The Internal Revenue Service (IRS) requires individuals to make timely payments of their tax liability throughout the year. Failure to comply with this requirement can result in penalties and interest on the underpaid amount. One of the forms used to calculate and report underpayment penalties is Form 2210, Schedule AI. In this article, we will delve into the world of underpayment penalties, explain how to complete Form 2210, Schedule AI, and provide valuable insights to help you avoid or minimize these penalties.

Understanding Underpayment Penalties

The IRS imposes underpayment penalties on individuals who fail to make timely payments of their tax liability. This penalty is calculated on the unpaid amount, and it can be substantial. The underpayment penalty is designed to encourage individuals to make timely payments and avoid deferring their tax liability to the end of the year.

Who is Subject to Underpayment Penalties?

Underpayment penalties apply to individuals who:

- Have a tax liability of $1,000 or more for the tax year

- Fail to make timely payments of their tax liability throughout the year

- Do not make estimated tax payments or annualize their income

Form 2210, Schedule AI: An Overview

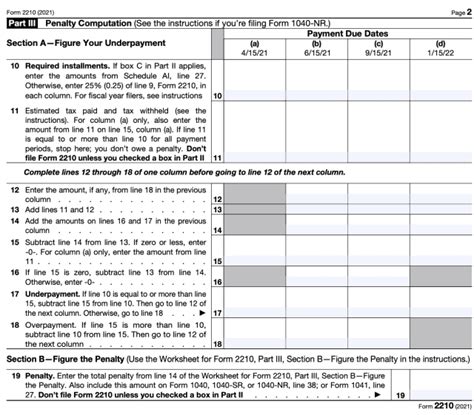

Form 2210, Schedule AI, is used to calculate and report underpayment penalties. This form is completed by individuals who owe underpayment penalties and are required to file Form 2210. Schedule AI is used to calculate the penalty amount, and it takes into account the following factors:

- The amount of underpayment

- The number of quarters the underpayment occurred

- The interest rate applicable to the underpayment

How to Complete Form 2210, Schedule AI

Completing Form 2210, Schedule AI, requires careful attention to detail. Here are the steps to follow:

- Determine the underpayment amount: Calculate the amount of underpayment for each quarter using Form 2210, Part III.

- Calculate the penalty amount: Use the underpayment amount and the interest rate to calculate the penalty amount for each quarter.

- Complete Schedule AI: Enter the penalty amount for each quarter on Schedule AI, lines 1-4.

- Calculate the total penalty: Add the penalty amounts for each quarter to calculate the total penalty due.

Avoiding or Minimizing Underpayment Penalties

While underpayment penalties can be substantial, there are ways to avoid or minimize them. Here are some strategies to consider:

- Make timely estimated tax payments: Make quarterly estimated tax payments to avoid underpayment penalties.

- Annualize your income: If you receive income unevenly throughout the year, consider annualizing your income to avoid underpayment penalties.

- Use the safe harbor rule: If you owe less than $1,000 in taxes for the year, you are exempt from underpayment penalties.

Waiver of Underpayment Penalty

In some cases, the IRS may waive the underpayment penalty if you meet certain conditions. These conditions include:

- You did not owe any tax for the prior tax year

- You are a first-time filer

- You experience a casualty, disaster, or other unusual circumstances that prevent you from making timely payments

To request a waiver of the underpayment penalty, complete Form 2210, Part II, and attach it to your tax return.

Conclusion

Underpayment penalties can be substantial, but by understanding how to complete Form 2210, Schedule AI, and taking steps to avoid or minimize these penalties, you can save money and avoid unnecessary stress. Remember to make timely estimated tax payments, annualize your income if necessary, and use the safe harbor rule to avoid underpayment penalties. If you do owe underpayment penalties, consider requesting a waiver if you meet the conditions.

What is the purpose of Form 2210, Schedule AI?

+Form 2210, Schedule AI, is used to calculate and report underpayment penalties.

Who is subject to underpayment penalties?

+Individuals who have a tax liability of $1,000 or more for the tax year and fail to make timely payments of their tax liability are subject to underpayment penalties.

How can I avoid underpayment penalties?

+You can avoid underpayment penalties by making timely estimated tax payments, annualizing your income if necessary, and using the safe harbor rule.