Filing CT Unemployment Form UC-61 Made Easy

Losing a job can be a stressful experience, and navigating the unemployment benefits system can be overwhelming. In Connecticut, filing the UC-61 form is a crucial step in claiming your unemployment benefits. In this article, we will guide you through the process of filing the CT unemployment form UC-61 easily and efficiently.

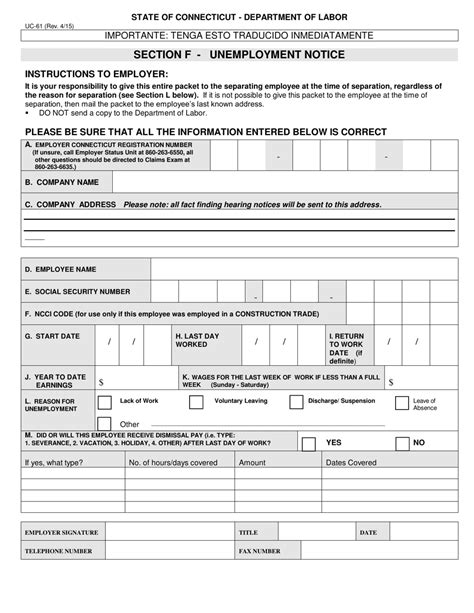

Understanding the UC-61 Form

The UC-61 form is used to certify your unemployment status and claim your weekly benefits. It's essential to fill out the form accurately and thoroughly to avoid any delays or issues with your benefits. The form will ask for personal and employment information, including your name, address, Social Security number, and details about your previous job.

Step-by-Step Guide to Filing the UC-61 Form

Filing the UC-61 form can be done online or by mail. Here's a step-by-step guide to help you through the process:

Step 1: Gather Required Documents

Before you start filling out the form, make sure you have the following documents:

- Your Social Security number or Alien Registration Number

- Your driver's license or state ID

- Your most recent paycheck stub

- Your W-2 form from your previous employer

- A list of your work history, including job titles, dates, and wages

Step 2: Create an Online Account (Optional)

If you want to file the UC-61 form online, you'll need to create an account on the Connecticut Department of Labor's website. Follow these steps:

- Go to the Connecticut Department of Labor's website and click on "File a Claim"

- Click on "Create an Account" and fill out the registration form

- Verify your email address and create a password

Step 3: Fill Out the UC-61 Form

Whether you're filing online or by mail, you'll need to fill out the UC-61 form accurately and thoroughly. Here are some tips to keep in mind:

- Use black ink to fill out the form

- Print clearly and legibly

- Answer all questions to the best of your ability

- Sign and date the form

Step 4: Submit the Form

If you're filing online, click the "Submit" button to send the form to the Connecticut Department of Labor. If you're filing by mail, make sure to send the form to the correct address:

Connecticut Department of Labor Attn: Unemployment Insurance 200 Folly Brook Boulevard Wethersfield, CT 06109

Common Mistakes to Avoid When Filing the UC-61 Form

When filling out the UC-61 form, it's essential to avoid common mistakes that can delay or deny your benefits. Here are some mistakes to watch out for:

- Incomplete or inaccurate information

- Failure to sign and date the form

- Misspelling your name or Social Security number

- Not providing required documentation

Tips for Filing the UC-61 Form Successfully

Here are some tips to help you file the UC-61 form successfully:

- Take your time and read the instructions carefully

- Use a pen with black ink to fill out the form

- Make a copy of the form for your records

- Keep track of your submission date and follow up if you don't receive a response

What to Expect After Filing the UC-61 Form

After filing the UC-61 form, you can expect the following:

- A confirmation email or letter from the Connecticut Department of Labor

- A determination of your eligibility for unemployment benefits

- A notice of your weekly benefit amount and duration

- A payment schedule for your benefits

Frequently Asked Questions

Here are some frequently asked questions about filing the UC-61 form:

- Q: How long does it take to process the UC-61 form? A: The processing time for the UC-61 form typically takes 2-3 weeks.

- Q: Can I file the UC-61 form online? A: Yes, you can file the UC-61 form online through the Connecticut Department of Labor's website.

- Q: What if I make a mistake on the UC-61 form? A: If you make a mistake on the UC-61 form, you can correct it by contacting the Connecticut Department of Labor.

Conclusion

Filing the CT unemployment form UC-61 can be a straightforward process if you follow the steps outlined in this article. Remember to gather required documents, fill out the form accurately, and submit it on time. If you have any questions or concerns, don't hesitate to reach out to the Connecticut Department of Labor.

What is the UC-61 form used for?

+The UC-61 form is used to certify your unemployment status and claim your weekly benefits in Connecticut.

How do I file the UC-61 form?

+You can file the UC-61 form online through the Connecticut Department of Labor's website or by mail.

What documents do I need to file the UC-61 form?

+You'll need to provide your Social Security number, driver's license or state ID, most recent paycheck stub, W-2 form, and a list of your work history.

We hope this article has been helpful in guiding you through the process of filing the CT unemployment form UC-61. If you have any further questions or concerns, please don't hesitate to reach out to us.