The state of California requires businesses to file various tax forms to report their income and comply with tax laws. One of these forms is the California Form 3522, also known as the Limited Liability Company Return of Income. In this article, we will delve into the world of California Form 3522, explaining its purpose, who needs to file it, and how to file it correctly.

What is California Form 3522?

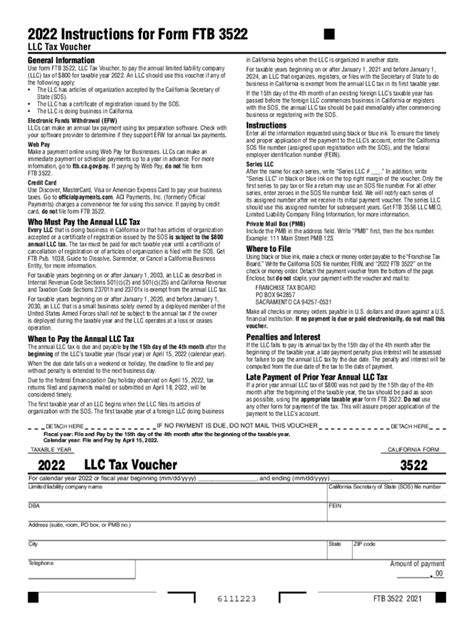

California Form 3522 is an annual tax return form required for limited liability companies (LLCs) operating in California. The form is used to report the LLC's income, deductions, and credits, as well as to calculate the LLC's tax liability. The form is typically filed by LLCs that are classified as partnerships or S corporations for federal tax purposes.

Who Needs to File California Form 3522?

Not all LLCs operating in California need to file Form 3522. The following LLCs are required to file the form:

- LLCs classified as partnerships or S corporations for federal tax purposes

- LLCs with California-source income

- LLCs with California withholding obligations

On the other hand, the following LLCs are exempt from filing Form 3522:

- Single-member LLCs (unless they have California withholding obligations)

- LLCs with no California-source income

- LLCs that are classified as C corporations for federal tax purposes

How to File California Form 3522

Filing California Form 3522 requires careful attention to detail and adherence to specific instructions. Here are the general steps to follow:

- Determine the Filing Status: Determine the LLC's filing status, which will depend on its classification for federal tax purposes.

- Gather Required Documents: Gather all required documents, including the LLC's federal tax return, financial statements, and any other relevant documentation.

- Complete the Form: Complete Form 3522, ensuring that all required information is provided accurately and completely.

- Calculate Tax Liability: Calculate the LLC's tax liability, taking into account any credits or deductions available.

- Submit the Form: Submit the completed form to the California Franchise Tax Board (FTB) by the deadline.

H2> California Form 3522 Filing Requirements

To ensure compliance with California tax laws, LLCs must meet specific filing requirements when submitting Form 3522.

- Filing Deadline: The filing deadline for Form 3522 is typically March 15th of each year, unless the LLC has an automatic six-month extension.

- Filing Method: The form can be filed electronically or by mail.

- Payment Requirements: Any tax liability must be paid by the filing deadline to avoid penalties and interest.

H2> Penalties for Non-Compliance

Failure to file California Form 3522 or pay any tax liability by the deadline can result in significant penalties and interest.

- Late Filing Penalty: A penalty of $18 per day, up to a maximum of $250, may be imposed for late filing.

- Late Payment Penalty: A penalty of 5% of the unpaid tax liability, plus interest, may be imposed for late payment.

H2> Conclusion

California Form 3522 is a critical tax return form for LLCs operating in California. By understanding the purpose, filing requirements, and potential penalties for non-compliance, LLCs can ensure compliance with California tax laws and avoid any unnecessary penalties or interest. If you are an LLC owner or manager, it is essential to consult with a tax professional to ensure accurate and timely filing of Form 3522.

FAQ Section

What is the deadline for filing California Form 3522?

+The filing deadline for Form 3522 is typically March 15th of each year, unless the LLC has an automatic six-month extension.

Who is exempt from filing California Form 3522?

+The following LLCs are exempt from filing Form 3522: single-member LLCs (unless they have California withholding obligations), LLCs with no California-source income, and LLCs that are classified as C corporations for federal tax purposes.

What are the penalties for non-compliance with California Form 3522?

+Failure to file Form 3522 or pay any tax liability by the deadline can result in significant penalties and interest, including a late filing penalty of $18 per day, up to a maximum of $250, and a late payment penalty of 5% of the unpaid tax liability, plus interest.