The Form 147c is a vital document for individuals who need to provide documentation for their income tax returns. It is a certificate that shows an individual's income from employment, investments, or other sources. In this article, we will delve into the world of Form 147c, exploring its significance, components, and providing a comprehensive guide on how to fill it out. We will also include a sample template to help you better understand the process.

The Importance of Form 147c

Form 147c is an essential document that helps the government keep track of an individual's income and ensure they are paying the correct amount of taxes. It is usually issued by an employer or a financial institution to provide proof of income. The form is used to report various types of income, including salaries, wages, tips, and investment income. It is also used to report deductions and exemptions that can reduce an individual's tax liability.

Components of Form 147c

Form 147c typically consists of several sections, including:

- Identification Section: This section includes the individual's name, address, and taxpayer identification number.

- Income Section: This section reports the individual's income from various sources, including employment, investments, and other sources.

- Deductions and Exemptions Section: This section reports any deductions and exemptions that can reduce the individual's tax liability.

- Certification Section: This section is signed by the employer or financial institution, certifying the accuracy of the information provided.

How to Fill Out Form 147c

Filling out Form 147c can be a daunting task, especially for those who are not familiar with tax terminology. Here is a step-by-step guide on how to fill out the form:

Step 1: Gather Required Documents

Before filling out Form 147c, gather all the required documents, including:

- Pay stubs

- W-2 forms

- 1099 forms

- Investment statements

- Any other documents that support your income and deductions

Step 2: Fill Out the Identification Section

- Enter your name and address in the designated fields.

- Enter your taxpayer identification number (TIN) in the designated field.

Step 3: Fill Out the Income Section

- Report your income from employment, investments, and other sources.

- Use the pay stubs, W-2 forms, and 1099 forms to support your income.

Step 4: Fill Out the Deductions and Exemptions Section

- Report any deductions and exemptions that can reduce your tax liability.

- Use the investment statements and other documents to support your deductions and exemptions.

Step 5: Fill Out the Certification Section

- Sign the form, certifying the accuracy of the information provided.

- Have the employer or financial institution sign the form, certifying the accuracy of the information provided.

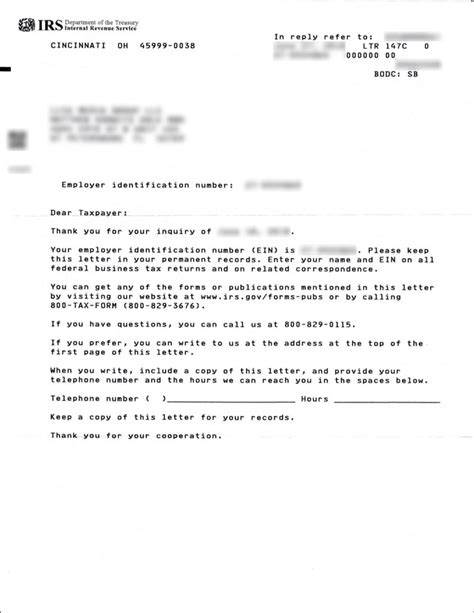

Form 147c Sample Template

Here is a sample template of Form 147c:

Identification Section

- Name: _____________________________________________________

- Address: _____________________________________________________

- TIN: _____________________________________________________

Income Section

- Employment Income: $ _______________________________________

- Investment Income: $ _______________________________________

- Other Income: $ _______________________________________

Deductions and Exemptions Section

- Deductions: $ _______________________________________

- Exemptions: $ _______________________________________

Certification Section

- I certify that the information provided is accurate and true.

- Signature: _____________________________________________________

- Date: _____________________________________________________

Tips and Tricks

- Make sure to keep accurate records of your income and deductions.

- Use the correct tax terminology to avoid any confusion.

- Have the employer or financial institution review the form before signing.

Frequently Asked Questions

Q: What is the purpose of Form 147c?

A: Form 147c is a certificate that shows an individual's income from employment, investments, or other sources.

Q: Who issues Form 147c?

A: Form 147c is usually issued by an employer or a financial institution.

Q: What is the deadline for filing Form 147c?

A: The deadline for filing Form 147c varies depending on the tax year and the individual's circumstances.

Q: Can I file Form 147c electronically?

A: Yes, Form 147c can be filed electronically through the IRS website.

Conclusion

Form 147c is an essential document that helps the government keep track of an individual's income and ensure they are paying the correct amount of taxes. By following the steps outlined in this article and using the sample template provided, you can ensure that you fill out the form accurately and efficiently. Remember to keep accurate records of your income and deductions, and have the employer or financial institution review the form before signing.

We hope this article has provided you with a comprehensive guide on Form 147c. If you have any further questions or concerns, please do not hesitate to comment below.

What is the purpose of Form 147c?

+Form 147c is a certificate that shows an individual's income from employment, investments, or other sources.

Who issues Form 147c?

+Form 147c is usually issued by an employer or a financial institution.

What is the deadline for filing Form 147c?

+The deadline for filing Form 147c varies depending on the tax year and the individual's circumstances.