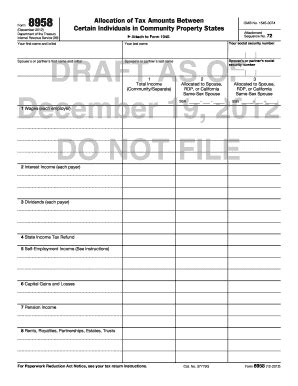

The world of tax forms can be overwhelming, but don't worry, we're here to help. Filling out Form 8958, also known as the Allocation of Tax Basis, is a crucial step in reporting the tax basis of a partner's interest in a partnership. In this article, we'll break down the process into easy-to-follow steps, making it simpler for you to complete this form accurately.

Why is Form 8958 Important?

Before we dive into the steps, let's quickly discuss why Form 8958 is essential. This form is used to report the allocation of tax basis of a partner's interest in a partnership. The tax basis is the partner's share of the partnership's assets, liabilities, and other items. Accurately reporting this information is crucial for tax purposes, as it affects the partner's taxable income and potential tax liabilities.

Step 1: Gather Required Information

To complete Form 8958, you'll need the following information:

- The partnership's name, address, and Employer Identification Number (EIN)

- The partner's name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN)

- The partner's percentage interest in the partnership

- The partnership's total assets, liabilities, and other items

- The partner's share of the partnership's assets, liabilities, and other items

Step 2: Complete Part I - Partnership Information

Part I - Partnership Information

In this section, you'll provide general information about the partnership. This includes:

- Partnership name and address

- Partnership EIN

- Partnership's tax year-end date

Make sure to double-check the partnership's information to ensure accuracy.

Step 3: Complete Part II - Partner Information

Part II - Partner Information

In this section, you'll provide information about the partner. This includes:

- Partner's name and address

- Partner's Social Security number or ITIN

- Partner's percentage interest in the partnership

Ensure the partner's information is accurate and matches the partnership's records.

Step 4: Complete Part III - Allocation of Tax Basis

Part III - Allocation of Tax Basis

This section is the heart of Form 8958. You'll allocate the partnership's tax basis to the partner based on their percentage interest. This includes:

- Allocation of assets, such as cash, stocks, and real estate

- Allocation of liabilities, such as loans and credit card debt

- Allocation of other items, such as depreciation and amortization

Use the partnership's financial statements and tax returns to determine the correct allocation of tax basis.

Step 5: Complete Part IV - Additional Information

Part IV - Additional Information

In this section, you'll provide any additional information required by the IRS. This may include:

- Explanation of any changes to the partner's interest in the partnership

- Explanation of any discrepancies between the partnership's tax basis and the partner's tax basis

Ensure you provide clear and concise explanations to avoid any potential issues.

Step 6: Sign and Date the Form

Once you've completed all sections of Form 8958, sign and date the form. This is an important step, as it verifies the accuracy of the information provided.

Additional Tips and Reminders

- Ensure you use the correct form version and instructions for the tax year you're reporting.

- Double-check your math and calculations to avoid errors.

- Keep a copy of the completed form for your records.

- If you're unsure about any aspect of the form, consider consulting a tax professional.

Frequently Asked Questions

What is the purpose of Form 8958?

+Form 8958 is used to report the allocation of tax basis of a partner's interest in a partnership.

Who needs to file Form 8958?

+Partnerships and partners who need to report the allocation of tax basis must file Form 8958.

What is the deadline for filing Form 8958?

+The deadline for filing Form 8958 is typically the same as the partnership's tax return deadline.

Conclusion

Filling out Form 8958 requires attention to detail and accuracy. By following these easy steps, you'll be able to complete this form with confidence. Remember to double-check your math, provide clear explanations, and keep a copy of the completed form for your records. If you're unsure about any aspect of the form, consider consulting a tax professional.

Don't hesitate to reach out if you have any questions or concerns. Share your experiences or tips for completing Form 8958 in the comments below.