As the world of cryptocurrency continues to grow and evolve, the importance of proper tax reporting has become increasingly evident. One of the most popular and user-friendly platforms for buying, selling, and trading cryptocurrencies is Coinbase. However, when it comes to tax season, Coinbase users may find themselves wondering how to accurately report their cryptocurrency transactions. That's where the Coinbase Form 8949 comes in – a crucial tool for crypto tax reporting.

In this article, we'll delve into the world of crypto tax reporting, exploring the ins and outs of Coinbase Form 8949. We'll cover what it is, how to use it, and provide valuable tips and tricks for making the most of this essential tool.

What is Coinbase Form 8949?

Coinbase Form 8949 is a tax reporting document specifically designed for Coinbase users. It's a Schedule D attachment that provides a detailed breakdown of all your cryptocurrency transactions, including buys, sells, sends, and receives. This form is used to report capital gains and losses from the sale or exchange of cryptocurrencies, which is a crucial aspect of crypto tax reporting.

Why is Coinbase Form 8949 Important?

Accurate tax reporting is essential for cryptocurrency investors, and Coinbase Form 8949 makes it easier to do so. By using this form, you can:

- Accurately report capital gains and losses from cryptocurrency transactions

- Take advantage of tax deductions and credits

- Avoid potential penalties and fines for inaccurate or incomplete tax reporting

- Simplify the tax preparation process

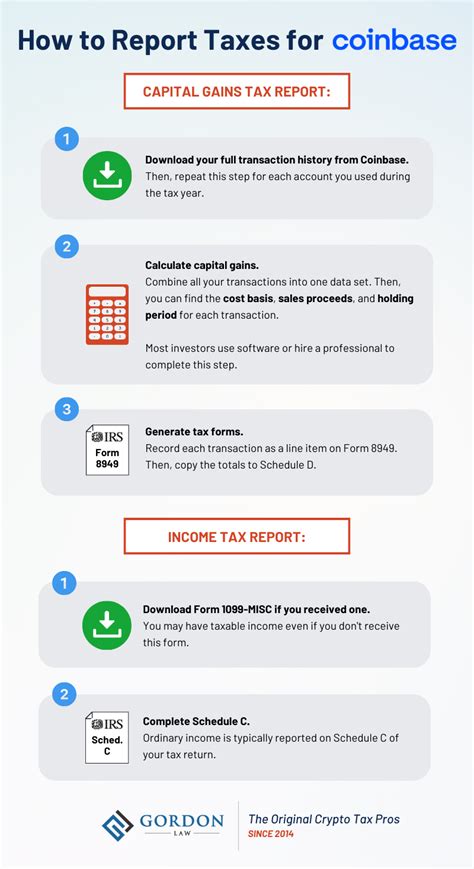

How to Use Coinbase Form 8949

Using Coinbase Form 8949 is relatively straightforward. Here's a step-by-step guide to help you get started:

- Log in to your Coinbase account: Go to the Coinbase website and log in to your account.

- Navigate to the tax center: Click on the "Tax Center" tab, usually located in the top menu bar.

- Select the tax year: Choose the tax year for which you want to generate the Form 8949.

- Generate the form: Click on the "Generate Form 8949" button to create the document.

- Review and download: Review the form for accuracy and download it as a PDF.

Understanding the Form 8949 Layout

The Coinbase Form 8949 is divided into several sections, including:

- Identification: Your name, address, and taxpayer identification number

- Transaction details: A list of all your cryptocurrency transactions, including date, time, amount, and type (buy, sell, send, or receive)

- Gains and losses: A calculation of your capital gains and losses from each transaction

- Totals: A summary of your total gains and losses for the tax year

Tips and Tricks for Using Coinbase Form 8949

Here are some valuable tips and tricks to help you make the most of Coinbase Form 8949:

- Keep accurate records: Make sure to keep accurate records of all your cryptocurrency transactions, including receipts and confirmations.

- Use the form to identify wash sales: Coinbase Form 8949 can help you identify wash sales, which can affect your capital gains and losses.

- Consult a tax professional: If you're unsure about how to use the form or have complex tax situations, consider consulting a tax professional.

- Take advantage of tax deductions: Use the form to identify potential tax deductions and credits.

Common Mistakes to Avoid

When using Coinbase Form 8949, it's essential to avoid common mistakes that can lead to inaccurate tax reporting or even penalties. Here are some mistakes to watch out for:

- Inaccurate transaction dates: Make sure to accurately record the date and time of each transaction.

- Incorrect transaction types: Ensure that you correctly identify the type of transaction (buy, sell, send, or receive).

- Failure to report wash sales: Don't forget to report wash sales, which can affect your capital gains and losses.

Conclusion

Coinbase Form 8949 is a valuable tool for cryptocurrency investors, making it easier to accurately report capital gains and losses. By understanding how to use this form and avoiding common mistakes, you can simplify the tax preparation process and ensure compliance with tax regulations.

Call to Action

If you're a Coinbase user, make sure to take advantage of Form 8949 to simplify your tax reporting. Share this article with fellow crypto investors to help them navigate the world of crypto tax reporting. If you have any questions or comments, please leave them below.

What is Coinbase Form 8949?

+Coinbase Form 8949 is a tax reporting document specifically designed for Coinbase users. It provides a detailed breakdown of all cryptocurrency transactions, including buys, sells, sends, and receives.

Why is Coinbase Form 8949 important?

+Accurate tax reporting is essential for cryptocurrency investors, and Coinbase Form 8949 makes it easier to do so. By using this form, you can accurately report capital gains and losses, take advantage of tax deductions and credits, and avoid potential penalties and fines.

How do I use Coinbase Form 8949?

+To use Coinbase Form 8949, log in to your Coinbase account, navigate to the tax center, select the tax year, generate the form, and review and download it as a PDF.