Limited Liability Companies (LLCs) are a popular business structure for entrepreneurs, offering liability protection and tax benefits. In the United States, each state has its own regulations and requirements for forming and maintaining an LLC. One of the essential compliance requirements for LLCs is filing the annual report, also known as Form LLC-12. In this article, we will discuss the importance of filing Form LLC-12 and provide a step-by-step guide on how to file it online easily.

What is Form LLC-12?

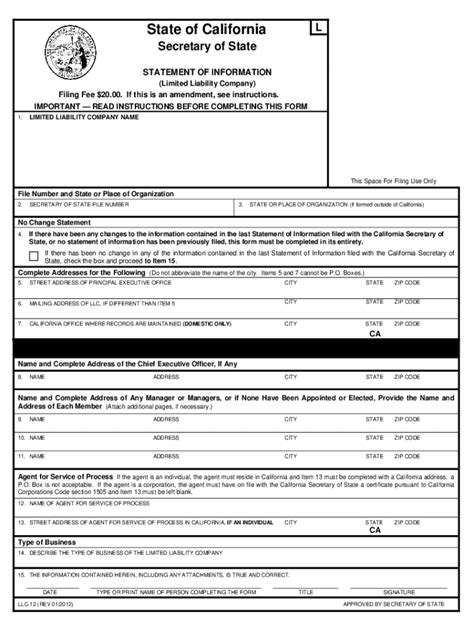

Form LLC-12 is an annual report that LLCs must file with their state's business registration agency, typically the Secretary of State or State Department. The report updates the state on any changes to the LLC's business structure, management, or ownership. It also confirms the LLC's contact information, business activities, and other essential details.

Why is Filing Form LLC-12 Important?

Filing Form LLC-12 is crucial for maintaining your LLC's good standing with the state. Failure to file the report can result in penalties, fines, and even the dissolution of your LLC. Here are some reasons why filing Form LLC-12 is essential:

- Maintains Good Standing: Filing the annual report ensures your LLC remains in good standing with the state, which is necessary for conducting business, obtaining loans, and accessing other benefits.

- Updates Business Information: The report allows you to update your LLC's business information, such as changes to your business name, address, or management structure.

- Confirms Compliance: Filing Form LLC-12 confirms your LLC's compliance with state regulations, which helps avoid penalties and fines.

5 Ways to File Form LLC-12 Online Easily

Filing Form LLC-12 online is a convenient and efficient way to meet your LLC's annual reporting requirements. Here are five ways to file the form online easily:

1. Use the State's Business Registration Portal

Most states offer online business registration portals where you can file Form LLC-12. To access the portal, follow these steps:

- Go to your state's business registration website (e.g., for California).

- Click on the "File Online" or "Annual Report" tab.

- Log in to your account or create a new one if you don't have an existing account.

- Fill out the online form and upload any required documents.

- Pay the filing fee using a credit card or other accepted payment methods.

2. Utilize a Business Filing Service

Business filing services, such as Incfile or ZenBusiness, offer online platforms to file Form LLC-12. These services typically charge a small fee for their services but can save you time and effort. Here's how to use a business filing service:

- Choose a reputable business filing service.

- Create an account or log in to your existing account.

- Fill out the online form and provide any required documentation.

- Pay the filing fee and service fee.

3. File Through a Registered Agent

If you have a registered agent, you can file Form LLC-12 through their online platform. Here's how:

- Contact your registered agent and ask about their online filing process.

- Log in to your account or create a new one if necessary.

- Fill out the online form and upload any required documents.

- Pay the filing fee and any applicable service fees.

4. Use a Business Formation Company

Business formation companies, such as Northwest Registered Agent or Rocket Lawyer, offer online platforms to file Form LLC-12. These companies often provide additional services, such as registered agent services or business license applications. Here's how to use a business formation company:

- Choose a reputable business formation company.

- Create an account or log in to your existing account.

- Fill out the online form and provide any required documentation.

- Pay the filing fee and any applicable service fees.

5. File Through an Attorney or Accountant

If you prefer to work with an attorney or accountant, you can file Form LLC-12 through their office. Here's how:

- Contact your attorney or accountant and ask about their filing process.

- Provide any required documentation and information.

- Pay the filing fee and any applicable service fees.

Tips for Filing Form LLC-12 Online

When filing Form LLC-12 online, keep the following tips in mind:

- Verify Your Business Information: Ensure your LLC's business information is accurate and up-to-date before filing the report.

- Use a Secure Connection: Make sure your internet connection is secure to protect your sensitive business information.

- Save a Copy: Save a copy of your filed report for your records.

- Check for Filing Fees: Verify the filing fee and any applicable service fees before submitting your report.

By following these tips and using one of the five methods outlined above, you can easily file Form LLC-12 online and maintain your LLC's good standing with the state.

Encourage Engagement

We hope this article has provided you with valuable information on filing Form LLC-12 online. If you have any questions or need further assistance, please don't hesitate to comment below. Share this article with your colleagues and friends who may benefit from this information. Remember to stay compliant with your state's regulations and file your annual report on time to avoid penalties and fines.

What is the deadline for filing Form LLC-12?

+The deadline for filing Form LLC-12 varies by state. Typically, it's due on the anniversary of your LLC's formation or registration date. Check with your state's business registration agency for specific deadlines.

Can I file Form LLC-12 by mail or in-person?

+Yes, you can file Form LLC-12 by mail or in-person, but it's recommended to file online for faster processing and to avoid errors. Check with your state's business registration agency for specific instructions.

What happens if I miss the deadline for filing Form LLC-12?

+If you miss the deadline for filing Form LLC-12, your LLC may be subject to penalties, fines, and even dissolution. Contact your state's business registration agency immediately to resolve the issue.