Clearing customs can be a daunting task, especially for individuals and businesses that are new to international trade. One crucial document that plays a significant role in this process is the Customs C5 Form. Also known as the Declaration of Goods form, it is a crucial document required by Customs authorities to process imports and exports.

The Customs C5 Form is a mandatory document that provides vital information about the goods being imported or exported. This form helps Customs authorities to assess the duties, taxes, and other levies applicable to the goods. In this article, we will delve into the five essential facts about the Customs C5 Form that you need to know.

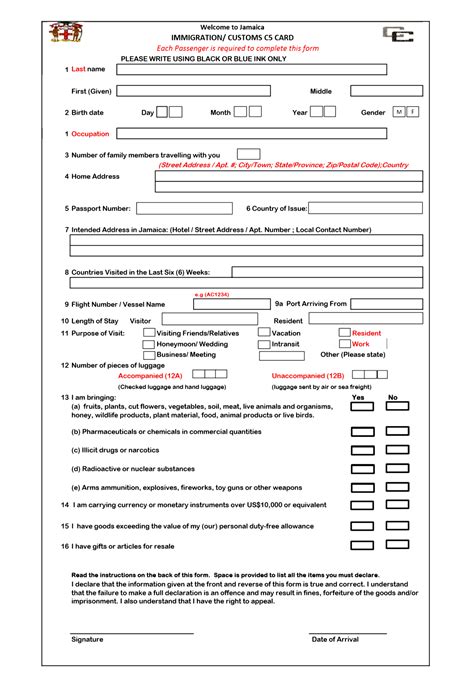

What is the Customs C5 Form?

The Customs C5 Form, also known as the Declaration of Goods form, is a document required by Customs authorities to process imports and exports. This form provides vital information about the goods being imported or exported, including their description, quantity, weight, value, and country of origin. The information provided on the Customs C5 Form is used by Customs authorities to assess the duties, taxes, and other levies applicable to the goods.

Why is the Customs C5 Form Required?

The Customs C5 Form is required by Customs authorities to ensure that all imports and exports comply with relevant laws and regulations. The information provided on the form helps Customs authorities to:

- Assess the duties, taxes, and other levies applicable to the goods

- Verify the authenticity of the goods

- Ensure compliance with relevant laws and regulations

- Prevent smuggling and other illicit activities

Who Needs to Complete the Customs C5 Form?

The Customs C5 Form must be completed by:

- Importers and exporters

- Customs brokers and agents

- Shipping lines and airlines

- Freight forwarders and logistics providers

What Information is Required on the Customs C5 Form?

The Customs C5 Form requires the following information:

- Description of the goods

- Quantity and weight of the goods

- Value of the goods

- Country of origin of the goods

- Harmonized System (HS) code of the goods

- Bill of lading or airway bill number

- Date and time of arrival or departure

What are the Consequences of Non-Compliance?

Failure to complete the Customs C5 Form accurately or provide false information can result in:

- Delayed clearance of goods

- Additional duties and taxes

- Penalties and fines

- Confiscation of goods

- Loss of business reputation

Best Practices for Completing the Customs C5 Form

To avoid any issues, it is essential to follow these best practices when completing the Customs C5 Form:

- Ensure accuracy and completeness of information

- Use the correct Harmonized System (HS) code

- Provide clear and concise descriptions of the goods

- Verify the authenticity of documents and signatures

- Keep records of the form and supporting documents

In conclusion, the Customs C5 Form is a critical document required by Customs authorities to process imports and exports. By understanding the essential facts about the Customs C5 Form, individuals and businesses can ensure compliance with relevant laws and regulations, avoid delays and penalties, and maintain a smooth and efficient clearance process.

We encourage you to share your experiences and insights about the Customs C5 Form in the comments below. If you have any questions or need further clarification, please feel free to ask.

What is the purpose of the Customs C5 Form?

+The Customs C5 Form is used by Customs authorities to assess the duties, taxes, and other levies applicable to the goods being imported or exported.

Who is required to complete the Customs C5 Form?

+The Customs C5 Form must be completed by importers and exporters, customs brokers and agents, shipping lines and airlines, and freight forwarders and logistics providers.

What information is required on the Customs C5 Form?

+The Customs C5 Form requires information such as description of the goods, quantity and weight of the goods, value of the goods, country of origin of the goods, and Harmonized System (HS) code of the goods.