The world of tax forms can be a daunting and complex place, especially for those who are new to filing their own taxes. One form that often raises questions is the Ej 130 Form, also known as the Certificate of Payment of Taxes on Imported Goods. In this article, we will delve into the world of the Ej 130 Form, exploring its purpose, benefits, and step-by-step guide on how to fill it out.

The Ej 130 Form is a crucial document for individuals and businesses that import goods into certain countries. It serves as proof of payment of taxes on imported goods, and it is typically required by customs authorities to clear goods through customs. Without a properly completed Ej 130 Form, importers may face delays or even fines.

One of the main benefits of the Ej 130 Form is that it helps to streamline the customs clearance process. By providing proof of payment of taxes, importers can ensure that their goods are cleared quickly and efficiently, reducing the risk of delays or additional costs.

Another benefit of the Ej 130 Form is that it helps to prevent tax evasion. By requiring importers to pay taxes on imported goods, governments can ensure that they receive the revenue they are owed. This, in turn, helps to fund public services and infrastructure.

Now, let's dive into the step-by-step guide on how to fill out the Ej 130 Form.

Understanding the Ej 130 Form

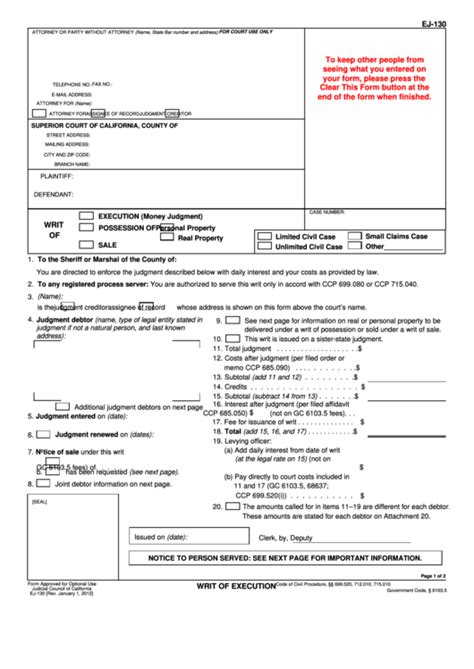

Before we begin, it's essential to understand the layout and content of the Ej 130 Form. The form typically consists of several sections, including:

- Importer's information

- Customs declaration number

- Description of goods

- Value of goods

- Taxes paid

- Signature and date

Step-by-Step Guide to Filling Out the Ej 130 Form

Here's a step-by-step guide to filling out the Ej 130 Form:

- Importer's Information: Enter your name, address, and tax identification number.

- Customs Declaration Number: Enter the customs declaration number assigned to your shipment.

- Description of Goods: Provide a detailed description of the goods being imported, including the Harmonized System (HS) code.

- Value of Goods: Enter the value of the goods being imported, including the currency and exchange rate.

- Taxes Paid: Calculate and enter the amount of taxes paid on the imported goods.

- Signature and Date: Sign and date the form.

Tips and Tricks for Filling Out the Ej 130 Form

Here are some tips and tricks to keep in mind when filling out the Ej 130 Form:

- Ensure that all information is accurate and complete.

- Use a clear and legible handwriting.

- Make sure to sign and date the form.

- Keep a copy of the form for your records.

Common Mistakes to Avoid

Here are some common mistakes to avoid when filling out the Ej 130 Form:

- Incomplete or inaccurate information.

- Failure to sign and date the form.

- Incorrect calculation of taxes paid.

Benefits of Using the Ej 130 Form

Here are some benefits of using the Ej 130 Form:

- Streamlines the customs clearance process.

- Prevents tax evasion.

- Provides proof of payment of taxes.

Conclusion

In conclusion, the Ej 130 Form is a crucial document for individuals and businesses that import goods into certain countries. By understanding the purpose and benefits of the form, and following the step-by-step guide, importers can ensure that their goods are cleared quickly and efficiently, while also preventing tax evasion. Remember to keep a copy of the form for your records, and avoid common mistakes to ensure a smooth customs clearance process.

What's Next?

We hope this comprehensive guide has helped you understand the Ej 130 Form and how to fill it out. If you have any questions or need further assistance, please don't hesitate to comment below. Share this article with your friends and colleagues who may also find it useful. Don't forget to bookmark this page for future reference.

What is the Ej 130 Form?

+The Ej 130 Form is a certificate of payment of taxes on imported goods.

Who needs to fill out the Ej 130 Form?

+Individuals and businesses that import goods into certain countries need to fill out the Ej 130 Form.

What are the benefits of using the Ej 130 Form?

+The Ej 130 Form streamlines the customs clearance process and prevents tax evasion.