The California Form 588 is a crucial document for businesses operating in the state, particularly those with a complex ownership structure. The form is used to certify the existence of a limited liability company (LLC) or a limited partnership (LP) in California, and it's essential for tax purposes. However, the filing process can be daunting, especially for those who are new to business ownership. In this article, we'll break down the CA Form 588 filing process into five simple steps, making it easier for you to comply with California's regulations.

What is the CA Form 588?

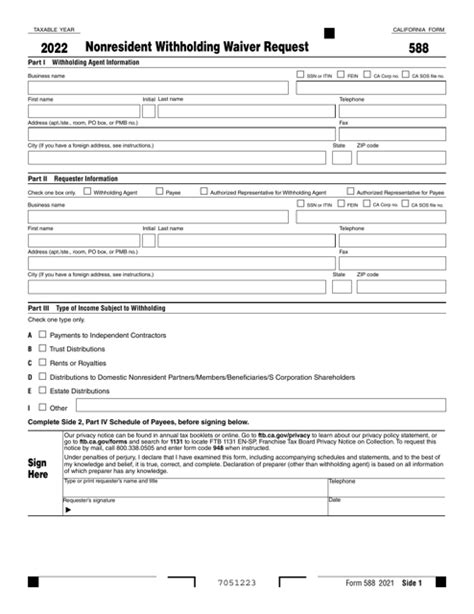

Before we dive into the filing process, let's quickly discuss what the CA Form 588 is and why it's essential for your business. The CA Form 588, also known as the Certificate of Determination, is a document that certifies the existence of an LLC or LP in California. It's used to:

- Verify the business's name and address

- Confirm the business's ownership structure

- Determine the business's tax classification

The form is required for all LLCs and LPs operating in California, and it must be filed annually with the California Secretary of State's office.

Why is the CA Form 588 Important?

Filing the CA Form 588 is crucial for several reasons:

- Tax compliance: The form is required for tax purposes, and failing to file it can result in penalties and fines.

- Business legitimacy: The form verifies the existence of your business, which can help establish credibility with clients, vendors, and partners.

- Compliance with state regulations: Filing the form ensures that your business is compliant with California's regulations, which can help avoid any potential issues.

Step 1: Gather Required Information

Before you start the filing process, you'll need to gather some essential information. This includes:

- Your business's name and address

- Your business's ownership structure (e.g., LLC, LP, sole proprietorship)

- Your business's tax classification (e.g., single-member LLC, multi-member LLC, partnership)

- The names and addresses of all owners/members

- The names and addresses of all managers/officers (if applicable)

Tips for Gathering Information

- Make sure to have all the necessary documents and information readily available.

- Double-check the accuracy of the information to avoid any errors or delays.

- If you're unsure about any aspect of the filing process, consider consulting with a professional (e.g., accountant, lawyer).

Step 2: Obtain the Required Forms

You can obtain the CA Form 588 from the California Secretary of State's website or by contacting their office directly. You'll also need to obtain any additional forms that may be required, such as:

- Form 3520 (Statement of Information)

- Form 3520A (Statement of Information (Limited Liability Company))

Tips for Obtaining Forms

- Make sure to download the most up-to-date version of the forms.

- Read the instructions carefully to ensure you're filling out the correct forms.

- If you're unsure about which forms to use, contact the California Secretary of State's office for guidance.

Step 3: Fill Out the Forms

Once you have all the necessary information and forms, it's time to fill them out. Make sure to:

- Read the instructions carefully

- Fill out the forms accurately and completely

- Sign the forms as required

Tips for Filling Out Forms

- Use black ink and write clearly.

- Make sure to sign the forms in the correct locations.

- If you're unsure about any aspect of the forms, consider consulting with a professional.

Step 4: File the Forms

Once you've completed the forms, it's time to file them with the California Secretary of State's office. You can file the forms online, by mail, or in person.

Tips for Filing Forms

- Make sure to file the forms on time to avoid any penalties or fines.

- Use a secure and trackable method of filing (e.g., certified mail, online filing).

- Keep a copy of the filed forms for your records.

Step 5: Verify Filing Status

After you've filed the forms, it's essential to verify your filing status with the California Secretary of State's office. You can do this online or by contacting their office directly.

Tips for Verifying Filing Status

- Make sure to verify your filing status to ensure that your forms were accepted.

- If there are any issues with your filing, address them promptly to avoid any delays.

- Keep a record of your verified filing status for your records.

By following these five simple steps, you can ensure that your CA Form 588 filing is accurate and compliant with California's regulations. Remember to stay organized, seek professional guidance if needed, and verify your filing status to avoid any potential issues.

What is the deadline for filing the CA Form 588?

+The deadline for filing the CA Form 588 is typically April 15th of each year, but it's essential to verify the exact deadline with the California Secretary of State's office.

Can I file the CA Form 588 online?

+Yes, you can file the CA Form 588 online through the California Secretary of State's website.

What are the penalties for not filing the CA Form 588?

+The penalties for not filing the CA Form 588 can include fines, penalties, and even suspension of your business's license.