The DCAD Homestead Exemption Form is a valuable tax break that can help homeowners in Texas save money on their property taxes. As a homeowner, it's essential to understand the benefits and requirements of this exemption to ensure you're taking advantage of the savings. In this article, we'll delve into the world of homestead exemptions, explaining what they are, how they work, and providing a step-by-step guide on how to apply for the DCAD Homestead Exemption Form.

What is a Homestead Exemption?

A homestead exemption is a tax exemption that allows homeowners to reduce their property taxes by exempting a certain amount of their home's value from taxation. In Texas, the homestead exemption is offered by the county appraisal district, which is responsible for determining the value of properties for tax purposes. The exemption is designed to help homeowners by reducing the amount of property taxes they owe, making homeownership more affordable.

Benefits of the DCAD Homestead Exemption Form

The DCAD Homestead Exemption Form offers several benefits to homeowners, including:

- Reduced property taxes: By exempting a portion of your home's value from taxation, you'll pay lower property taxes.

- Increased affordability: With lower property taxes, homeownership becomes more affordable, especially for low-income families and seniors.

- Protection from rising taxes: As property values increase, the exemption amount remains the same, protecting homeowners from rising taxes.

Eligibility Requirements for the DCAD Homestead Exemption Form

To be eligible for the DCAD Homestead Exemption Form, you must meet the following requirements:

- You must own and occupy the property as your primary residence.

- The property must be located in the appraisal district's jurisdiction.

- You must not have claimed a homestead exemption on any other property in the state.

- You must meet the deadline for filing the exemption application.

How to Apply for the DCAD Homestead Exemption Form

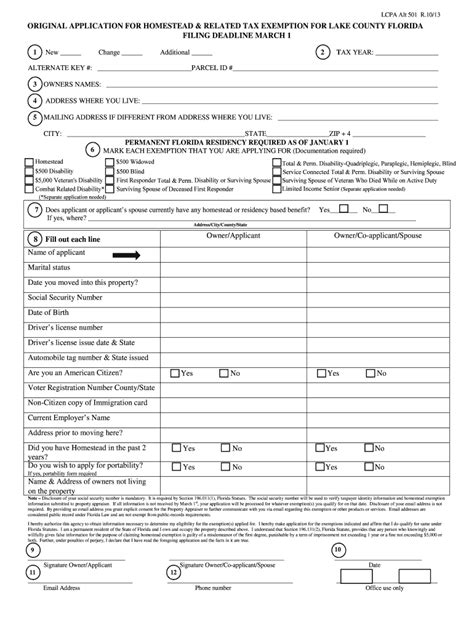

Applying for the DCAD Homestead Exemption Form is a straightforward process. Here's a step-by-step guide:

- Check your eligibility: Ensure you meet the eligibility requirements mentioned above.

- Gather required documents: You'll need to provide proof of ownership, such as a deed or title, and proof of residency, such as a utility bill or driver's license.

- Download and complete the application form: You can download the DCAD Homestead Exemption Form from the appraisal district's website or pick one up in person.

- Submit the application: Return the completed application form to the appraisal district's office, either in person, by mail, or online.

- Wait for processing: The appraisal district will review your application and notify you of the outcome.

Common Mistakes to Avoid When Applying for the DCAD Homestead Exemption Form

When applying for the DCAD Homestead Exemption Form, it's essential to avoid common mistakes that can delay or deny your application. Here are some mistakes to watch out for:

- Missing deadlines: Make sure to submit your application before the deadline to avoid missing out on the exemption.

- Incomplete applications: Ensure you provide all required documents and information to avoid delays.

- Incorrect information: Double-check your application for accuracy to avoid errors.

Tips for Maximizing Your Homestead Exemption Savings

To maximize your homestead exemption savings, follow these tips:

- File on time: Submit your application before the deadline to ensure you receive the exemption for the current tax year.

- Keep records: Keep a copy of your application and supporting documents in case of an audit or review.

- Monitor your exemption: Check your property tax bill to ensure the exemption is applied correctly.

By following these tips and understanding the benefits and requirements of the DCAD Homestead Exemption Form, you can save money on your property taxes and make homeownership more affordable.

Conclusion

The DCAD Homestead Exemption Form is a valuable tax break that can help homeowners in Texas save money on their property taxes. By understanding the benefits and requirements of the exemption, you can take advantage of the savings and make homeownership more affordable. Remember to file your application on time, keep records, and monitor your exemption to maximize your savings.

If you have any questions or concerns about the DCAD Homestead Exemption Form, leave a comment below. Share this article with friends and family who may be eligible for the exemption, and help them save money on their property taxes.

What is the deadline for filing the DCAD Homestead Exemption Form?

+The deadline for filing the DCAD Homestead Exemption Form is typically April 30th of each year.

Can I apply for the homestead exemption online?

+Yes, you can apply for the homestead exemption online through the appraisal district's website.

How much can I save with the homestead exemption?

+The amount you can save with the homestead exemption varies depending on the appraisal district and your property's value. However, the exemption can save you hundreds or even thousands of dollars on your property taxes.