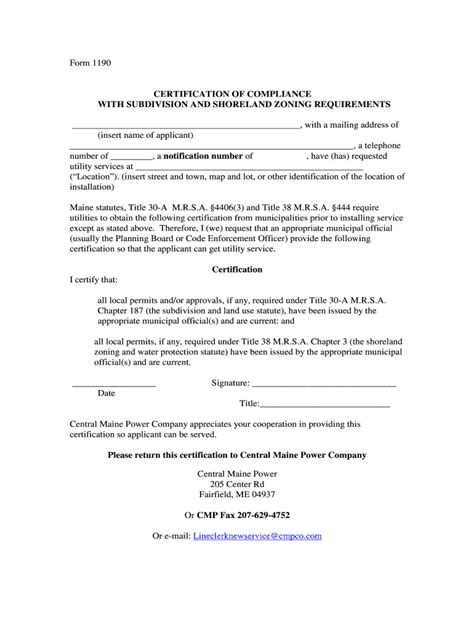

The Cmp 1190 form is a crucial document for individuals who are dealing with debt collection issues. It is a consumer complaint form that allows individuals to file a complaint against a debt collector who has allegedly violated the Fair Debt Collection Practices Act (FDCPA). In this article, we will provide a comprehensive guide to help you understand the Cmp 1190 form and how to use it to resolve your debt collection issues.

What is the Cmp 1190 Form?

The Cmp 1190 form is a consumer complaint form that is used to file a complaint against a debt collector who has allegedly violated the FDCPA. The form is designed to help individuals who are being harassed or treated unfairly by debt collectors. The form is typically used to report complaints about debt collectors who are using abusive, harassing, or deceptive tactics to collect debts.

How to File a Complaint Using the Cmp 1190 Form

Filing a complaint using the Cmp 1190 form is a straightforward process. Here are the steps you need to follow:

- Download the Cmp 1190 form from the official website of the Federal Trade Commission (FTC) or other government agencies that regulate debt collection practices.

- Fill out the form completely and accurately. Make sure to provide all the required information, including your name, address, and contact information.

- Provide details about the debt collector who allegedly violated the FDCPA. This includes the name of the debt collector, the debt collector's company, and the date and time of the alleged violation.

- Describe the alleged violation in detail. Be specific about what happened and how it affected you.

- Attach any supporting documentation, such as letters or emails from the debt collector, to the form.

- Sign and date the form.

- Submit the form to the FTC or other government agencies that regulate debt collection practices.

Benefits of Using the Cmp 1190 Form

Using the Cmp 1190 form to file a complaint against a debt collector can have several benefits. Here are some of the benefits:

- It helps to resolve debt collection disputes: Filing a complaint using the Cmp 1190 form can help to resolve debt collection disputes in a fair and efficient manner.

- It protects consumers from abusive debt collectors: The Cmp 1190 form provides a mechanism for consumers to report abusive debt collectors and helps to prevent further abuse.

- It promotes compliance with the FDCPA: The Cmp 1190 form helps to promote compliance with the FDCPA by encouraging debt collectors to follow the law.

Common Mistakes to Avoid When Filing a Complaint Using the Cmp 1190 Form

When filing a complaint using the Cmp 1190 form, there are several common mistakes to avoid. Here are some of the most common mistakes:

- Failure to provide complete and accurate information: Make sure to provide all the required information, including your name, address, and contact information.

- Failure to attach supporting documentation: Attach any supporting documentation, such as letters or emails from the debt collector, to the form.

- Failure to sign and date the form: Make sure to sign and date the form before submitting it.

Consequences of Not Using the Cmp 1190 Form

Not using the Cmp 1190 form to file a complaint against a debt collector can have several consequences. Here are some of the consequences:

- Continued harassment: If you don't file a complaint, the debt collector may continue to harass you.

- Further abuse: If you don't file a complaint, the debt collector may continue to engage in abusive practices.

- Loss of rights: If you don't file a complaint, you may lose your rights under the FDCPA.

Tips for Filing a Complaint Using the Cmp 1190 Form

Here are some tips for filing a complaint using the Cmp 1190 form:

- Keep a record of all correspondence with the debt collector.

- Keep a record of all payments made to the debt collector.

- Be specific about the alleged violation.

- Attach supporting documentation.

- Sign and date the form.

Alternatives to the Cmp 1190 Form

There are several alternatives to the Cmp 1190 form. Here are some of the alternatives:

- Filing a complaint with the Consumer Financial Protection Bureau (CFPB)

- Filing a complaint with the state Attorney General's office

- Filing a lawsuit against the debt collector

Conclusion

The Cmp 1190 form is an important tool for consumers who are dealing with debt collection issues. By using the form, consumers can file a complaint against a debt collector who has allegedly violated the FDCPA. We hope this guide has provided you with the information you need to use the Cmp 1190 form effectively.

Now that you have read this article, we encourage you to share your thoughts and experiences with the Cmp 1190 form. Have you ever used the form to file a complaint against a debt collector? What was your experience like? Share your story in the comments below.

What is the Cmp 1190 form?

+The Cmp 1190 form is a consumer complaint form that is used to file a complaint against a debt collector who has allegedly violated the Fair Debt Collection Practices Act (FDCPA).

How do I file a complaint using the Cmp 1190 form?

+To file a complaint using the Cmp 1190 form, download the form from the official website of the Federal Trade Commission (FTC) or other government agencies that regulate debt collection practices, fill out the form completely and accurately, and submit it to the FTC or other government agencies.

What are the benefits of using the Cmp 1190 form?

+The benefits of using the Cmp 1190 form include resolving debt collection disputes, protecting consumers from abusive debt collectors, and promoting compliance with the FDCPA.