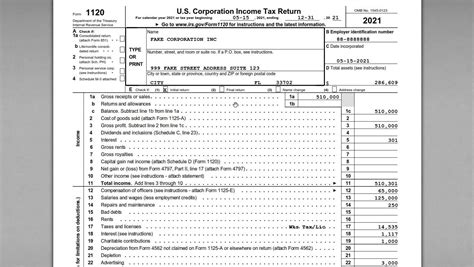

As a business owner in Florida, understanding and accurately completing your tax forms is crucial for maintaining compliance and avoiding unnecessary penalties. The Form 1120, also known as the U.S. Corporation Income Tax Return, is a critical document that the Internal Revenue Service (IRS) requires all domestic corporations to file annually. In this article, we will delve into the world of Florida Form 1120 instructions, providing a comprehensive, step-by-step guide to help you navigate the process with ease.

Completing the Form 1120 can be a daunting task, especially for those who are new to the world of corporate taxation. The form requires detailed information about your corporation's income, deductions, and tax credits, among other things. In the following sections, we will break down the Form 1120 into manageable parts, providing clear explanations and examples to ensure you are well-equipped to tackle the task at hand.

Who Needs to File Form 1120?

Before we dive into the nitty-gritty of the Form 1120 instructions, it's essential to determine whether your corporation is required to file this form. In general, all domestic corporations must file Form 1120, regardless of whether they have taxable income or not. This includes:

- C corporations

- S corporations that have made certain elections

- Corporate subsidiaries

- Consolidated groups

If your corporation is a single-member limited liability company (LLC) or a qualified subchapter S subsidiary, you may not need to file Form 1120. However, it's always best to consult with a tax professional or accountant to determine the specific filing requirements for your business.

What You'll Need to File Form 1120

To accurately complete the Form 1120, you'll need to gather the following information and documents:

- Your corporation's Employer Identification Number (EIN)

- Business income and expense records

- Depreciation and amortization records

- Tax credits and deductions

- Balance sheet and income statement

- W-2 and 1099 forms for employees and contractors

It's also a good idea to consult the IRS instructions for Form 1120, as well as any relevant Florida state tax regulations, to ensure you are meeting all the necessary requirements.

Step-by-Step Guide to Completing Form 1120

Now that we've covered the basics, let's move on to the step-by-step guide to completing Form 1120.

Step 1: Identify Your Corporation's Type and Filing Status

- Check the box that corresponds to your corporation's type (e.g., C corporation, S corporation, etc.)

- Indicate your corporation's filing status (e.g., single-member LLC, consolidated group, etc.)

Step 2: Report Business Income

- Complete Schedule C (Form 1120) to report your corporation's business income

- Include all sources of income, such as sales, services, and interest

Step 3: Calculate Cost of Goods Sold

- Complete Schedule A (Form 1120) to calculate your corporation's cost of goods sold

- Include direct costs, such as materials and labor, as well as indirect costs, such as overhead

Step 4: Claim Deductions and Credits

- Complete Schedule D (Form 1120) to claim deductions, such as depreciation and amortization

- Complete Form 3800 to claim tax credits, such as the research and development credit

Step 5: Calculate Tax Liability

- Complete Form 1120, Page 1, to calculate your corporation's tax liability

- Include any tax credits and deductions claimed in previous steps

Step 6: Report Balance Sheet and Income Statement

- Complete Schedule L (Form 1120) to report your corporation's balance sheet

- Complete Schedule M-1 (Form 1120) to report your corporation's income statement

Florida State Tax Requirements

In addition to filing Form 1120 with the IRS, Florida corporations are also required to file state tax returns with the Florida Department of Revenue. The specific requirements will depend on your corporation's type and filing status, but in general, you'll need to file:

- Form F-1120 (Florida Corporate Income/Franchise Tax Return)

- Form F-7004 (Florida Automatic Extension of Time to File Corporate Income/Franchise Tax Return)

It's essential to consult the Florida Department of Revenue's instructions and regulations to ensure you are meeting all the necessary state tax requirements.

Tips and Reminders

- File Form 1120 by the due date (typically March 15th) to avoid penalties and interest

- Make timely payments to avoid late payment penalties

- Keep accurate and detailed records of your corporation's income, deductions, and tax credits

- Consult with a tax professional or accountant to ensure accuracy and compliance

By following these steps and tips, you'll be well on your way to accurately completing the Form 1120 and meeting your corporation's tax obligations. Remember to stay organized, keep detailed records, and consult with a tax professional or accountant if you're unsure about any aspect of the process.

Now that you've made it to the end of this article, we encourage you to take the next step in ensuring your corporation's tax compliance. Share your thoughts and questions in the comments below, and don't forget to like and share this article with your fellow business owners.

What is the due date for filing Form 1120?

+The due date for filing Form 1120 is typically March 15th.

What is the difference between a C corporation and an S corporation?

+A C corporation is a standard corporation that is taxed on its profits, whereas an S corporation is a pass-through entity that is not taxed at the corporate level.

Do I need to file Form 1120 if my corporation has no taxable income?

+Yes, all domestic corporations are required to file Form 1120, regardless of whether they have taxable income or not.