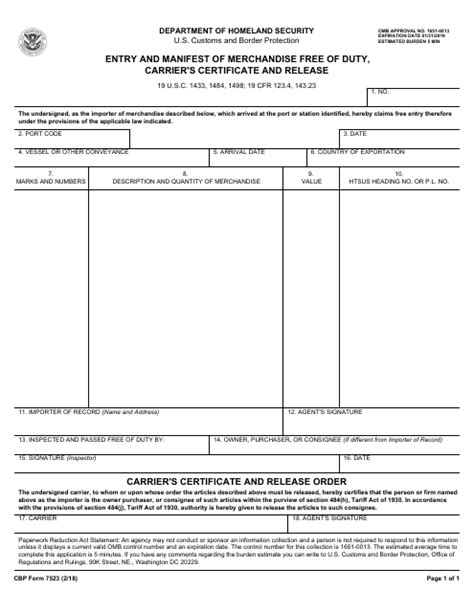

The world of customs brokerage and international trade can be complex and overwhelming, especially for those who are new to the industry. One of the most critical documents in this field is the CBP Form 7523, also known as the Entry Summary Declaration. This form is used to declare the importation of goods into the United States and is a crucial part of the customs clearance process. However, filling out this form can be a daunting task, especially for those who are unfamiliar with the required information and procedures.

In this article, we will provide you with 5 tips for filling out CBP Form 7523, including understanding the required information, knowing the different types of entries, using the correct Harmonized System (HS) codes, providing accurate valuations, and submitting the form electronically.

Tip 1: Understand the Required Information

Before you start filling out the CBP Form 7523, it's essential to understand the required information. The form requires a significant amount of data, including:

- The name and address of the importer

- The name and address of the customs broker

- The date of entry

- The entry number

- The Harmonized System (HS) code for the goods being imported

- The country of origin

- The value of the goods

- The quantity of the goods

- The unit of measure

It's crucial to ensure that you have all the necessary information before starting to fill out the form. This will help you avoid mistakes and ensure that the form is completed correctly.

Types of Entries

There are several types of entries that can be made on the CBP Form 7523, including:

- Consumption entry: This is the most common type of entry and is used for goods that are being imported for consumption in the United States.

- Warehouse entry: This type of entry is used for goods that are being stored in a bonded warehouse.

- Temporary Importation Under Bond (TIB) entry: This type of entry is used for goods that are being imported temporarily and will be re-exported.

It's essential to know which type of entry to use, as this will affect the information required on the form.

Tip 2: Know the Different Types of Entries

As mentioned earlier, there are several types of entries that can be made on the CBP Form 7523. It's essential to know which type of entry to use, as this will affect the information required on the form.

Here are some key differences between the different types of entries:

- Consumption entry: This type of entry requires the payment of duties and taxes.

- Warehouse entry: This type of entry does not require the payment of duties and taxes, but the goods must be stored in a bonded warehouse.

- TIB entry: This type of entry requires the posting of a bond and the goods must be re-exported.

It's crucial to choose the correct type of entry, as this will affect the information required on the form and the customs clearance process.

Tip 3: Use the Correct Harmonized System (HS) Codes

The Harmonized System (HS) code is a critical piece of information required on the CBP Form 7523. The HS code is a standardized system used to classify goods for customs purposes.

Here are some tips for using the correct HS codes:

- Use the most specific HS code possible

- Ensure that the HS code is correct and up-to-date

- Use the HS code that corresponds to the goods being imported

It's essential to use the correct HS code, as this will affect the duties and taxes payable and the customs clearance process.

Tip 4: Provide Accurate Valuations

The value of the goods being imported is a critical piece of information required on the CBP Form 7523. It's essential to provide accurate valuations, as this will affect the duties and taxes payable.

Here are some tips for providing accurate valuations:

- Use the transaction value of the goods

- Ensure that the valuation is accurate and up-to-date

- Use the correct valuation method

It's essential to provide accurate valuations, as this will affect the duties and taxes payable and the customs clearance process.

Tip 5: Submit the Form Electronically

The CBP Form 7523 can be submitted electronically through the Automated Broker Interface (ABI) system. This system allows customs brokers to submit entry summaries electronically, which can help to speed up the customs clearance process.

Here are some benefits of submitting the form electronically:

- Faster processing times

- Reduced errors

- Increased efficiency

It's essential to submit the form electronically, as this will help to speed up the customs clearance process and reduce errors.

In conclusion, filling out the CBP Form 7523 requires careful attention to detail and a thorough understanding of the required information and procedures. By following these 5 tips, you can ensure that the form is completed correctly and efficiently, which will help to speed up the customs clearance process and reduce errors.

We invite you to share your experiences and tips for filling out the CBP Form 7523 in the comments section below.

What is the CBP Form 7523?

+The CBP Form 7523 is a document used to declare the importation of goods into the United States. It is also known as the Entry Summary Declaration.

What information is required on the CBP Form 7523?

+The CBP Form 7523 requires a significant amount of data, including the name and address of the importer, the name and address of the customs broker, the date of entry, the entry number, the Harmonized System (HS) code for the goods being imported, the country of origin, the value of the goods, the quantity of the goods, and the unit of measure.

What are the different types of entries on the CBP Form 7523?

+There are several types of entries that can be made on the CBP Form 7523, including consumption entry, warehouse entry, and Temporary Importation Under Bond (TIB) entry.