As a resident of Canton, Ohio, it's essential to understand the process of filling out the Canton city tax form. The city of Canton has a municipal income tax, which requires individuals and businesses to file a tax return. Failing to file or paying taxes late can result in penalties and interest. In this article, we will guide you through the process of filling out the Canton city tax form, highlighting six ways to ensure you complete it accurately and on time.

Understanding the Canton City Tax Form

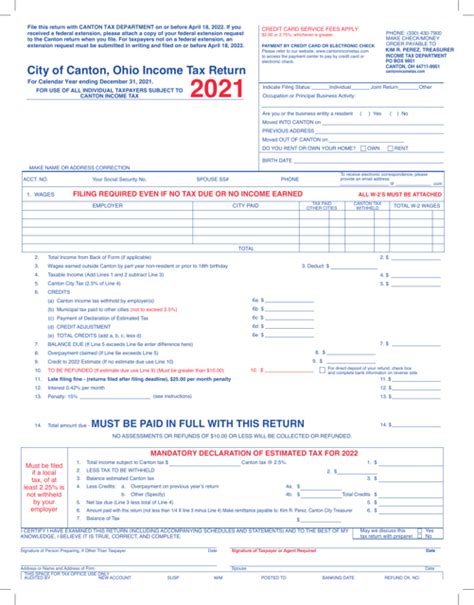

Before we dive into the six ways to fill out the Canton city tax form, it's essential to understand the basics. The Canton city tax form is used to report your income and calculate your tax liability. The form is divided into sections, including personal information, income, deductions, and tax credits. You will need to provide documentation, such as your W-2 forms, 1099 forms, and receipts for deductions.

1. Gather Necessary Documents

To fill out the Canton city tax form accurately, you will need to gather all necessary documents. This includes:

- W-2 forms from your employer(s)

- 1099 forms for freelance or contract work

- Receipts for deductions, such as charitable donations or medical expenses

- Your social security number or ITIN

- Your Canton city tax account number (if you have one)

Make sure you have all these documents ready before starting the tax form.

2. Choose the Correct Filing Status

Your filing status determines how much tax you owe and which deductions you are eligible for. The Canton city tax form has several filing statuses, including single, married filing jointly, married filing separately, head of household, and qualifying widow(er). Choose the correct filing status to ensure you are taxed correctly.

3. Report All Income

The Canton city tax form requires you to report all income earned during the tax year. This includes:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains

- Rent and royalty income

Make sure you report all income earned, even if it's not subject to withholding.

4. Claim Deductions and Credits

Deductions and credits can reduce your tax liability. The Canton city tax form allows you to claim various deductions and credits, including:

- Standard deduction

- Itemized deductions (charitable donations, medical expenses, etc.)

- Earned Income Tax Credit (EITC)

- Child Tax Credit

Claim all eligible deductions and credits to minimize your tax liability.

5. Calculate Tax Liability

Once you have reported all income, claimed deductions and credits, you will need to calculate your tax liability. The Canton city tax form provides a tax table or tax calculator to help you determine your tax liability.

6. Submit the Form and Pay Taxes

Finally, submit the completed tax form and pay any taxes owed by the deadline. You can file the form online, by mail, or in person. Make sure to keep a copy of the form and proof of payment for your records.

Additional Tips and Reminders

- File the tax form by the deadline to avoid penalties and interest.

- Use the correct tax form for your filing status and income type.

- Keep accurate records and documentation to support your tax return.

- Consider consulting a tax professional if you are unsure about any part of the tax form.

By following these six ways to fill out the Canton city tax form, you can ensure you complete it accurately and on time. Remember to gather all necessary documents, choose the correct filing status, report all income, claim deductions and credits, calculate tax liability, and submit the form and pay taxes by the deadline.

Share Your Thoughts

We hope this article has helped you understand the process of filling out the Canton city tax form. Share your thoughts and experiences in the comments below. Have you encountered any challenges or difficulties while filling out the tax form? What tips or advice would you like to share with others?

What is the deadline for filing the Canton city tax form?

+The deadline for filing the Canton city tax form is typically April 15th of each year.

Can I file the Canton city tax form online?

+Yes, you can file the Canton city tax form online through the city's website.

What is the penalty for late filing or payment of Canton city taxes?

+The penalty for late filing or payment of Canton city taxes varies, but it can include interest, late fees, and penalties.