Filing taxes in California can be a daunting task, especially when it comes to forms that are specific to the state. One such form is the California Form 592-Pt, which is used to report pass-through entity items. In this article, we will provide you with 5 tips to help you navigate the process of filing California Form 592-Pt.

The California Form 592-Pt is a crucial document for pass-through entities, such as partnerships, S corporations, and limited liability companies (LLCs), that do business in California. The form is used to report the entity's income, deductions, and credits, as well as the distributive share of these items to its owners. Filing this form accurately and on time is essential to avoid penalties and ensure compliance with California tax laws.

Tip 1: Understand the Purpose of Form 592-Pt

Before you start filling out the form, it's essential to understand its purpose. The California Form 592-Pt is used to report pass-through entity items, such as income, deductions, and credits, to the state of California. The form is used to calculate the entity's tax liability and to provide information to the owners of the entity about their distributive share of the entity's income, deductions, and credits.

What is a Pass-Through Entity?

A pass-through entity is a type of business entity that is not subject to federal income tax. Instead, the income, deductions, and credits of the entity are passed through to the owners of the entity, who report these items on their individual tax returns. In California, pass-through entities are required to file Form 592-Pt to report their income, deductions, and credits to the state.

Tip 2: Gather All Necessary Information

Before you start filling out the form, make sure you have all the necessary information. This includes:

- The entity's federal employer identification number (FEIN)

- The entity's California tax ID number

- The entity's name and address

- The names and addresses of the owners of the entity

- The entity's income, deductions, and credits for the tax year

- Any other relevant information, such as depreciation and amortization

What if I Don't Have All the Necessary Information?

If you don't have all the necessary information, you may need to request an extension of time to file the form. You can file Form 3536, which is the California Application for Automatic Extension of Time to File, to request an extension. However, be aware that an extension of time to file is not an extension of time to pay. You will still be required to make any necessary tax payments by the original due date.

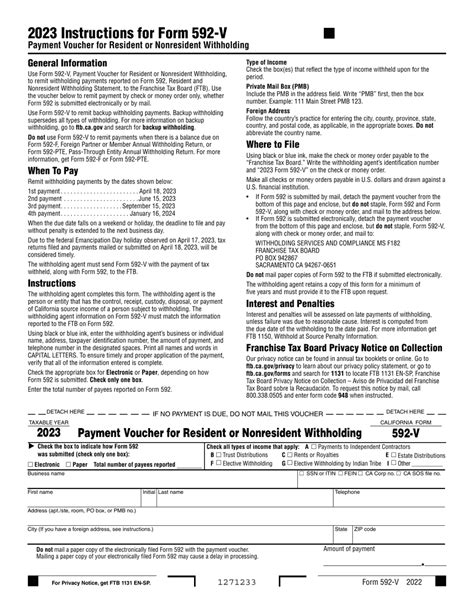

Tip 3: Use the Correct Form and Instructions

Make sure you are using the correct form and instructions for the tax year you are filing for. The California Form 592-Pt and its instructions are updated annually, so it's essential to use the correct version for your tax year.

Where Can I Find the Form and Instructions?

You can find the California Form 592-Pt and its instructions on the California Franchise Tax Board (FTB) website. You can also order the form and instructions by phone or by mail.

Tip 4: File the Form on Time

The California Form 592-Pt is due on the 15th day of the 3rd month after the end of the entity's tax year. For example, if the entity's tax year ends on December 31, the form is due on March 15. Make sure you file the form on time to avoid penalties and interest.

What if I Miss the Deadline?

If you miss the deadline, you may be subject to penalties and interest. You can file Form 3536 to request an extension of time to file, but this will not relieve you of any penalties or interest that may be due.

Tip 5: Seek Professional Help if Necessary

If you are having trouble filling out the form or have questions about the filing process, consider seeking professional help. A tax professional, such as a certified public accountant (CPA) or an enrolled agent (EA), can provide you with guidance and ensure that your form is filed accurately and on time.

How Can I Find a Tax Professional?

You can find a tax professional by searching online or by asking for referrals from friends or family members. Make sure to choose a tax professional who is qualified and experienced in California tax law.

By following these 5 tips, you can ensure that you file your California Form 592-Pt accurately and on time. Remember to understand the purpose of the form, gather all necessary information, use the correct form and instructions, file the form on time, and seek professional help if necessary.

We hope you found this article helpful. If you have any questions or comments, please leave them below.

What is the purpose of California Form 592-Pt?

+California Form 592-Pt is used to report pass-through entity items, such as income, deductions, and credits, to the state of California.

What is a pass-through entity?

+A pass-through entity is a type of business entity that is not subject to federal income tax. Instead, the income, deductions, and credits of the entity are passed through to the owners of the entity, who report these items on their individual tax returns.

How do I file California Form 592-Pt?

+You can file California Form 592-Pt electronically or by mail. Make sure to follow the instructions carefully and file the form on time to avoid penalties and interest.