Direct deposit is a convenient and efficient way to receive payments, and CIBC (Canadian Imperial Bank of Commerce) offers a simple and secure process for setting up direct deposit. In this article, we will guide you through the easy setup process and highlight the benefits of using CIBC direct deposit.

Receiving payments through direct deposit can save you time and effort, as it eliminates the need to physically visit a bank branch or wait for cheques to clear. With CIBC direct deposit, you can have your payments deposited directly into your account, ensuring that your funds are available to you as soon as possible.

Setting Up CIBC Direct Deposit

Setting up CIBC direct deposit is a straightforward process that can be completed in a few easy steps. Here's what you need to do:

Step 1: Gather Required Information

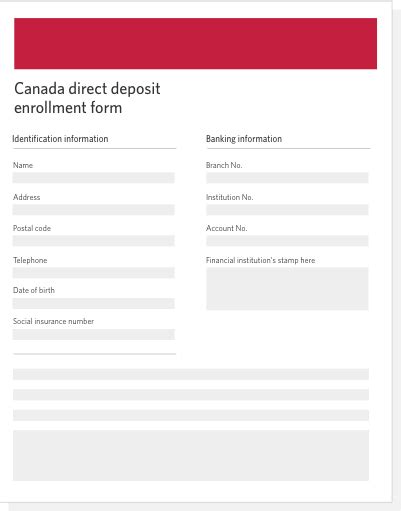

To set up direct deposit, you will need to provide your employer or payer with your account information. You will need to provide the following:

- Your name and address

- Your CIBC account number

- Your CIBC branch transit number (located on your cheque or bank statement)

- Your Social Insurance Number (SIN) or other identification number (if required)

Step 2: Fill Out the Direct Deposit Form

You can obtain a direct deposit form from your employer or payer, or you can download one from the CIBC website. The form will require you to provide your account information and authorization for direct deposit.

Step 3: Submit the Form

Once you have completed the direct deposit form, submit it to your employer or payer. They will then forward the form to CIBC, and your direct deposit will be set up.

Benefits of CIBC Direct Deposit

Using CIBC direct deposit offers several benefits, including:

- Convenience: Direct deposit eliminates the need to physically visit a bank branch or wait for cheques to clear.

- Security: Direct deposit reduces the risk of lost or stolen cheques.

- Speed: Your payments are deposited directly into your account, ensuring that your funds are available to you as soon as possible.

- Reduced fees: Direct deposit can help reduce fees associated with cheque clearing and bank visits.

Common Uses of CIBC Direct Deposit

CIBC direct deposit is commonly used for:

- Payroll deposits

- Government benefits (such as EI and CPP)

- Pension payments

- Tax refunds

- Investment income

FAQs

Here are some frequently asked questions about CIBC direct deposit:

Q: How long does it take to set up direct deposit? A: The setup process typically takes 2-3 business days.

Q: Can I set up direct deposit online? A: Yes, you can set up direct deposit online through the CIBC website.

Q: Can I cancel direct deposit at any time? A: Yes, you can cancel direct deposit at any time by contacting your employer or payer.

Q: Is direct deposit secure? A: Yes, direct deposit is a secure way to receive payments, as it eliminates the risk of lost or stolen cheques.

What is the CIBC direct deposit form?

+The CIBC direct deposit form is a document that requires you to provide your account information and authorization for direct deposit.

How do I obtain a CIBC direct deposit form?

+You can obtain a CIBC direct deposit form from your employer or payer, or you can download one from the CIBC website.

Can I use CIBC direct deposit for international payments?

+No, CIBC direct deposit is only available for domestic payments. For international payments, you will need to use a different payment method.

In conclusion, setting up CIBC direct deposit is a simple and convenient way to receive payments. With its numerous benefits, including convenience, security, and speed, direct deposit is an attractive option for anyone looking to streamline their payment process.