As a business owner, selling or disposing of property can be a significant event that has tax implications. The federal government requires you to report these transactions using Form 4797, Sales of Business Property. Filing this form accurately and on time is crucial to avoid any potential penalties or audits. In this article, we will provide you with 5 tips for filing federal Form 4797 to help you navigate the process smoothly.

Understanding Form 4797

Before we dive into the tips, let's briefly discuss what Form 4797 is and what it's used for. Form 4797 is used to report the sale or exchange of business property, including real estate, equipment, and other depreciable assets. The form is used to calculate the gain or loss from these transactions and report it on your business tax return.

Tip 1: Identify the Type of Property Sold

The first step in filing Form 4797 is to identify the type of property sold. This is crucial because different types of property have different tax implications. For example, the sale of real estate is reported on a different part of the form than the sale of equipment. Make sure to review the instructions for Form 4797 to determine which part of the form to use for your specific transaction.

Tip 2: Calculate the Gain or Loss

Once you've identified the type of property sold, the next step is to calculate the gain or loss from the transaction. This involves determining the sale price, the adjusted basis of the property, and any depreciation or amortization that was claimed on the property. The gain or loss is calculated by subtracting the adjusted basis from the sale price.

Tip 3: Report Depreciation Recapture

If you sold depreciable property, such as equipment or vehicles, you may need to report depreciation recapture on Form 4797. Depreciation recapture is the amount of depreciation that was claimed on the property while it was in use. This amount is subject to taxation as ordinary income.

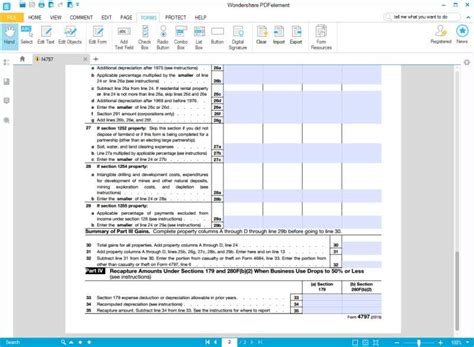

Tip 4: Complete Part IV of Form 4797

Part IV of Form 4797 is used to report the gain or loss from the sale of business property. This part of the form requires you to calculate the total gain or loss from all transactions reported on the form. Make sure to complete this part accurately, as it will affect your business tax liability.

Tip 5: Attach Supporting Documentation

Finally, make sure to attach supporting documentation to your Form 4797. This may include a copy of the sale agreement, a bill of sale, or other documentation that supports the transaction. This documentation will help to substantiate the gain or loss reported on the form.

Conclusion

Filing Form 4797 can be a complex process, but by following these 5 tips, you can ensure that you report your business property transactions accurately and avoid any potential penalties or audits. Remember to identify the type of property sold, calculate the gain or loss, report depreciation recapture, complete Part IV of the form, and attach supporting documentation. By taking the time to understand the requirements of Form 4797, you can ensure that your business is in compliance with federal tax laws.

We hope you found this article helpful. If you have any questions or need further clarification on any of the topics discussed, please don't hesitate to comment below. We'd be happy to help.

What is Form 4797 used for?

+Form 4797 is used to report the sale or exchange of business property, including real estate, equipment, and other depreciable assets.

How do I calculate the gain or loss on Form 4797?

+The gain or loss is calculated by subtracting the adjusted basis from the sale price.

What is depreciation recapture?

+Depreciation recapture is the amount of depreciation that was claimed on the property while it was in use. This amount is subject to taxation as ordinary income.