Tax returns and schedules

- Certificates of completion or placement in service

To ensure that you're attaching the required documentation:

- Refer to the IRS instructions and guidelines for the specific tax credit program.

- Verify that you're including all required documentation and supporting materials.

- Keep accurate records of all attached documentation.

Benefits of Attaching Required Documentation

Attaching required documentation is essential for several reasons:

- Ensures timely processing of tax credit claims

- Reduces the risk of errors or discrepancies

- Helps to prevent delays or rejection of tax credit claims

- Ensures compliance with IRS regulations

Tip 4: Submit the Form 3554 Correctly

Once you've completed the Form 3554 Credit Owner Entry, it's essential to submit it correctly to the IRS. Failure to submit the form correctly can result in delays or rejection of the tax credit claim.

To submit the Form 3554 correctly:

- Refer to the IRS instructions and guidelines for the specific tax credit program.

- Verify that you're submitting the form to the correct address or online portal.

- Keep accurate records of all submissions and confirmations.

Common Mistakes to Avoid

When submitting the Form 3554, it's essential to avoid common mistakes, such as:

- Submitting the form to the wrong address or online portal

- Failing to include all required documentation and supporting materials

- Not keeping accurate records of submissions and confirmations

Tip 5: Seek Professional Assistance

Finally, it's essential to seek professional assistance when completing the Form 3554 Credit Owner Entry. Tax credit regulations and guidelines can be complex and nuanced, and failure to comply with these regulations can result in errors or discrepancies.

To seek professional assistance:

- Consult with a qualified tax professional or attorney.

- Verify that the professional has experience with tax credit programs and the Form 3554.

- Keep accurate records of all professional assistance and advice.

Benefits of Seeking Professional Assistance

Seeking professional assistance is essential for several reasons:

- Ensures compliance with IRS regulations and guidelines

- Reduces the risk of errors or discrepancies

- Helps to prevent delays or rejection of tax credit claims

- Provides peace of mind and confidence in the tax credit claim process

By following these 5 tips, you can ensure that you're making the most out of your tax credits and avoiding common mistakes and pitfalls. Remember to always seek professional assistance when completing the Form 3554 Credit Owner Entry, and don't hesitate to reach out to a qualified tax professional or attorney for guidance.

What is the Form 3554 Credit Owner Entry?

+The Form 3554 Credit Owner Entry is a tax form used to claim tax credits for businesses and individuals who have invested in low-income housing, renewable energy projects, or other qualified activities.

What is the purpose of the Form 3554 Credit Owner Entry?

+The purpose of the Form 3554 Credit Owner Entry is to report the tax credits generated by the qualified activity and to claim the credits against the taxpayer's liability.

What are the consequences of not completing the Form 3554 correctly?

+Failure to complete the Form 3554 correctly can result in errors or discrepancies, delays or rejection of tax credit claims, and non-compliance with IRS regulations.