Establishing a Chase checking account beneficiary form is a crucial step in ensuring that your financial assets are distributed according to your wishes in the event of your passing. This process can seem daunting, but with the right guidance, it can be made easy. In this article, we will walk you through the importance of having a beneficiary form, the benefits of designating a beneficiary, and the step-by-step process of creating a Chase checking account beneficiary form.

Why You Need a Beneficiary Form

A beneficiary form, also known as a payable-on-death (POD) designation, is a document that allows you to name a beneficiary to receive your checking account assets upon your death. This ensures that your assets are transferred directly to the beneficiary without the need for probate, which can be a lengthy and costly process.

Benefits of Designating a Beneficiary

Designating a beneficiary for your Chase checking account offers several benefits, including:

- Avoiding probate: By naming a beneficiary, you can avoid the probate process, which can save your loved ones time, money, and stress.

- Ensuring asset distribution: A beneficiary form ensures that your assets are distributed according to your wishes, reducing the risk of disputes or mismanagement.

- Providing financial security: By designating a beneficiary, you can provide financial security for your loved ones in the event of your passing.

How to Create a Chase Checking Account Beneficiary Form

Creating a Chase checking account beneficiary form is a straightforward process that can be completed in a few steps:

Step 1: Gather Required Information

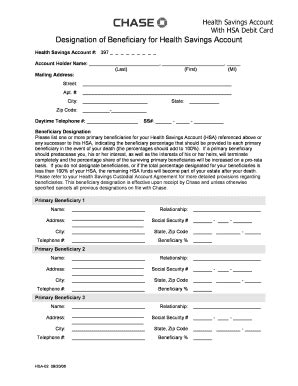

Before you begin, gather the required information, including:

- Your Chase checking account number

- The beneficiary's name, address, and social security number or tax identification number

- Your relationship to the beneficiary

Step 2: Obtain a Beneficiary Form

You can obtain a beneficiary form from Chase in several ways:

- Visit a Chase branch: You can visit a Chase branch in person and request a beneficiary form.

- Download from the Chase website: You can download a beneficiary form from the Chase website.

- Call Chase customer service: You can call Chase customer service and request a beneficiary form be mailed to you.

Step 3: Complete the Beneficiary Form

Once you have obtained a beneficiary form, complete it by providing the required information, including your account number, beneficiary's information, and your relationship to the beneficiary.

Step 4: Sign and Date the Form

Sign and date the beneficiary form in the presence of a notary public.

Step 5: Return the Form to Chase

Return the completed and signed beneficiary form to Chase by mail or in person.

FAQs

What is a beneficiary form?

+A beneficiary form, also known as a payable-on-death (POD) designation, is a document that allows you to name a beneficiary to receive your checking account assets upon your death.

Who can be a beneficiary?

+A beneficiary can be a person, trust, or organization. You can name multiple beneficiaries and specify the percentage of assets each will receive.

Can I change my beneficiary designation?

+Yes, you can change your beneficiary designation at any time by completing a new beneficiary form and returning it to Chase.

In conclusion, creating a Chase checking account beneficiary form is an essential step in ensuring that your financial assets are distributed according to your wishes. By following the steps outlined above, you can complete the process with ease and provide financial security for your loved ones.