Contractors and construction companies often encounter various forms and agreements as part of their daily operations. One such document is the Contractors Bond Form 13b-1, a crucial document that ensures compliance with regulatory requirements and protects the interests of all parties involved. In this article, we will delve into the world of Contractors Bond Form 13b-1, exploring its definition, importance, and key aspects.

What is Contractors Bond Form 13b-1?

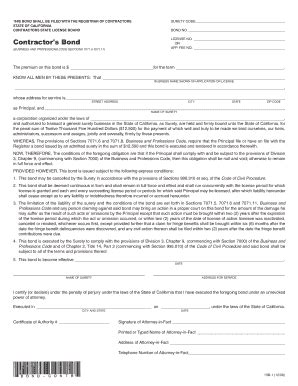

Contractors Bond Form 13b-1 is a type of surety bond that contractors are required to obtain as a condition of their license or permit to work on a specific project. The bond serves as a guarantee that the contractor will comply with the terms and conditions of the contract, including payment of all labor, materials, and taxes.

Why is Contractors Bond Form 13b-1 Important?

The Contractors Bond Form 13b-1 is essential for several reasons:

- Protection of the Project Owner: The bond ensures that the project owner is protected in case the contractor fails to complete the project or meet their obligations.

- Compliance with Regulatory Requirements: The bond demonstrates that the contractor has met the necessary regulatory requirements to work on the project.

- Payment of Labor and Materials: The bond guarantees that the contractor will pay all labor, materials, and taxes associated with the project.

Key Aspects of Contractors Bond Form 13b-1

Understanding the key aspects of Contractors Bond Form 13b-1 is crucial for contractors and project owners. Here are some key points to consider:

- Bond Amount: The bond amount is typically a percentage of the total contract value.

- Bond Term: The bond term is usually the duration of the project.

- Bond Conditions: The bond conditions outline the terms and conditions of the bond, including the obligations of the contractor and the project owner.

- Claims Process: The claims process outlines the procedure for filing claims under the bond.

How to Obtain a Contractors Bond Form 13b-1

Obtaining a Contractors Bond Form 13b-1 involves several steps:

- Determine the Bond Amount: The contractor must determine the required bond amount, which is typically a percentage of the total contract value.

- Choose a Surety Bond Provider: The contractor must choose a surety bond provider that is licensed and experienced in providing contractors bonds.

- Apply for the Bond: The contractor must apply for the bond, providing required documentation and information.

- Pay the Bond Premium: The contractor must pay the bond premium, which is typically a percentage of the bond amount.

Common Mistakes to Avoid

When dealing with Contractors Bond Form 13b-1, contractors and project owners must avoid common mistakes that can lead to delays, cost overruns, or even project cancellation. Here are some common mistakes to avoid:

- Failure to Obtain the Bond: Failure to obtain the bond can result in project delays or cancellation.

- Insufficient Bond Amount: Insufficient bond amount can lead to financial losses for the project owner.

- Non-Compliance with Bond Conditions: Non-compliance with bond conditions can result in claims under the bond.

Conclusion

In conclusion, Contractors Bond Form 13b-1 is a critical document that ensures compliance with regulatory requirements and protects the interests of all parties involved. By understanding the definition, importance, and key aspects of the bond, contractors and project owners can avoid common mistakes and ensure successful project completion.

We invite you to share your experiences or ask questions about Contractors Bond Form 13b-1 in the comments section below. Your feedback is essential in helping us provide valuable information to our readers.

What is the purpose of Contractors Bond Form 13b-1?

+The purpose of Contractors Bond Form 13b-1 is to ensure compliance with regulatory requirements and protect the interests of all parties involved in a construction project.

How do I obtain a Contractors Bond Form 13b-1?

+To obtain a Contractors Bond Form 13b-1, you must determine the required bond amount, choose a surety bond provider, apply for the bond, and pay the bond premium.

What are the common mistakes to avoid when dealing with Contractors Bond Form 13b-1?

+Common mistakes to avoid when dealing with Contractors Bond Form 13b-1 include failure to obtain the bond, insufficient bond amount, and non-compliance with bond conditions.