Understanding Form 1116: Foreign Tax Credit

The Alternative Minimum Tax (AMT) is a complex and often misunderstood aspect of the US tax code. One of the key forms used to calculate the AMT is Form 1116, which is used to claim the foreign tax credit. The foreign tax credit is a vital component of the AMT calculation, as it allows taxpayers to offset their US tax liability with foreign taxes paid on foreign-sourced income.

In this article, we will explore the six ways to fill out Form 1116 for the AMT, including the necessary steps, calculations, and considerations. We will also provide practical examples and statistical data to illustrate the concepts.

Why is Form 1116 Important for the AMT?

Form 1116 is a critical component of the AMT calculation because it allows taxpayers to claim the foreign tax credit. The foreign tax credit is a non-refundable credit that can be used to offset US tax liability on foreign-sourced income. The credit is calculated based on the foreign taxes paid or accrued on foreign-sourced income, and it can significantly reduce a taxpayer's AMT liability.

Step 1: Determine if You Need to File Form 1116

Before filling out Form 1116, you need to determine if you are required to file it. You will need to file Form 1116 if you have foreign-sourced income and have paid or accrued foreign taxes on that income. This includes income from foreign stocks, bonds, mutual funds, and other foreign investments.

To determine if you need to file Form 1116, you can use the following criteria:

- You have foreign-sourced income that is subject to US taxation.

- You have paid or accrued foreign taxes on that income.

- You are claiming a foreign tax credit on your US tax return.

If you meet any of these criteria, you will need to file Form 1116.

Step 2: Calculate Your Foreign Tax Credit

Once you have determined that you need to file Form 1116, you will need to calculate your foreign tax credit. The foreign tax credit is calculated based on the foreign taxes paid or accrued on foreign-sourced income.

To calculate your foreign tax credit, you will need to complete the following steps:

- Identify the foreign-sourced income that is subject to US taxation.

- Determine the foreign taxes paid or accrued on that income.

- Calculate the foreign tax credit based on the foreign taxes paid or accrued.

The foreign tax credit is calculated using the following formula:

Foreign Tax Credit = (Foreign Taxes Paid or Accrued / Total Foreign-Sourced Income) x Total US Tax Liability

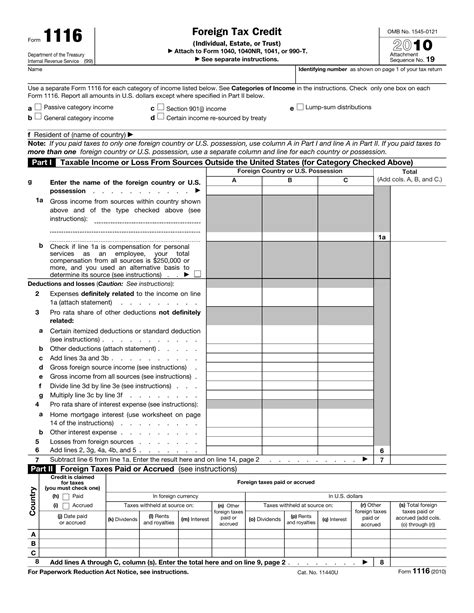

Step 3: Complete Form 1116

Once you have calculated your foreign tax credit, you will need to complete Form 1116. Form 1116 is a multi-part form that requires you to provide detailed information about your foreign-sourced income and foreign taxes paid or accrued.

To complete Form 1116, you will need to provide the following information:

- Your name, address, and taxpayer identification number.

- A description of the foreign-sourced income that is subject to US taxation.

- The amount of foreign taxes paid or accrued on that income.

- The calculation of the foreign tax credit.

You will also need to attach supporting documentation to Form 1116, including:

- A copy of your foreign tax return.

- A copy of your US tax return.

- Documentation of the foreign taxes paid or accrued.

Step 4: Attach Supporting Documentation

In addition to completing Form 1116, you will also need to attach supporting documentation to your US tax return. This documentation includes:

- A copy of your foreign tax return.

- A copy of your US tax return.

- Documentation of the foreign taxes paid or accrued.

The supporting documentation is used to substantiate the foreign tax credit claimed on Form 1116.

Step 5: Claim the Foreign Tax Credit on Your US Tax Return

Once you have completed Form 1116 and attached the supporting documentation, you can claim the foreign tax credit on your US tax return. The foreign tax credit is claimed on Form 1040, Schedule 3.

To claim the foreign tax credit, you will need to complete the following steps:

- Enter the foreign tax credit on Form 1040, Schedule 3.

- Attach Form 1116 and the supporting documentation to your US tax return.

The foreign tax credit can significantly reduce your US tax liability, so it is essential to claim it correctly.

Step 6: Review and Revise Your Form 1116

Finally, it is essential to review and revise your Form 1116 to ensure that it is accurate and complete. You should review the form for the following:

- Accuracy of the foreign-sourced income and foreign taxes paid or accrued.

- Completeness of the supporting documentation.

- Calculation of the foreign tax credit.

If you find any errors or inaccuracies, you should revise the form and reattach the supporting documentation.

Conclusion

Filling out Form 1116 for the AMT requires careful attention to detail and a thorough understanding of the foreign tax credit. By following the six steps outlined in this article, you can ensure that you accurately calculate and claim the foreign tax credit on your US tax return.

Remember to review and revise your Form 1116 to ensure that it is accurate and complete. If you have any questions or concerns, you should consult with a tax professional or seek guidance from the IRS.

We hope this article has provided you with a comprehensive understanding of how to fill out Form 1116 for the AMT. If you have any further questions or would like to share your experiences, please leave a comment below.

What is the purpose of Form 1116?

+Form 1116 is used to claim the foreign tax credit, which is a non-refundable credit that can be used to offset US tax liability on foreign-sourced income.

Who needs to file Form 1116?

+You will need to file Form 1116 if you have foreign-sourced income and have paid or accrued foreign taxes on that income.

How do I calculate the foreign tax credit?

+The foreign tax credit is calculated based on the foreign taxes paid or accrued on foreign-sourced income. You can use the formula: Foreign Tax Credit = (Foreign Taxes Paid or Accrued / Total Foreign-Sourced Income) x Total US Tax Liability.