Obtaining a CorpCode Request Form NJ is a crucial step for businesses operating in New Jersey, as it is required for various tax purposes. In this article, we will guide you through the process of getting your CorpCode Request Form NJ in 5 easy steps.

Understanding the Importance of CorpCode Request Form NJ

Before we dive into the steps, it's essential to understand the significance of the CorpCode Request Form NJ. The CorpCode is a unique identifier assigned to businesses by the New Jersey Department of the Treasury, Division of Taxation. It is used to track and manage business tax accounts, ensuring that businesses comply with tax laws and regulations.

Step 1: Determine Your Business Structure

To obtain a CorpCode Request Form NJ, you need to determine your business structure. This will help you identify the type of tax account you need to create. The most common business structures in New Jersey are:

- Sole Proprietorship

- Partnership

- Corporation (C-Corp or S-Corp)

- Limited Liability Company (LLC)

Step 2: Gather Required Information

To complete the CorpCode Request Form NJ, you will need to gather specific information about your business. This includes:

- Business name and address

- Federal Employer Identification Number (FEIN)

- Type of business structure

- Type of tax account (e.g., sales tax, withholding tax, etc.)

- Owner/officer information (name, address, and Social Security number or FEIN)

Step 3: Register for a Business Tax Account

You can register for a business tax account online through the New Jersey Division of Taxation's website. You will need to create an account and provide the required information. Once you have registered, you will be issued a CorpCode.

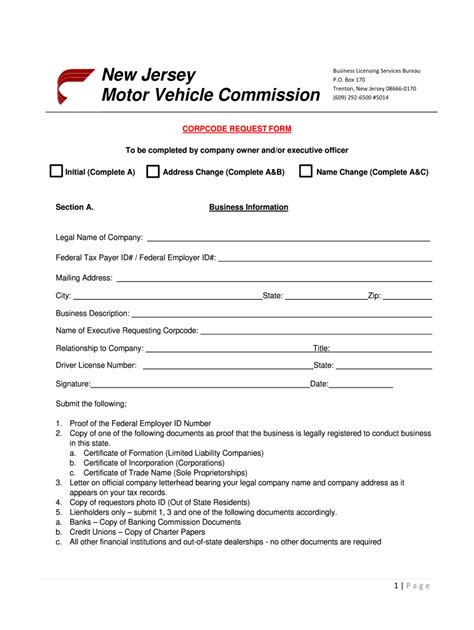

Step 4: Complete the CorpCode Request Form NJ

After registering for a business tax account, you will need to complete the CorpCode Request Form NJ. This form is used to request a CorpCode for your business. You can download the form from the New Jersey Division of Taxation's website or obtain it from your local tax office.

Step 5: Submit the Form and Receive Your CorpCode

Once you have completed the CorpCode Request Form NJ, you can submit it to the New Jersey Division of Taxation. You can submit the form online, by mail, or in person at your local tax office. After processing your application, you will receive your CorpCode, which you can use to manage your business tax accounts.

Benefits of Obtaining a CorpCode Request Form NJ

Obtaining a CorpCode Request Form NJ provides several benefits for businesses operating in New Jersey. These include:

- Streamlined Tax Compliance: A CorpCode helps businesses comply with tax laws and regulations, reducing the risk of penalties and fines.

- Simplified Tax Filing: With a CorpCode, businesses can easily file tax returns and make payments online.

- Improved Record-Keeping: A CorpCode helps businesses keep accurate records of their tax accounts, making it easier to manage finances.

Common Mistakes to Avoid When Filing for a CorpCode Request Form NJ

When filing for a CorpCode Request Form NJ, businesses should avoid the following common mistakes:

- Incomplete or inaccurate information: Ensure that all information provided is complete and accurate to avoid delays or rejection of your application.

- Failure to register for a business tax account: Registering for a business tax account is a prerequisite for obtaining a CorpCode.

- Not submitting the form correctly: Ensure that you submit the form correctly, either online, by mail, or in person at your local tax office.

CorpCode Request Form NJ FAQs

Here are some frequently asked questions about the CorpCode Request Form NJ:

What is the purpose of a CorpCode?

A CorpCode is a unique identifier assigned to businesses by the New Jersey Department of the Treasury, Division of Taxation. It is used to track and manage business tax accounts.

How long does it take to obtain a CorpCode?

The processing time for a CorpCode Request Form NJ varies, but it typically takes 2-4 weeks.

Can I obtain a CorpCode online?

Yes, you can register for a business tax account and obtain a CorpCode online through the New Jersey Division of Taxation's website.

What is the purpose of a CorpCode?

+A CorpCode is a unique identifier assigned to businesses by the New Jersey Department of the Treasury, Division of Taxation. It is used to track and manage business tax accounts.

How long does it take to obtain a CorpCode?

+The processing time for a CorpCode Request Form NJ varies, but it typically takes 2-4 weeks.

Can I obtain a CorpCode online?

+Yes, you can register for a business tax account and obtain a CorpCode online through the New Jersey Division of Taxation's website.

We hope this article has provided you with a comprehensive guide on how to obtain a CorpCode Request Form NJ in 5 easy steps. Remember to avoid common mistakes and ensure that you provide complete and accurate information to avoid delays or rejection of your application. If you have any further questions or concerns, please don't hesitate to comment below.