If you're a business owner in Delaware, you're likely familiar with the numerous forms and filings required to maintain your company's good standing. One such form is the Delaware Form 5403, also known as the Certificate of Formation - Limited Liability Company (LLC). In this article, we'll delve into the world of Delaware Form 5403, exploring its purpose, benefits, and providing a step-by-step guide on how to file it correctly.

Understanding Delaware Form 5403

Delaware Form 5403 is a document used to form a Limited Liability Company (LLC) in the state of Delaware. The form is filed with the Delaware Division of Corporations, and its primary purpose is to create a new LLC entity. By filing this form, you're officially registering your business with the state, which provides several benefits, including personal liability protection, tax advantages, and increased credibility.

Benefits of Filing Delaware Form 5403

Filing Delaware Form 5403 offers numerous benefits to business owners, including:

- Personal liability protection: By forming an LLC, you're separating your personal assets from your business assets, which protects you from personal liability in case the business is sued.

- Tax advantages: LLCs are pass-through entities, meaning that the business income is only taxed at the individual level, avoiding double taxation.

- Increased credibility: Forming a Delaware LLC can increase your business's credibility, as it shows that you're committed to operating a legitimate and formal business entity.

Step-by-Step Filing Guide for Delaware Form 5403

Now that we've covered the basics of Delaware Form 5403, let's dive into the step-by-step filing process.

Step 1: Gather Required Information

Before you start filling out the form, make sure you have the following information:

- Business name and address

- Registered agent name and address

- Management structure (member-managed or manager-managed)

- Purpose of the LLC

- Organizer's name and address

Step 2: Fill Out the Form

Delaware Form 5403 can be filed online or by mail. If you choose to file online, you can use the Delaware Division of Corporations' online portal. If you prefer to file by mail, you can download the form from the Delaware Division of Corporations' website.

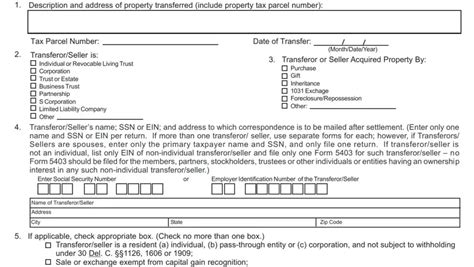

The form consists of several sections, including:

- Section 1: Business Information

- Section 2: Registered Agent Information

- Section 3: Management Structure

- Section 4: Purpose of the LLC

- Section 5: Organizer's Information

Make sure to fill out all the required fields accurately and completely.

Step 3: Sign and Date the Form

Once you've completed the form, sign and date it. If you're filing online, you'll need to provide your electronic signature.

Step 4: File the Form

If you're filing online, submit the form through the Delaware Division of Corporations' online portal. If you're filing by mail, send the completed form to:

Delaware Division of Corporations John G. Townsend Building 401 Federal Street Dover, DE 19901

Step 5: Pay the Filing Fee

The filing fee for Delaware Form 5403 is $90. You can pay by credit card, check, or money order.

Additional Requirements

In addition to filing Delaware Form 5403, you'll need to obtain an Employer Identification Number (EIN) from the IRS and open a business bank account.

Maintenance and Compliance Requirements

After filing Delaware Form 5403, you'll need to comply with ongoing maintenance and compliance requirements, including:

- Annual report filings

- Franchise tax payments

- Business license renewals

Failure to comply with these requirements can result in penalties, fines, and even the dissolution of your LLC.

Conclusion

Filing Delaware Form 5403 is a crucial step in forming a Limited Liability Company in the state of Delaware. By following the step-by-step guide outlined in this article, you can ensure that your LLC is formed correctly and that you're complying with all the necessary requirements. Remember to maintain ongoing compliance and maintenance requirements to keep your LLC in good standing.

We hope this article has provided you with a comprehensive understanding of Delaware Form 5403 and the filing process. If you have any further questions or concerns, please don't hesitate to reach out.

What's Next?

If you're ready to file Delaware Form 5403, you can start by gathering the required information and filling out the form. If you need help or have questions, consider consulting with a business attorney or using an online business formation service.

Share Your Thoughts

Have you filed Delaware Form 5403 or have experience with forming an LLC in Delaware? Share your thoughts and experiences in the comments below.

What is the purpose of Delaware Form 5403?

+Delaware Form 5403 is used to form a Limited Liability Company (LLC) in the state of Delaware.

How do I file Delaware Form 5403?

+You can file Delaware Form 5403 online or by mail. If you file online, use the Delaware Division of Corporations' online portal. If you file by mail, send the completed form to the Delaware Division of Corporations.

What is the filing fee for Delaware Form 5403?

+The filing fee for Delaware Form 5403 is $90.