The thrill of tax season is upon us, and with it, the prospect of claiming a refund. But, to get that refund, you'll need to navigate the often-confusing world of tax forms. One of the most important forms for individual taxpayers is the Form 1040 Worksheet. In this article, we'll break down the process into 5 manageable steps, helping you to accurately fill out your Form 1040 Worksheet and claim the refund you're entitled to.

Understanding the Form 1040 Worksheet

Before we dive into the steps, it's essential to understand what the Form 1040 Worksheet is and why it's necessary. The Form 1040 Worksheet is a supporting document that accompanies your Form 1040 tax return. It's used to calculate your total tax liability, deductions, and credits, which ultimately determines your refund amount.

Step 1: Gather Your Documents and Information

To accurately fill out your Form 1040 Worksheet, you'll need to gather all relevant tax documents and information. This includes:

- Your W-2 forms from your employer(s)

- 1099 forms for any freelance or contract work

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Charitable donation receipts

- Medical expense records

- Mortgage interest statements (1098)

Having all these documents at hand will save you time and reduce errors when filling out your worksheet.

Step 2: Calculate Your Total Income

Your total income is the foundation of your tax return. You'll need to calculate your total income from all sources, including wages, tips, and self-employment income. Be sure to include any income from investments, such as interest and dividends.

- Use your W-2 and 1099 forms to calculate your total income from employment

- Add any self-employment income, such as freelance work or consulting fees

- Include any interest and dividend income from investments

Total Income Formula:

Total Income = W-2 Income + 1099 Income + Self-Employment Income + Interest and Dividend Income

Step 3: Calculate Your Deductions and Credits

Deductions and credits can significantly reduce your tax liability. You'll need to calculate your deductions and credits, including:

-

Standard deduction or itemized deductions (e.g., mortgage interest, charitable donations)

-

Personal exemptions (e.g., yourself, spouse, dependents)

-

Tax credits (e.g., earned income tax credit, child tax credit)

-

Use Schedule A (Form 1040) to calculate your itemized deductions

-

Claim the standard deduction if it's greater than your itemized deductions

-

Calculate your personal exemptions and tax credits using the relevant forms and schedules

Deductions and Credits Formula:

Total Deductions and Credits = Standard Deduction or Itemized Deductions + Personal Exemptions + Tax Credits

Step 4: Calculate Your Tax Liability

Now that you have your total income, deductions, and credits, you can calculate your tax liability. You'll need to use the tax tables or tax calculator to determine your tax liability.

- Use the tax tables or tax calculator to determine your tax liability based on your total income and filing status

- Subtract your deductions and credits from your total tax liability

Tax Liability Formula:

Tax Liability = Total Tax Liability - Deductions and Credits

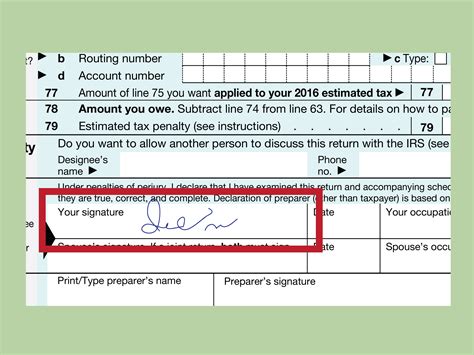

Step 5: Claim Your Refund

The final step is to claim your refund. If you've followed the previous steps correctly, you should have a accurate calculation of your refund amount.

- Use Form 1040 to report your refund amount

- Choose your refund option: direct deposit, check, or apply to next year's taxes

By following these 5 steps, you'll be able to accurately fill out your Form 1040 Worksheet and claim the refund you're entitled to. Remember to double-check your calculations and seek professional help if you're unsure about any part of the process.

We hope this article has helped you navigate the Form 1040 Worksheet and claim your refund. Share your tax refund stories and tips in the comments below!

What is the Form 1040 Worksheet?

+The Form 1040 Worksheet is a supporting document that accompanies your Form 1040 tax return. It's used to calculate your total tax liability, deductions, and credits, which ultimately determines your refund amount.

What documents do I need to fill out the Form 1040 Worksheet?

+You'll need to gather all relevant tax documents and information, including W-2 forms, 1099 forms, interest statements, dividend statements, charitable donation receipts, medical expense records, and mortgage interest statements.

How do I calculate my total income?

+Calculate your total income from all sources, including wages, tips, and self-employment income. Add any income from investments, such as interest and dividends.