Ebay Tax Exempt Form Address And Requirements

As an eBay seller, understanding tax exemption and its requirements is crucial to ensure compliance with the platform's policies and tax laws. eBay provides a tax exempt form to help sellers navigate the process, but where do you send it and what are the requirements? In this comprehensive guide, we'll delve into the eBay tax exempt form address and requirements, providing you with the necessary information to stay compliant.

The Importance of Tax Exemption on eBay

As an eBay seller, you're considered a business owner, and as such, you're required to collect sales tax from your buyers. However, some sellers may be exempt from collecting sales tax, depending on their location, business type, and other factors. To take advantage of tax exemption, you'll need to provide eBay with a valid tax exempt form.

Why is tax exemption important on eBay? For one, it helps you avoid paying unnecessary taxes on your sales. Secondly, it can give you a competitive edge, as you can offer lower prices to your buyers. Lastly, tax exemption can simplify your accounting and bookkeeping processes.

eBay Tax Exempt Form Address

To submit your tax exempt form to eBay, you'll need to send it to the following address:

eBay Inc. Attn: Tax Exemptions 2065 Hamilton Avenue San Jose, CA 95125

Please note that this address is only for tax exempt forms, and you should not send any other correspondence to this address.

Requirements for eBay Tax Exempt Form

To ensure your tax exempt form is accepted by eBay, you'll need to meet the following requirements:

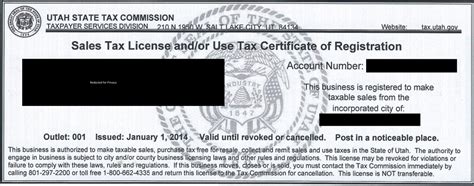

- Valid Tax Exempt Certificate: You'll need to provide a valid tax exempt certificate, which can be obtained from your state's tax authority or department of revenue.

- Business Information: You'll need to provide your business information, including your business name, address, and tax ID number.

- Exemption Type: You'll need to specify the type of exemption you're applying for, such as resale exemption or charitable exemption.

- States of Exemption: You'll need to list the states where you're exempt from collecting sales tax.

- Signature: Your tax exempt form must be signed by an authorized representative of your business.

Types of Tax Exemptions on eBay

There are several types of tax exemptions available on eBay, including:

- Resale Exemption: This exemption applies to sellers who purchase items for resale, rather than for personal use.

- Charitable Exemption: This exemption applies to non-profit organizations that are exempt from paying sales tax.

- Agricultural Exemption: This exemption applies to farmers and agricultural businesses that are exempt from paying sales tax on certain items.

- Government Exemption: This exemption applies to government agencies and entities that are exempt from paying sales tax.

How to Obtain a Tax Exempt Certificate

To obtain a tax exempt certificate, you'll need to contact your state's tax authority or department of revenue. You can usually find the contact information on their website or by calling their customer service number.

Once you've obtained your tax exempt certificate, you can fill out the eBay tax exempt form and submit it to the address listed above.

Frequently Asked Questions

- What is the deadline for submitting my tax exempt form?: There is no specific deadline for submitting your tax exempt form, but it's recommended that you submit it as soon as possible to avoid any delays in processing.

- Can I submit my tax exempt form electronically?: No, eBay only accepts tax exempt forms submitted by mail or fax.

- How long does it take for eBay to process my tax exempt form?: eBay typically processes tax exempt forms within 5-7 business days.

- Can I use a digital signature on my tax exempt form?: No, eBay requires a physical signature on the tax exempt form.

What is the purpose of the eBay tax exempt form?

+The eBay tax exempt form is used to certify that a seller is exempt from collecting sales tax on their sales.

How do I obtain a tax exempt certificate?

+You can obtain a tax exempt certificate by contacting your state's tax authority or department of revenue.

What are the requirements for submitting a tax exempt form to eBay?

+To submit a tax exempt form to eBay, you'll need to provide a valid tax exempt certificate, business information, exemption type, states of exemption, and a signature.

Conclusion

In conclusion, understanding the eBay tax exempt form address and requirements is crucial for sellers who want to take advantage of tax exemption on the platform. By following the guidelines outlined in this article, you can ensure that your tax exempt form is accepted by eBay and that you're in compliance with the platform's policies and tax laws.

If you have any further questions or concerns, please don't hesitate to comment below or reach out to eBay's customer support team. Don't forget to share this article with your fellow sellers to help them navigate the complex world of eBay tax exemption.