As a business owner or accountant in California, understanding the intricacies of the state's tax laws and filing requirements is crucial to avoiding costly mistakes and penalties. One of the most important forms in the California tax landscape is the Form 100, also known as the California Corporation Franchise or Income Tax Return. In this article, we will delve into the world of California Form 100s, exploring the essential filing tips and insights to help you navigate this complex landscape.

Understanding the Purpose of California Form 100

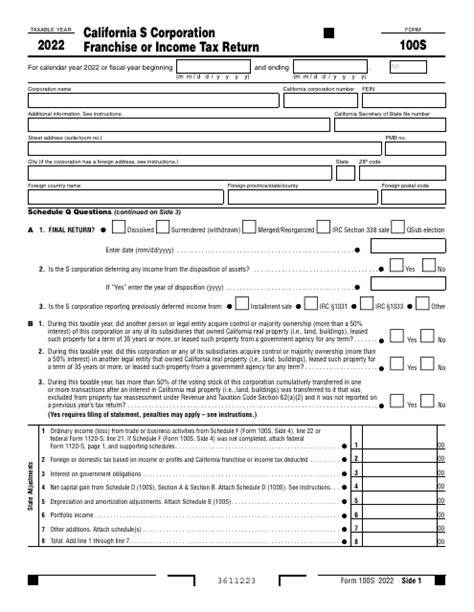

The California Form 100 is a tax return filed by corporations, S corporations, and partnerships doing business in California. The form is used to report the entity's income, deductions, and credits, and to calculate the amount of tax owed to the state. It's a critical document that requires meticulous attention to detail to ensure accuracy and compliance with California tax laws.

Who Needs to File California Form 100?

Not all businesses operating in California are required to file Form 100. The following entities must file:

- Corporations, including C corporations and S corporations

- Partnerships, including limited liability partnerships (LLPs) and limited partnerships (LPs)

- Limited liability companies (LLCs) that are classified as corporations or partnerships for tax purposes

7 Essential Filing Tips for California Form 100

To ensure a smooth and accurate filing process, follow these seven essential tips:

1. Determine Your Filing Status

Before filing Form 100, determine your entity's filing status. This will help you identify the correct form and schedules to complete. For example, corporations must file Form 100, while S corporations must file Form 100S.

2. Gather Required Documents and Information

To complete Form 100, you'll need to gather various documents and information, including:

- Federal tax return (Form 1120 or Form 1120S)

- California tax ID number

- Business income and expense records

- Depreciation and amortization schedules

- Information about ownership structure and stockholders (if applicable)

3. Choose the Correct Filing Method

California offers two filing methods for Form 100: e-file or paper file. E-filing is the recommended method, as it's faster and more secure. However, if you're unable to e-file, you can paper file, but be aware that this method may take longer to process.

4. Complete Schedules and Attachments

Form 100 requires various schedules and attachments, depending on your entity's specific situation. Some common schedules include:

- Schedule C: Income and deductions

- Schedule D: Capital gains and losses

- Schedule K-1: Partner's share of income, deductions, and credits (for partnerships)

Make sure to complete all required schedules and attach any supporting documentation.

5. Calculate and Report Tax Liability

Calculate your entity's tax liability using the correct tax rates and laws. Report this information on Form 100, and be prepared to provide supporting documentation if audited.

6. Meet Filing Deadlines

California Form 100 is typically due on the 15th day of the fourth month after the close of the tax year. For example, if your tax year ends on December 31, the filing deadline is April 15. Late filing can result in penalties and interest, so be sure to mark your calendar accordingly.

7. Seek Professional Help if Needed

If you're unsure about any aspect of the filing process, consider seeking professional help from a certified public accountant (CPA) or tax professional. They can guide you through the process and ensure compliance with California tax laws.

Common Mistakes to Avoid When Filing California Form 100

To avoid costly mistakes and penalties, be aware of the following common errors:

- Inaccurate or incomplete information

- Failure to report all income or deductions

- Incorrect tax calculation or reporting

- Missing or incomplete schedules and attachments

- Late filing or payment

Conclusion: Mastering California Form 100

Mastering California Form 100 requires attention to detail, organization, and a deep understanding of California tax laws. By following these essential filing tips and avoiding common mistakes, you can ensure a smooth and accurate filing process. Remember to seek professional help if needed, and stay up-to-date on any changes to California tax laws and regulations.

Take the Next Step

If you're ready to take your California tax knowledge to the next level, consider the following resources:

- California Franchise Tax Board (FTB) website: ftb.ca.gov

- California Society of Certified Public Accountants (CalCPA) website: calcpa.org

- Tax professional or CPA services

What is California Form 100?

+California Form 100 is a tax return filed by corporations, S corporations, and partnerships doing business in California.

Who needs to file California Form 100?

+Corporations, S corporations, partnerships, and limited liability companies (LLCs) classified as corporations or partnerships for tax purposes must file Form 100.

What is the filing deadline for California Form 100?

+The filing deadline for California Form 100 is typically the 15th day of the fourth month after the close of the tax year.