In today's fast-paced business environment, managing finances effectively is crucial for success. One essential tool for achieving this is the Doubletree credit card authorization form. This form is designed to streamline transactions, reduce financial risks, and provide a seamless experience for customers and businesses alike. In this article, we will delve into the world of credit card authorization forms, specifically focusing on the Doubletree credit card authorization form, and provide you with seven valuable tips to optimize its use.

Understanding the Doubletree Credit Card Authorization Form

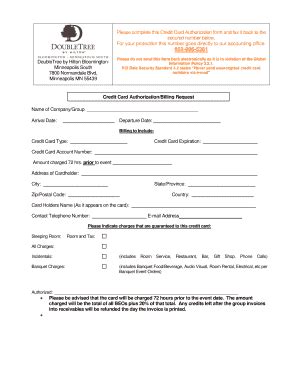

The Doubletree credit card authorization form is a document used by businesses to obtain permission from clients to charge their credit cards for specific transactions. This form is particularly popular in the hospitality industry, where customers often need to provide their credit card information to secure reservations or pay for services. By understanding how to use this form effectively, businesses can protect themselves against financial losses and ensure a smooth transaction process.

Benefits of Using the Doubletree Credit Card Authorization Form

- Simplifies the payment process

- Reduces the risk of financial losses

- Provides a clear record of transactions

- Enhances customer trust and confidence

Tips for Using the Doubletree Credit Card Authorization Form

1. Clearly Define the Authorization Scope

When creating a Doubletree credit card authorization form, it's essential to clearly define the scope of the authorization. This includes specifying the type of transactions that can be made, the amount that can be charged, and the duration of the authorization. By providing this information, you can avoid any potential disputes or misunderstandings.

2. Obtain Necessary Information

To ensure that the authorization form is valid, you need to obtain the necessary information from the customer. This includes their name, credit card number, expiration date, and signature. Make sure to also include a section for the customer to provide their consent for the authorization.

3. Specify the Payment Terms

Clearly outline the payment terms, including the amount to be charged, the frequency of payments, and any applicable fees. This will help avoid any confusion or disputes down the line.

4. Include a Cancellation Policy

It's essential to include a cancellation policy in the authorization form, outlining the procedures for canceling or terminating the authorization. This will help protect both the business and the customer in case of any changes or disputes.

5. Keep Records Up-to-Date

Ensure that all records related to the authorization form are kept up-to-date and securely stored. This includes maintaining a record of all transactions, customer information, and authorization forms.

6. Comply with PCI-DSS Regulations

The Payment Card Industry Data Security Standard (PCI-DSS) is a set of regulations designed to ensure the secure handling of credit card information. Make sure to comply with these regulations when creating and storing authorization forms.

7. Review and Update the Form Regularly

Regularly review and update the Doubletree credit card authorization form to ensure that it remains compliant with changing regulations and industry standards. This will help protect your business and customers from any potential risks or disputes.

Best Practices for Implementing the Doubletree Credit Card Authorization Form

- Train staff on the proper use and handling of the authorization form

- Ensure that the form is easily accessible and understandable for customers

- Regularly review and update the form to reflect changes in regulations or industry standards

- Maintain accurate and secure records of all authorization forms and transactions

Conclusion

In conclusion, the Doubletree credit card authorization form is a valuable tool for businesses looking to streamline transactions and reduce financial risks. By following the seven tips outlined in this article, you can optimize the use of this form and provide a seamless experience for your customers. Remember to regularly review and update the form to ensure compliance with changing regulations and industry standards.

What is the purpose of the Doubletree credit card authorization form?

+The purpose of the Doubletree credit card authorization form is to obtain permission from customers to charge their credit cards for specific transactions, reducing the risk of financial losses and providing a clear record of transactions.

What information should be included in the Doubletree credit card authorization form?

+The form should include the customer's name, credit card number, expiration date, and signature, as well as a clear definition of the authorization scope, payment terms, and cancellation policy.

How often should the Doubletree credit card authorization form be reviewed and updated?

+The form should be reviewed and updated regularly to ensure compliance with changing regulations and industry standards, as well as to reflect any changes in business operations or policies.