As we navigate the complexities of financial planning, it's essential to understand the intricacies of annuity withdrawals. For Equitrust annuity holders, having a clear grasp of the withdrawal process can help ensure a seamless experience. In this comprehensive guide, we'll delve into the Equitrust annuity withdrawal form requirements, providing you with the necessary information to make informed decisions about your financial future.

Understanding Equitrust Annuity Withdrawals

Before we dive into the withdrawal process, it's crucial to understand the basics of Equitrust annuities. An annuity is a contract between you and an insurance company, where you pay a lump sum or series of payments in exchange for a guaranteed income stream. Equitrust annuities offer a range of benefits, including tax-deferred growth, guaranteed income, and flexible payout options.

Why Withdraw from an Equitrust Annuity?

There are various reasons why you may need to withdraw from your Equitrust annuity. Some common scenarios include:

- Supplementing retirement income

- Covering unexpected expenses

- Funding a down payment on a new home

- Paying for long-term care or medical expenses

Equitrust Annuity Withdrawal Form Requirements

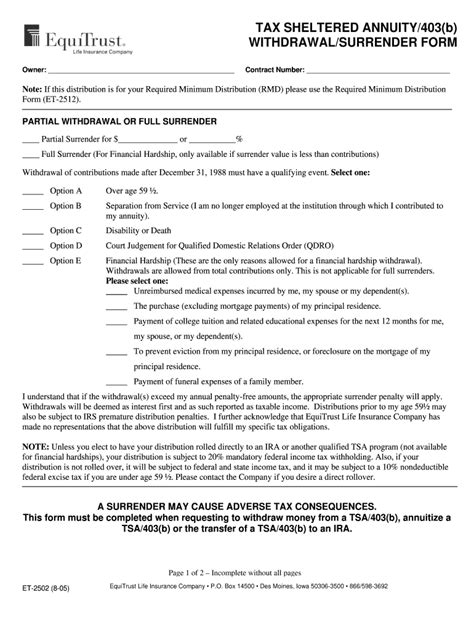

To initiate an annuity withdrawal, you'll need to complete the Equitrust annuity withdrawal form. Here are the necessary steps and requirements:

- Gather Required Documents: You'll need to provide identification, proof of address, and documentation supporting your reason for withdrawal (e.g., medical bills or a letter from a financial institution).

- Choose Your Withdrawal Option: Equitrust offers various withdrawal options, including lump-sum withdrawals, systematic withdrawals, and required minimum distributions (RMDs). Select the option that best suits your needs.

- Complete the Withdrawal Form: Fill out the Equitrust annuity withdrawal form, ensuring you provide all required information, including your annuity contract number, withdrawal amount, and payment method.

- Submit the Form: Mail or fax the completed form to Equitrust, along with any supporting documentation.

Equitrust Annuity Withdrawal Form Instructions

To ensure a smooth withdrawal process, follow these instructions:

- Use black ink when completing the form.

- Sign and date the form in the presence of a notary public, if required.

- Attach all supporting documentation, as specified in the form.

- Keep a copy of the completed form for your records.

Equitrust Annuity Withdrawal Fees and Penalties

It's essential to understand the potential fees and penalties associated with Equitrust annuity withdrawals:

- Surrender Charges: You may incur surrender charges if you withdraw funds within a certain period (usually 5-10 years) after purchasing the annuity.

- Administrative Fees: Equitrust may charge administrative fees for processing withdrawals.

- Penalty for Early Withdrawal: If you withdraw funds before age 59 1/2, you may be subject to a 10% penalty, in addition to income tax on the withdrawal amount.

Tax Implications of Equitrust Annuity Withdrawals

Annuity withdrawals are taxed as ordinary income, and the tax implications will depend on your individual circumstances:

- Tax-Deferred Growth: Annuity earnings grow tax-deferred, meaning you won't pay taxes until you withdraw the funds.

- Income Tax: Withdrawals are subject to income tax, which may impact your tax bracket.

Conclusion and Next Steps

In conclusion, withdrawing from an Equitrust annuity requires careful consideration of the associated fees, penalties, and tax implications. By understanding the withdrawal process and requirements, you can make informed decisions about your financial future.

If you have any further questions or concerns, please don't hesitate to reach out to Equitrust or a licensed financial professional. Share your thoughts and experiences with annuity withdrawals in the comments below, and help others navigate the complexities of financial planning.

What is the minimum withdrawal amount for an Equitrust annuity?

+The minimum withdrawal amount for an Equitrust annuity varies depending on the specific product and contract terms. Please refer to your annuity contract or contact Equitrust for more information.

Can I withdraw from my Equitrust annuity at any time?

+While you can withdraw from your Equitrust annuity, there may be surrender charges, fees, or penalties associated with early withdrawals. It's essential to review your contract and understand the terms and conditions before making a withdrawal.

How long does it take to process an Equitrust annuity withdrawal?

+The processing time for an Equitrust annuity withdrawal varies depending on the complexity of the request and the method of submission. Please allow 7-10 business days for processing, and contact Equitrust for more information on expedited processing options.