As a business owner in Massachusetts, it's essential to understand the importance of filing your corporate excise tax return, Form 355SBC, accurately and on time. The Massachusetts Department of Revenue requires corporations to file this form annually to report their taxable income and pay the necessary excise tax. In this article, we'll provide you with five valuable tips to help you navigate the process of filing Form 355SBC and avoid potential pitfalls.

Understanding the Basics of Form 355SBC

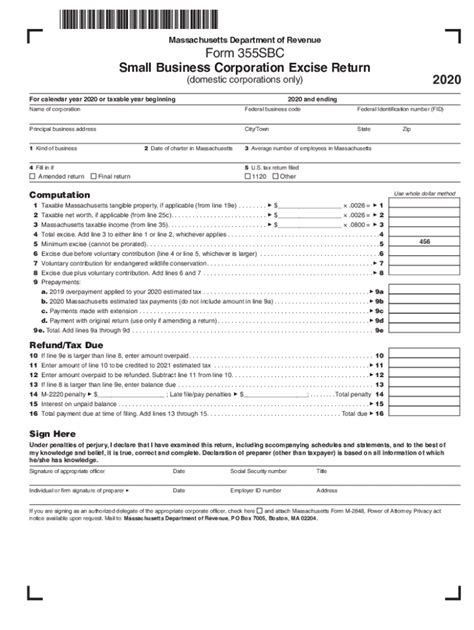

Before we dive into the tips, let's cover the basics of Form 355SBC. This form is used to report a corporation's taxable income, which includes income from business operations, investments, and other sources. The form also requires corporations to report their excise tax liability, which is based on their taxable income and the applicable tax rates. The Massachusetts Department of Revenue uses the information reported on Form 355SBC to determine a corporation's excise tax liability and to ensure compliance with state tax laws.

Tip 1: Ensure Timely Filing

The first tip for filing Form 355SBC is to ensure timely filing. The deadline for filing Form 355SBC is typically March 15th for calendar-year corporations. However, if your corporation uses a fiscal year, the deadline will be the 15th day of the third month following the close of your fiscal year. It's essential to file Form 355SBC on time to avoid penalties and interest on any unpaid excise tax.

Tip 2: Accurately Report Taxable Income

Breaking Down Taxable Income

To accurately report taxable income on Form 355SBC, you'll need to understand what types of income are subject to the corporate excise tax. Taxable income includes:

- Business income from operations

- Investment income

- Rent and royalty income

- Interest income

- Capital gains

When reporting taxable income, make sure to include all relevant income sources and follow the instructions provided on Form 355SBC.

Tip 3: Claim Applicable Credits and Deductions

Available Credits and Deductions

Massachusetts offers several credits and deductions that corporations can claim on Form 355SBC to reduce their excise tax liability. Some of the most common credits and deductions include:

- The research and development credit

- The job creation credit

- The historic rehabilitation credit

- The low-income housing credit

- The deduction for net operating losses

To claim these credits and deductions, you'll need to complete the relevant schedules and attach them to Form 355SBC. Make sure to review the instructions carefully and follow the guidelines for claiming each credit and deduction.

Tip 4: File Supporting Schedules and Attachments

Required Schedules and Attachments

In addition to Form 355SBC, you may need to file supporting schedules and attachments to report specific types of income, credits, and deductions. Some common schedules and attachments include:

- Schedule C: Capital gains and losses

- Schedule D: Depreciation and amortization

- Schedule E: Rental income and expenses

- Schedule K-1: Partner's share of income, deductions, and credits

Make sure to review the instructions for Form 355SBC and complete all required schedules and attachments to ensure accurate reporting and avoid delays in processing your return.

Tip 5: Seek Professional Help When Needed

Finally, if you're unsure about any aspect of filing Form 355SBC, don't hesitate to seek professional help. A qualified tax professional or accountant can guide you through the process, ensure accurate reporting, and help you take advantage of available credits and deductions.

By following these five tips, you'll be well on your way to accurately and efficiently filing your corporate excise tax return, Form 355SBC. Remember to stay organized, seek help when needed, and carefully review the instructions to ensure a smooth filing process.

What's Next?

If you have any questions or concerns about filing Form 355SBC, we encourage you to leave a comment below. Additionally, if you found this article helpful, please share it with your colleagues and friends who may benefit from this information.

FAQ Section

What is the deadline for filing Form 355SBC?

+The deadline for filing Form 355SBC is typically March 15th for calendar-year corporations. However, if your corporation uses a fiscal year, the deadline will be the 15th day of the third month following the close of your fiscal year.

What types of income are subject to the corporate excise tax?

+Taxable income includes business income from operations, investment income, rent and royalty income, interest income, and capital gains.

Can I claim credits and deductions on Form 355SBC?

+Yes, Massachusetts offers several credits and deductions that corporations can claim on Form 355SBC to reduce their excise tax liability. Some common credits and deductions include the research and development credit, the job creation credit, and the historic rehabilitation credit.