The QuickBooks credit card authorization form is a crucial document that allows businesses to process credit card transactions securely and efficiently. As a business owner, you want to ensure that your customers' sensitive financial information is protected while also streamlining your payment processing operations. In this article, we will delve into the world of QuickBooks credit card authorization forms, explaining what they are, how they work, and how to create and use them effectively.

What is a QuickBooks Credit Card Authorization Form?

A QuickBooks credit card authorization form is a document that authorizes a business to charge a customer's credit card for a specific amount or recurring payments. This form is typically used for recurring transactions, such as subscription-based services or regular deliveries. By completing and signing the form, customers grant permission for the business to process their credit card information, ensuring a seamless payment experience.

Why Use a QuickBooks Credit Card Authorization Form?

Using a QuickBooks credit card authorization form offers several benefits for businesses and customers alike:

- Streamlined payment processing: By having a signed authorization form on file, businesses can process credit card transactions efficiently, reducing the risk of missed or delayed payments.

- Enhanced security: The form provides a secure way to store and process sensitive credit card information, reducing the risk of data breaches and unauthorized transactions.

- Compliance with industry regulations: QuickBooks credit card authorization forms help businesses comply with industry regulations, such as the Payment Card Industry Data Security Standard (PCI DSS).

- Improved customer relationships: By obtaining explicit authorization from customers, businesses demonstrate their commitment to protecting sensitive financial information, fostering trust and loyalty.

How to Create a QuickBooks Credit Card Authorization Form

Creating a QuickBooks credit card authorization form is a straightforward process. Here's a step-by-step guide:

- Determine the purpose of the form: Clearly define the purpose of the form, including the type of transactions, payment frequency, and amount.

- Choose a template or create from scratch: You can either use a pre-designed template or create a form from scratch using a word processor or spreadsheet software.

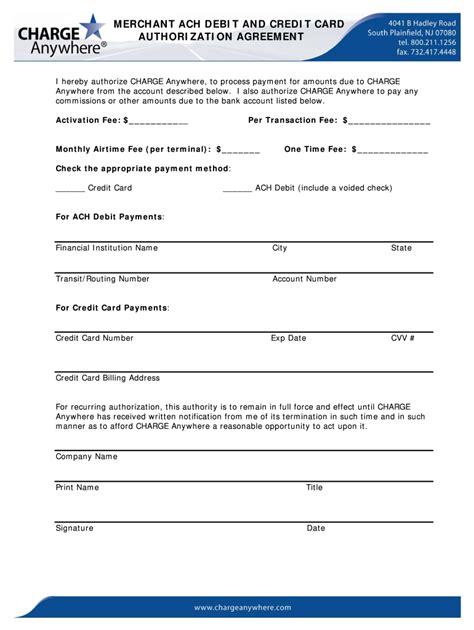

- Include required fields: Ensure the form includes the following essential fields:

- Customer name and contact information

- Credit card details (card number, expiration date, CVV)

- Authorization statement (clearly stating the purpose and scope of the authorization)

- Signature and date fields

- Add any additional requirements: Depending on your business needs, you may want to include additional fields, such as:

- Payment schedule or frequency

- Transaction amount or range

- Cancellation or termination terms

Best Practices for Using QuickBooks Credit Card Authorization Forms

To get the most out of your QuickBooks credit card authorization forms, follow these best practices:

- Clearly communicate with customers: Ensure customers understand the purpose and scope of the authorization form, including the payment schedule and amount.

- Store forms securely: Keep signed authorization forms in a secure, easily accessible location, such as a locked file cabinet or encrypted digital storage.

- Regularly review and update forms: Periodically review and update authorization forms to ensure compliance with changing industry regulations and business needs.

- Train staff on form usage: Educate staff on the proper use and handling of credit card authorization forms to maintain security and compliance.

Common Challenges and Solutions

While using QuickBooks credit card authorization forms can be beneficial, some businesses may encounter challenges. Here are common issues and solutions:

- Lost or misplaced forms: Implement a secure digital storage system to keep authorization forms organized and easily accessible.

- Incomplete or inaccurate forms: Develop a comprehensive template and train staff to ensure accurate and complete form completion.

- Changing customer information: Regularly review and update authorization forms to reflect changes in customer credit card information or payment schedules.

By following these guidelines and best practices, businesses can effectively create and use QuickBooks credit card authorization forms, streamlining payment processing, enhancing security, and improving customer relationships.

We hope this article has provided you with valuable insights into the world of QuickBooks credit card authorization forms. If you have any questions or need further clarification, please don't hesitate to comment below.

What is the purpose of a QuickBooks credit card authorization form?

+The purpose of a QuickBooks credit card authorization form is to obtain explicit permission from customers to process their credit card information for specific transactions or recurring payments.

How do I create a QuickBooks credit card authorization form?

+To create a QuickBooks credit card authorization form, determine the purpose of the form, choose a template or create from scratch, include required fields, and add any additional requirements.

What are the benefits of using a QuickBooks credit card authorization form?

+The benefits of using a QuickBooks credit card authorization form include streamlined payment processing, enhanced security, compliance with industry regulations, and improved customer relationships.