In the world of international trade, navigating complex forms and regulations can be a daunting task. One such form is the ENG Form 4288-R, which is used to declare the origin of goods and ensure compliance with various international trade agreements. In this article, we will delve into the importance of accurately filling out the ENG Form 4288-R and provide a step-by-step guide on how to do it correctly.

As a business owner or exporter, it is crucial to understand the significance of this form and the consequences of non-compliance. Failure to accurately complete the ENG Form 4288-R can lead to delays, fines, and even loss of business. Therefore, it is essential to take the time to carefully review and complete this form to avoid any potential issues.

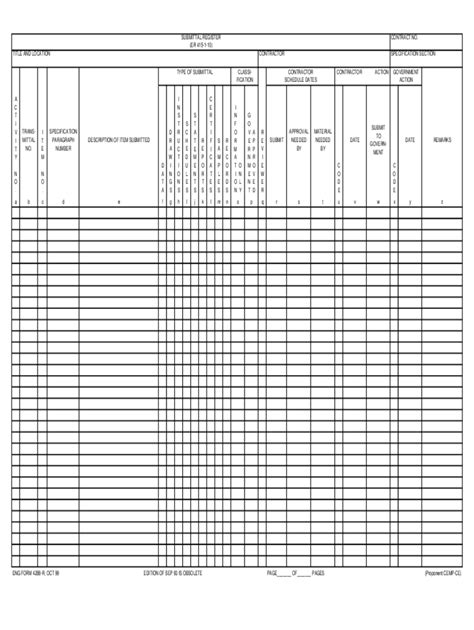

Understanding the ENG Form 4288-R

The ENG Form 4288-R, also known as the Certificate of Origin, is a document that certifies the origin of goods being exported. It is used to determine the country of origin of the goods and to ensure compliance with various international trade agreements, such as the North American Free Trade Agreement (NAFTA) and the Central American Free Trade Agreement (CAFTA).

5 Ways to Fill Out ENG Form 4288-R Correctly

Filling out the ENG Form 4288-R requires attention to detail and a thorough understanding of the form's requirements. Here are five ways to ensure that you fill out the form correctly:

1. Gather Required Information

Before starting to fill out the ENG Form 4288-R, it is essential to gather all the required information. This includes:

- The name and address of the exporter

- The name and address of the importer

- A detailed description of the goods being exported, including the Harmonized System (HS) code

- The country of origin of the goods

- The value of the goods being exported

Having all the necessary information readily available will help you to accurately complete the form and avoid any potential errors.

2. Determine the Country of Origin

Determining the country of origin is a critical aspect of filling out the ENG Form 4288-R. The country of origin is the country where the goods were produced or manufactured. In some cases, the country of origin may be different from the country where the goods were shipped from.

To determine the country of origin, you can use the following guidelines:

- If the goods were produced or manufactured in the United States, the country of origin is the United States.

- If the goods were produced or manufactured in a foreign country, the country of origin is that foreign country.

- If the goods were assembled or processed in a foreign country, the country of origin may be the country where the goods were assembled or processed.

3. Complete the Form Accurately

Once you have gathered all the required information and determined the country of origin, it is time to complete the ENG Form 4288-R. Make sure to accurately complete all the fields, including:

- The exporter's name and address

- The importer's name and address

- A detailed description of the goods being exported

- The HS code for the goods being exported

- The country of origin of the goods

- The value of the goods being exported

4. Sign and Date the Form

After completing the ENG Form 4288-R, make sure to sign and date the form. The form must be signed by the exporter or the exporter's authorized representative. The signature confirms that the information provided is accurate and true.

5. Review and Verify the Form

Finally, review and verify the ENG Form 4288-R to ensure that all the information is accurate and complete. Double-check the form for any errors or omissions, and make any necessary corrections.

By following these five steps, you can ensure that you fill out the ENG Form 4288-R correctly and avoid any potential issues.

Additional Tips and Reminders

Here are some additional tips and reminders to keep in mind when filling out the ENG Form 4288-R:

- Use the correct HS code for the goods being exported. The HS code is used to classify the goods and determine the country of origin.

- Use the correct country of origin code. The country of origin code is used to identify the country where the goods were produced or manufactured.

- Make sure to keep a copy of the ENG Form 4288-R for your records. The form is required for customs purposes, and you may need to provide a copy to the customs authorities.

- Use the correct format for the date. The date should be in the format of MM/DD/YYYY.

By following these tips and reminders, you can ensure that you accurately complete the ENG Form 4288-R and avoid any potential issues.

Conclusion

Filling out the ENG Form 4288-R requires attention to detail and a thorough understanding of the form's requirements. By following the five steps outlined in this article, you can ensure that you accurately complete the form and avoid any potential issues. Remember to gather all the required information, determine the country of origin, complete the form accurately, sign and date the form, and review and verify the form. By doing so, you can ensure that your goods are exported smoothly and efficiently.

FAQs

What is the purpose of the ENG Form 4288-R?

+The ENG Form 4288-R is used to declare the origin of goods being exported and to ensure compliance with various international trade agreements.

What information is required to complete the ENG Form 4288-R?

+The ENG Form 4288-R requires the following information: the exporter's name and address, the importer's name and address, a detailed description of the goods being exported, the HS code for the goods being exported, the country of origin of the goods, and the value of the goods being exported.

How do I determine the country of origin of the goods?

+The country of origin is the country where the goods were produced or manufactured. In some cases, the country of origin may be different from the country where the goods were shipped from.