The state of California requires nonresidents to pay taxes on income earned within its borders. To facilitate this process, the state has introduced Form 592-B, also known as the Nonresident Withholding Tax Statement. This article aims to provide a comprehensive understanding of Form 592-B, its purpose, and its significance for nonresidents earning income in California.

California's nonresident withholding requirements are designed to ensure that nonresidents pay their fair share of taxes on income earned within the state. This is particularly important for individuals who are not residents of California but have investments, businesses, or other sources of income in the state. By understanding the requirements and procedures surrounding Form 592-B, nonresidents can avoid potential penalties and ensure compliance with California tax laws.

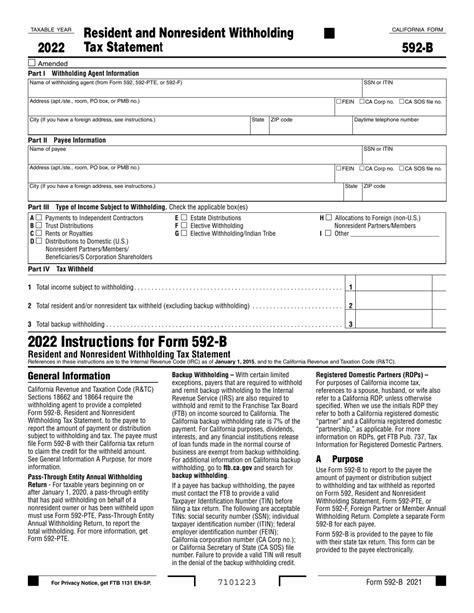

Who Needs to File Form 592-B?

Form 592-B is typically required for nonresidents who have earned income in California, including:

- Individuals who are not residents of California but have investments or businesses in the state

- Nonresident aliens who have earned income in California

- Estates and trusts that have earned income in California

However, not all nonresidents are required to file Form 592-B. For example, if a nonresident's only source of California income is from stocks, bonds, or other securities, they may not be required to file the form.

Types of Income Subject to Withholding

California requires withholding on certain types of income earned by nonresidents, including:

- Real estate transactions

- Partnership income

- S corporation income

- Limited liability company (LLC) income

- Rent and royalties

These types of income are subject to withholding at a rate of 7% or 10.8% of the gross amount, depending on the type of income and the nonresident's tax status.

How to File Form 592-B

To file Form 592-B, nonresidents will need to gather certain information and documents, including:

- Their name and address

- Their tax identification number (Social Security number or Individual Taxpayer Identification Number)

- The type and amount of California income earned

- The withholding rate applied to the income

- Any exemptions or deductions claimed

Nonresidents can file Form 592-B electronically or by mail, depending on their preference. The form must be filed by the 15th day of the 4th month following the close of the calendar year in which the income was earned.

Consequences of Non-Compliance

Failure to file Form 592-B or failure to withhold the required amount can result in penalties and interest. Nonresidents who fail to comply with California's nonresident withholding requirements may be subject to:

- A penalty of up to 35% of the underpaid amount

- Interest on the underpaid amount

- Potential audit and examination by the California Franchise Tax Board

Exemptions and Deductions

Nonresidents may be eligible for certain exemptions or deductions on their California income. For example:

- Nonresidents who earn income from real estate transactions may be eligible for an exemption from withholding if the property is sold for less than $100,000.

- Nonresidents who earn income from partnership or S corporation interests may be eligible for a deduction for their share of losses or expenses.

Nonresidents should consult with a tax professional to determine if they are eligible for any exemptions or deductions on their California income.

Record Keeping Requirements

Nonresidents are required to keep accurate records of their California income and withholding for at least four years. These records should include:

- Copies of Form 592-B and any supporting documentation

- Records of income earned and withholding applied

- Records of any exemptions or deductions claimed

Seeking Professional Help

Filing Form 592-B and complying with California's nonresident withholding requirements can be complex and time-consuming. Nonresidents may benefit from seeking the help of a tax professional who is familiar with California tax laws and regulations.

A tax professional can help nonresidents navigate the requirements and procedures surrounding Form 592-B, including:

- Determining if withholding is required

- Calculating the correct withholding rate

- Preparing and filing Form 592-B

- Claiming exemptions or deductions

Conclusion

California Form 592-B is an important tax document that nonresidents must file to report their California income and withholding. By understanding the requirements and procedures surrounding Form 592-B, nonresidents can avoid potential penalties and ensure compliance with California tax laws.

If you are a nonresident who has earned income in California, it is essential to seek the help of a tax professional who can guide you through the process of filing Form 592-B and complying with California's nonresident withholding requirements.

Who is required to file Form 592-B?

+Form 592-B is typically required for nonresidents who have earned income in California, including individuals, nonresident aliens, estates, and trusts.

What types of income are subject to withholding in California?

+California requires withholding on certain types of income earned by nonresidents, including real estate transactions, partnership income, S corporation income, LLC income, rent, and royalties.

What is the deadline for filing Form 592-B?

+Form 592-B must be filed by the 15th day of the 4th month following the close of the calendar year in which the income was earned.