Filing taxes can be a daunting task, especially for those who are new to the process or have complex financial situations. However, with the right guidance, it can be made easier and less time-consuming. In this article, we will discuss 5 easy ways to file California tax form, making it simpler for you to comply with tax regulations and avoid any potential penalties.

Tax season can be a stressful time for many Californians. The Golden State has a complex tax system, with multiple forms and schedules to navigate. However, by understanding the different filing options available, you can make the process more manageable. Whether you're a student, a working professional, or a retiree, there's a filing method that suits your needs.

E-Filing with the California Franchise Tax Board (FTB)

The California Franchise Tax Board (FTB) is the state's tax authority, responsible for collecting and processing tax returns. One of the easiest ways to file your California tax form is through the FTB's e-file system. This method is fast, secure, and convenient, allowing you to submit your return from the comfort of your own home.

To e-file with the FTB, you'll need to create an account on their website and follow the prompts to submit your return. You'll need to provide personal and financial information, including your Social Security number, income, and deductions. The FTB will then review your return and process your refund, if applicable.

Benefits of E-Filing with the FTB

- Fast and secure submission

- Reduced risk of errors and audits

- Faster refund processing

- Environmentally friendly

How to E-File with the FTB

- Create an account on the FTB website

- Gather personal and financial information

- Follow the prompts to submit your return

- Review and confirm your submission

- Receive your refund, if applicable

Using Tax Preparation Software

Another easy way to file your California tax form is by using tax preparation software. These programs guide you through the filing process, ensuring you take advantage of all eligible deductions and credits. Some popular tax preparation software includes TurboTax, H&R Block, and TaxAct.

Tax preparation software is user-friendly and often includes features such as:

- Step-by-step guidance

- Automatic calculation of deductions and credits

- Importing of W-2 and 1099 forms

- E-filing and refund tracking

Benefits of Using Tax Preparation Software

- Easy to use and navigate

- Reduces risk of errors and audits

- Fast and secure submission

- Often includes free e-filing and refund tracking

How to Use Tax Preparation Software

- Choose a reputable tax preparation software

- Download and install the software

- Follow the prompts to input personal and financial information

- Review and confirm your submission

- E-file and track your refund

Filing with a Tax Professional

If you're not comfortable filing your California tax form on your own, you may want to consider hiring a tax professional. Tax professionals, such as certified public accountants (CPAs) and enrolled agents (EAs), have the expertise and knowledge to navigate complex tax situations.

Tax professionals can:

- Prepare and file your tax return

- Represent you in front of the FTB and IRS

- Provide guidance on tax planning and optimization

- Help with audit and appeal processes

Benefits of Filing with a Tax Professional

- Expert knowledge and guidance

- Reduced risk of errors and audits

- Personalized service and support

- Representation in front of tax authorities

How to Find a Tax Professional

- Ask for referrals from friends and family

- Check online directories and reviews

- Verify credentials and certifications

- Schedule a consultation to discuss your needs

- Choose a reputable and experienced tax professional

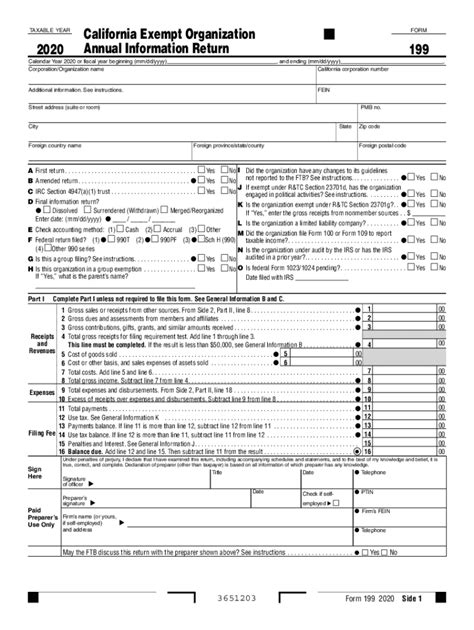

Mail Filing

If you prefer to file your California tax form by mail, you can do so by printing and mailing a paper return. This method is more time-consuming and may result in delays, but it's still an option for those who prefer a more traditional approach.

To mail file, you'll need to:

- Print and complete the necessary forms and schedules

- Attach supporting documentation, such as W-2 and 1099 forms

- Mail the return to the FTB address listed on their website

Benefits of Mail Filing

- No need for computer or internet access

- Can be a more traditional and familiar approach

- May be suitable for simple tax situations

How to Mail File

- Print and complete the necessary forms and schedules

- Attach supporting documentation

- Mail the return to the FTB address

- Keep a copy of your return for your records

Using a Tax Clinic

Finally, if you're eligible, you may be able to use a tax clinic to file your California tax form. Tax clinics are free or low-cost services that provide tax preparation and filing assistance to qualifying individuals.

Tax clinics are often staffed by volunteers and may be located at community centers, libraries, and other public locations.

Benefits of Using a Tax Clinic

- Free or low-cost service

- Expert guidance and support

- Convenient locations and hours

- May be suitable for simple tax situations

How to Find a Tax Clinic

- Search online for tax clinics in your area

- Check with local community centers and libraries

- Verify eligibility and requirements

- Schedule an appointment and bring necessary documents

We hope this article has provided you with a comprehensive guide to filing your California tax form. Whether you choose to e-file with the FTB, use tax preparation software, or seek the help of a tax professional, there's a method that suits your needs and preferences. Remember to stay organized, take advantage of deductions and credits, and seek help when needed to ensure a smooth and stress-free tax filing experience.

What is the deadline for filing California tax form?

+The deadline for filing California tax form is typically April 15th, but it may vary depending on your specific situation. Check with the FTB for more information.

Do I need to file a California tax form if I'm a non-resident?

+Yes, you may need to file a California tax form as a non-resident if you have income from California sources. Check with the FTB for more information.

Can I e-file my California tax form if I owe taxes?

+Yes, you can e-file your California tax form even if you owe taxes. However, you'll need to make arrangements to pay your tax bill by the deadline to avoid penalties and interest.