The Certificate of Origin (CBP Form 3499) is a crucial document in international trade, serving as a declaration of the country of origin for goods being imported or exported. Its significance cannot be overstated, as it directly impacts customs clearance, tariffs, and the enforcement of trade policies. In this comprehensive guide, we will delve into the intricacies of CBP Form 3499, explaining its importance, how to complete it, and the benefits it offers to traders and customs authorities alike.

What is a Certificate of Origin?

A Certificate of Origin is a document that certifies the country of origin of goods being exported or imported. It is typically issued by the exporter or the manufacturer of the goods and is used to determine the eligibility of goods for preferential tariffs or other trade benefits. The Certificate of Origin serves as a proof of origin, ensuring that the goods comply with the rules of origin specified in various trade agreements.

Importance of Certificate of Origin

The Certificate of Origin plays a vital role in international trade, as it helps to:

- Determine the eligibility of goods for preferential tariffs or other trade benefits

- Ensure compliance with trade agreements and regulations

- Facilitate customs clearance and reduce the risk of delays or penalties

- Provide transparency and accountability in trade transactions

CBP Form 3499: Certificate of Origin

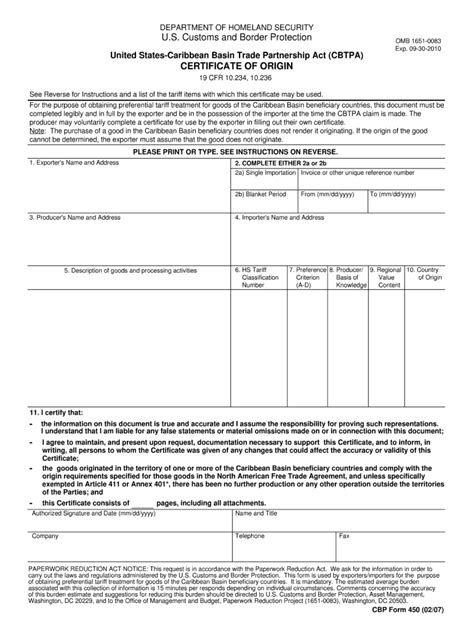

CBP Form 3499 is the standardized form used by U.S. Customs and Border Protection (CBP) to certify the origin of goods being imported or exported. The form is typically completed by the exporter or the manufacturer of the goods and is presented to CBP as part of the customs clearance process.

Completing CBP Form 3499

To complete CBP Form 3499, the following information is required:

- Name and address of the exporter or manufacturer

- Name and address of the importer

- Description of the goods being imported or exported

- Country of origin of the goods

- Harmonized System (HS) code for the goods

- Certificate of origin declaration

It is essential to ensure that the form is completed accurately and truthfully, as any errors or discrepancies can lead to delays or penalties.

Benefits of Using CBP Form 3499

Using CBP Form 3499 offers several benefits to traders and customs authorities, including:

- Facilitates customs clearance and reduces the risk of delays or penalties

- Ensures compliance with trade agreements and regulations

- Provides transparency and accountability in trade transactions

- Helps to determine the eligibility of goods for preferential tariffs or other trade benefits

Common Mistakes to Avoid

When completing CBP Form 3499, it is essential to avoid common mistakes that can lead to delays or penalties. These include:

- Inaccurate or incomplete information

- Failure to sign the form

- Using an outdated or incorrect form

- Not retaining records of the form

Best Practices for Using CBP Form 3499

To ensure a smooth customs clearance process, it is recommended to:

- Use the most up-to-date version of CBP Form 3499

- Complete the form accurately and truthfully

- Retain records of the form for a minimum of five years

- Ensure that the form is signed and dated

Conclusion: The Importance of CBP Form 3499

In conclusion, CBP Form 3499 is a critical document in international trade, serving as a declaration of the country of origin for goods being imported or exported. Its importance cannot be overstated, as it directly impacts customs clearance, tariffs, and the enforcement of trade policies. By understanding the significance of CBP Form 3499 and following best practices for its completion, traders and customs authorities can ensure a smooth and efficient customs clearance process.

Call to Action

We hope this comprehensive guide has provided you with a deeper understanding of CBP Form 3499 and its significance in international trade. If you have any further questions or concerns, please do not hesitate to reach out to us. Additionally, we encourage you to share your experiences and best practices for using CBP Form 3499 in the comments section below.

What is the purpose of CBP Form 3499?

+CBP Form 3499 is used to certify the country of origin of goods being imported or exported, ensuring compliance with trade agreements and regulations.

How do I complete CBP Form 3499?

+To complete CBP Form 3499, you will need to provide information such as the name and address of the exporter or manufacturer, the name and address of the importer, and the description of the goods being imported or exported.

What are the benefits of using CBP Form 3499?

+Using CBP Form 3499 facilitates customs clearance, ensures compliance with trade agreements and regulations, and provides transparency and accountability in trade transactions.