Tax season is upon us, and with it comes the daunting task of navigating the complex world of tax returns. For California residents, the CA State Tax Form 540EZ is a simplified option for filing state income taxes. In this comprehensive guide, we will walk you through the process of filling out the CA State Tax Form 540EZ, highlighting the benefits, eligibility criteria, and step-by-step instructions to ensure a stress-free tax filing experience.

Benefits of Using the CA State Tax Form 540EZ

The CA State Tax Form 540EZ is designed for California residents with simple tax situations, offering a streamlined and hassle-free filing process. By using this form, you can:

- Reduce paperwork and administrative burdens

- File your state taxes quickly and efficiently

- Take advantage of a simpler and more straightforward tax filing process

Eligibility Criteria for the CA State Tax Form 540EZ

To qualify for the CA State Tax Form 540EZ, you must meet the following requirements:

- You are a California resident

- You have a simple tax situation, with only one or two sources of income

- You do not have any dependents

- You are not claiming any credits or deductions

- You are not filing for a prior year's tax return

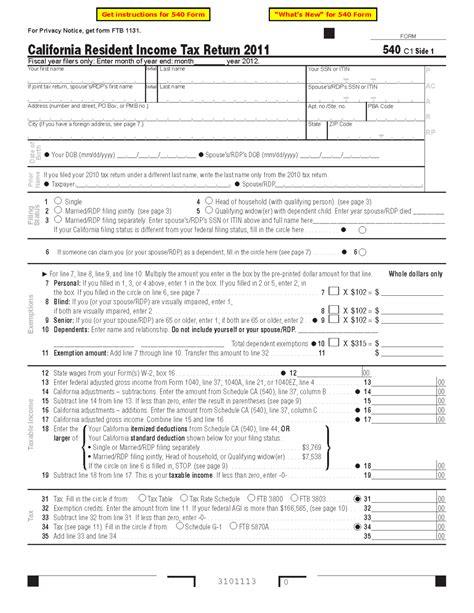

Step-by-Step Guide to Filling Out the CA State Tax Form 540EZ

To begin, gather the necessary documents, including:

- Your W-2 forms

- Your 1099 forms (if applicable)

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

Section 1: Identification

In this section, you will provide basic identifying information, including:

- Your name and address

- Your Social Security number or ITIN

- Your date of birth

Section 2: Income

Report your income from all sources, including:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

Section 3: Adjustments and Deductions

Claim any adjustments and deductions you are eligible for, such as:

- Standard deduction

- Personal exemption

Section 4: Tax Calculation

Calculate your state tax liability based on your income and adjustments.

Section 5: Payment and Refund

Determine if you owe taxes or are due a refund.

Additional Information and Credits

While the CA State Tax Form 540EZ is designed for simple tax situations, you may still be eligible for certain credits and deductions. These include:

- Earned Income Tax Credit (EITC): A refundable credit for low-income working individuals and families.

- California Earned Income Tax Credit (CalEITC): A state-specific credit for low-income working individuals and families.

Claiming Credits and Deductions

To claim credits and deductions, you will need to complete additional forms and schedules, such as:

- Form 3514: Earned Income Tax Credit (EITC) Certification

- Form 3584: California Earned Income Tax Credit (CalEITC) Certification

Submission and Payment Options

Once you have completed the CA State Tax Form 540EZ, you can submit it via:

- Mail: Send the completed form to the California Franchise Tax Board (FTB) address listed on the form.

- Electronic Filing: File electronically through the FTB's website or a tax preparation software.

If you owe taxes, you can pay by:

- Check or money order: Attach a check or money order to the completed form.

- Electronic payment: Make a payment online through the FTB's website.

Common Mistakes to Avoid

When filling out the CA State Tax Form 540EZ, be aware of common mistakes that can delay or complicate the filing process. These include:

- Inaccurate or incomplete information: Double-check your math and ensure all information is accurate and complete.

- Missing signatures: Sign and date the form to avoid delays.

- Incorrect filing status: Ensure you are filing as a single individual, as the CA State Tax Form 540EZ is not suitable for joint filers.

Conclusion

Filing state taxes in California can be a daunting task, but the CA State Tax Form 540EZ provides a simplified solution for residents with simple tax situations. By following this guide, you can ensure a stress-free tax filing experience and take advantage of the benefits offered by this streamlined form.

Don't forget to share your thoughts and questions in the comments below! Have you used the CA State Tax Form 540EZ before? What was your experience like?

FAQs

Who is eligible for the CA State Tax Form 540EZ?

+California residents with simple tax situations, including single individuals with only one or two sources of income, no dependents, and no credits or deductions.

Can I claim credits and deductions on the CA State Tax Form 540EZ?

+While the CA State Tax Form 540EZ is designed for simple tax situations, you may still be eligible for certain credits and deductions, such as the Earned Income Tax Credit (EITC) and the California Earned Income Tax Credit (CalEITC).

How do I submit the CA State Tax Form 540EZ?

+You can submit the CA State Tax Form 540EZ via mail or electronic filing through the California Franchise Tax Board (FTB) website or a tax preparation software.