As a renter in California, you may be eligible for a tax break that can help reduce your state income tax liability. The California Form 540 Renters Credit is a tax credit designed to provide relief to low- and moderate-income renters who are paying a significant portion of their income towards rent. In this article, we will delve into the details of the California Form 540 Renters Credit, including eligibility requirements, how to claim the credit, and its benefits.

What is the California Form 540 Renters Credit?

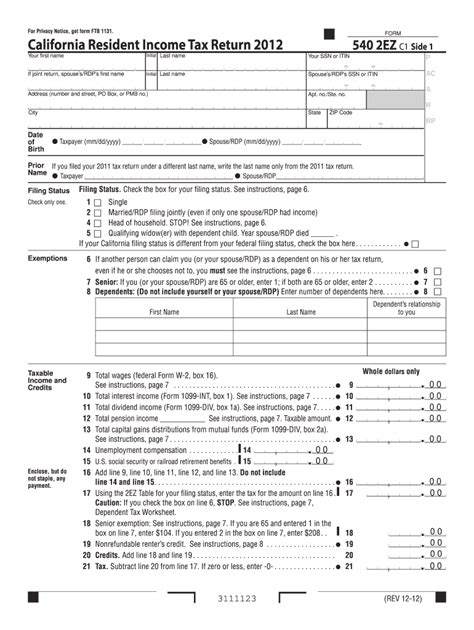

The California Form 540 Renters Credit is a non-refundable tax credit that is available to eligible renters who file their state income tax return using Form 540. The credit is designed to help renters who are paying a significant portion of their income towards rent, which can be a substantial burden for many Californians. The credit can help reduce the amount of state income tax owed, which can result in a larger refund or a lower tax bill.

Eligibility Requirements

To be eligible for the California Form 540 Renters Credit, you must meet the following requirements:

- You must be a California resident and have filed a state income tax return using Form 540.

- You must have paid rent on your primary residence in California.

- Your rent must be at least 30% of your gross income.

- Your gross income must be below a certain threshold, which varies depending on the number of dependents you claim.

For the 2022 tax year, the income limits for the California Form 540 Renters Credit are as follows:

- Single filers with no dependents: $43,533 or less

- Single filers with one dependent: $53,833 or less

- Single filers with two or more dependents: $64,133 or less

- Joint filers with no dependents: $65,533 or less

- Joint filers with one dependent: $75,833 or less

- Joint filers with two or more dependents: $86,133 or less

How to Claim the California Form 540 Renters Credit

To claim the California Form 540 Renters Credit, you will need to complete Schedule R (Form 540) and attach it to your Form 540 state income tax return. You will need to provide information about your rent payments, including the address of your rental property, the name and address of your landlord, and the amount of rent you paid during the tax year.

Benefits of the California Form 540 Renters Credit

The California Form 540 Renters Credit can provide several benefits to eligible renters, including:

- Reduced state income tax liability: The credit can help reduce the amount of state income tax owed, which can result in a larger refund or a lower tax bill.

- Increased affordability: By reducing the amount of state income tax owed, the credit can help make renting more affordable for low- and moderate-income Californians.

- Simplified tax filing: The credit is relatively easy to claim, and the California Franchise Tax Board (FTB) provides a simple and straightforward process for filing.

Common Mistakes to Avoid

When claiming the California Form 540 Renters Credit, there are several common mistakes to avoid, including:

- Failing to meet the eligibility requirements: Make sure you meet the income and rent payment requirements before claiming the credit.

- Failing to complete Schedule R: You must complete Schedule R (Form 540) and attach it to your Form 540 state income tax return to claim the credit.

- Failing to provide required documentation: Make sure you have all required documentation, including rent payment receipts and landlord information, before filing.

Tips for Maximizing the Credit

To maximize the California Form 540 Renters Credit, consider the following tips:

- Keep accurate records: Keep accurate records of your rent payments, including receipts and landlord information.

- Claim the credit annually: The credit is available annually, so make sure to claim it every year you are eligible.

- Check for updates: The California FTB may update the credit requirements or eligibility rules, so make sure to check for updates before filing.

Conclusion

The California Form 540 Renters Credit is a valuable tax break for low- and moderate-income renters in California. By understanding the eligibility requirements, how to claim the credit, and its benefits, you can take advantage of this credit and reduce your state income tax liability. Remember to avoid common mistakes and follow tips for maximizing the credit to get the most out of this tax break.

We encourage you to share your thoughts and experiences with the California Form 540 Renters Credit in the comments below. Have you claimed this credit before? Do you have any tips or advice for maximizing the credit? Share your story with us!

FAQ Section:

What is the California Form 540 Renters Credit?

+The California Form 540 Renters Credit is a non-refundable tax credit available to eligible renters who file their state income tax return using Form 540.

Who is eligible for the California Form 540 Renters Credit?

+To be eligible, you must be a California resident, have paid rent on your primary residence in California, and meet certain income and rent payment requirements.

How do I claim the California Form 540 Renters Credit?

+To claim the credit, complete Schedule R (Form 540) and attach it to your Form 540 state income tax return.