The world of self-employment can be both liberating and overwhelming, especially when it comes to dealing with paperwork and bureaucratic processes. For those who are self-employed and receiving unemployment benefits, filling out the DHS-432 Self-Employment Statement form can be a daunting task. However, with the right guidance, you can navigate this process with ease and confidence.

In this article, we will provide you with five valuable tips to help you fill out the DHS-432 Self-Employment Statement form accurately and efficiently. Whether you're a freelancer, consultant, or entrepreneur, these tips will ensure that you're well-prepared to tackle this essential form.

Understanding the Importance of Accurate Reporting

Before we dive into the tips, it's crucial to understand the significance of accurate reporting on the DHS-432 form. As a self-employed individual, you're required to report your income and expenses to the Department of Human Services (DHS) to determine your eligibility for unemployment benefits. Inaccurate or incomplete reporting can lead to delays, penalties, or even denial of benefits.

Tip #1: Gather All Necessary Documents and Information

To fill out the DHS-432 form accurately, you'll need to gather all relevant documents and information related to your self-employment income and expenses. This includes:

- Business receipts and invoices

- Bank statements and ledgers

- Tax returns and schedules (e.g., Schedule C)

- Records of business expenses (e.g., equipment, supplies, travel)

- Any other relevant financial documents

Having all the necessary documents and information readily available will save you time and reduce the likelihood of errors.

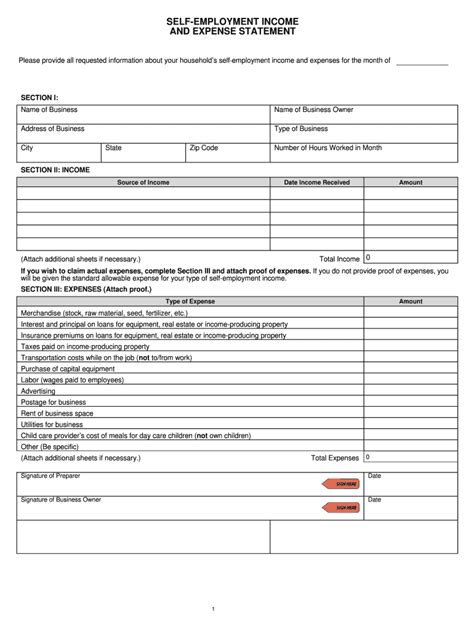

Tip #2: Understand the Form's Sections and Requirements

The DHS-432 form is divided into several sections, each requiring specific information. Take the time to review the form carefully and understand what's being asked in each section. This will help you:

- Identify the type of income you need to report (e.g., gross income, net income)

- Determine which expenses are eligible for reporting (e.g., business use of home, vehicle expenses)

- Understand the calculation formulas and rounding rules

Familiarizing yourself with the form's sections and requirements will ensure that you're providing accurate and complete information.

Tip #3: Calculate Your Net Earnings from Self-Employment

Calculating your net earnings from self-employment is a critical step in filling out the DHS-432 form. To do this, you'll need to:

- Calculate your gross income from self-employment (e.g., total revenue, sales)

- Subtract eligible business expenses (e.g., cost of goods sold, operating expenses)

- Apply the self-employment tax rate (e.g., 15.3% for Social Security and Medicare taxes)

Use the IRS's Schedule C (Form 1040) as a guide to help you calculate your net earnings from self-employment.

Tip #4: Report Business Use of Home and Vehicle Expenses

If you use your home or vehicle for business purposes, you may be eligible to report these expenses on the DHS-432 form. To do this, you'll need to:

- Calculate the business use percentage of your home (e.g., home office deduction)

- Determine the business use mileage for your vehicle (e.g., miles driven for business purposes)

Keep accurate records of your business use expenses, as these can be subject to audit.

Tip #5: Review and Verify Your Information

Before submitting the DHS-432 form, review and verify your information carefully. Check for:

- Accuracy and completeness of all sections

- Mathematical errors and calculation mistakes

- Consistency with previous reports (if applicable)

Verify your information with your accountant, bookkeeper, or financial advisor if needed.

Wrapping Up

Filling out the DHS-432 Self-Employment Statement form requires attention to detail and a solid understanding of self-employment reporting requirements. By following these five tips, you'll be well-equipped to navigate this process with confidence. Remember to:

- Gather all necessary documents and information

- Understand the form's sections and requirements

- Calculate your net earnings from self-employment accurately

- Report business use of home and vehicle expenses correctly

- Review and verify your information carefully

If you have any questions or concerns, don't hesitate to reach out to the Department of Human Services or a qualified financial professional for guidance.

Share Your Thoughts!

Have you filled out the DHS-432 Self-Employment Statement form before? What challenges did you face, and how did you overcome them? Share your experiences and tips in the comments below!

What is the purpose of the DHS-432 Self-Employment Statement form?

+The DHS-432 form is used to report self-employment income and expenses to the Department of Human Services (DHS) for the purpose of determining eligibility for unemployment benefits.

What documents do I need to gather to fill out the DHS-432 form?

+You'll need to gather documents such as business receipts, bank statements, tax returns, and records of business expenses.

How do I calculate my net earnings from self-employment?

+You'll need to calculate your gross income from self-employment, subtract eligible business expenses, and apply the self-employment tax rate.